Stay Away from “Pie in the Sky” Stocks

The market is never short of stocks that are primarily driven by storytelling to inflate their prices. These are called dream stocks, which emerged like mushrooms after rain in 2020-2021, with stock prices soaring daily, creating various wealth myths that are tempting.

The characteristics of dream stocks are: no actual profits, only appealing stories and enticing prospects, with a price-to-earnings (PE) ratio that is in line with the market average. For such stocks, the author prefers to affectionately call them “pie in the sky” stocks.

However, without real profits to support them, no matter how touching the story, the surge in stock prices is just a short-term speculation and a stock market carnival, which will eventually end up with a plunge in stock prices and a bitter defeat.

Indeed, whether stock prices can rise depends on future earnings and growth, to be precise, largely on expectations and prospects for the future. Of course, we have emphasized many times that the future is unpredictable. Management plans are just plans, and whether they can be executed and how effective they are is unknown.

So, what can we rely on?

We focus on business models and management teams that have been proven by the market. Although future performance cannot be guaranteed, there is a performance inertia in excellent companies in the market, and assuming that the company’s future performance will be similar to the past has a higher probability of being correct.

This is because consumer behavior (both individual and corporate) has inertia; excellent products used this year will likely continue to be purchased and used by the same brand next year. The performance inertia brought by excellent business models is almost the only predictability we can trust in the stock market.

The market is often generous in giving high stock prices to excellent companies. For excellent stocks, value investors’ opportunities come from the failure of the market’s efficient assumption. The market efficiency theory assumes that the market is rational and can price assets reasonably in real-time. However, the market is always overly pessimistic about bad news, which provides a window for undervaluing high-quality assets.

For example, recently NKE’s stock price fell by 20% on June 27-28 due to poor financial performance and a downward revision of future prospects, setting the largest single-day drop since 2001.

However, looking back at NKE’s ROE over the past 10 years, it has been above 25% for 9 years, and the current ROE is as high as 37%. Judging solely from ROE, NKE may be a very excellent company, and a one-day drop of 20% may provide an entry opportunity for value investors.

Looking back at NKE’s performance over the past few years, there have been several instances where it did not meet market expectations, affecting short-term stock performance:

- In the fourth quarter of 2023, NKE’s net profit decreased by 28% year-on-year, missing market expectations.

- In the fourth quarter of 2022, revenue was $12.6 billion, below analysts’ expectations of $12.8 billion.

- In the second quarter of 2022, overall revenue increased by 1% year-on-year, but revenue in the Greater China region and the Asia-Pacific and Latin America region decreased.

- In the third quarter of 2021, overall revenue increased by 3% year-on-year, but revenue in North America decreased by 11%.

As NKE’s stock price trend shows, market pessimism is short-lived, and the inertia of excellent business models is relatively long-lasting. As long as time is given, the market will once again give reasonable stock prices to excellent companies.

Therefore, by buying undervalued stocks and waiting for the market to return to a reasonable valuation, value investors have the opportunity to make a profit.

However, the same logic cannot be applied to “pie in the sky” stocks. Our most basic requirement for investment targets is positive earnings. Investing in stocks without positive earnings is not without the opportunity to make money, but it requires the same level of risk as venture capital because there is a lack of reliable valuation basis, and buying at a high premium is the norm.

However, stock investment does not have the risk control advantages that venture capital has. Venture capital has more diverse exit mechanisms compared to stock investment, which helps to reduce risks. In addition, venture capitalists often participate deeply in the operation and management of the invested companies, using their advantageous position to further reduce risks.

Finally, the capital gains of venture capital in the same period are far higher than those of stock investment. Therefore, treating stock investment as venture capital is not advisable.

In addition, the author particularly points out that unlike high-quality stocks (which can make investors profit by holding long-term and waiting for the stock price to return to its intrinsic value), holding “pie in the sky” stocks for a long time will also likely result in losses.

The author has also made a mistake with “pie in the sky” stocks, thinking that if a stock is stuck, as long as you hold it and do not move, you will not really lose money. In fact, after a sharp drop in the price of “pie in the sky” stocks, they may be delisted or acquired at a low price, causing permanent capital loss for investors.

Next, the author would like to share two painful personal experiences with “pie in the sky” stocks. I believed the big pies painted by the media and analysts for these stocks. Although I bought them when the stock price had plummeted more than 50% from its peak, I still suffered a loss of more than 90%. Now, please enjoy the pies painted by the analysts at that time.

VLDRW Pie:

- At the beginning of 2020, Velodyne was seen as the leader in the lidar industry, holding more than 90% of the market share, and its sensors were used in autonomous driving, robotics, drones, and other fields.

- In February 2020, when Velodyne released its financial report, it stated that it expected to generate more than $1 billion in revenue from 2021 to 2025, with more than $4.4 billion in 190 potential projects.

- In July 2020, Velodyne went public through a SPAC, with its valuation increasing from about $1.8 billion to $3 billion. The market expected its turnover to grow sevenfold from about $100 million in 2019 to $685 million in 2024 (doubling every year).

- In December 2020, a Wall Street analyst gave Velodyne a bullish rating, driving up the stock price. The analyst believed that Velodyne had a “clear first-mover advantage” in the lidar sensor category, which is the core of ADAS and autonomous driving. By 2024, about 60% of new vehicles equipped with ADAS systems will be equipped with lidar, and the cost of automotive-grade lidar will be reduced to less than $600.

VLDRW End:

- In 2021, the Chinese company Hesai Technology quickly rose to challenge Velodyne’s market position. Velodyne’s poor service in the Chinese market, along with serious product quality and repair issues, led to Hesai Technology occupying 67% of the lidar market share in the autonomous taxi industry.

- The company continued to lose money every year from 2019 to 2020, reaching a historical high of about $32 per share in December 2020. By the end of 2021, Velodyne’s market value had shrunk significantly. It later merged with Ouster, at which point Velodyne’s stock price had already fallen to about $0.9 per share.

PTON Pie: (Excerpted from a deep analysis by a US stock investment blogger in 2020)

- Peloton is known as the “Netflix of the fitness industry.”

- In 2020, Peloton announced its third-quarter financial report, showing a 66% increase in total revenue to $520 million, far exceeding Wall Street’s expectations of $480 million. This growth rate is astonishing for an already publicly traded mature asset.

- Wall Street tycoon Soros took a position in PTON. For such a prestigious and professional investment institution, he must go through a very strict due diligence and screening process from ideal to investment implementation. In short, he must completely analyze a company before implementing the investment. If there is a problem with any detail, the investment project is killed. Therefore, no matter how much Soros invests, it indicates that Peloton has emerged from the selection and is a very high-quality asset.

- How good is Peloton’s financial report? The company’s fitness equipment end-users grew by 94% last quarter, and online fitness course subscribers grew by 64%. Overall, Peloton’s retention rate within 12 months is 93%. Peloton’s gross margin has also increased significantly to 46.8%.

- The CEO stated that seeking profits is not the company’s current top priority, and seeking rapid growth is more important than seeking profits in the short term.

- Peloton combines intelligent fitness hardware with high-quality content, disrupting the traditional home fitness model.

- The market worries that after the pandemic, Peloton’s growth momentum may fall rapidly. In response, founder John Foley said that Peloton’s user base has grown at a rate of over 100% for six consecutive years, and the company’s revenue and growth are healthy regardless of the pandemic.

- Peloton does very well in both hardware and content, but essentially it is still a product company, with hardware sales contributing to most of the revenue, and it is the excellence of the hardware that makes Peloton’s hardware + content business model strong enough.

PTON Ending:

- After seven or eight years of listing, Peloton has never had a positive surplus. The stock price has fallen 98% from its peak of $162 at the end of 2020 to about $3 today (one-tenth of the IPO price).

These personal experiences have made the author deeply realize the risks and pitfalls of “pie in the sky” stocks.

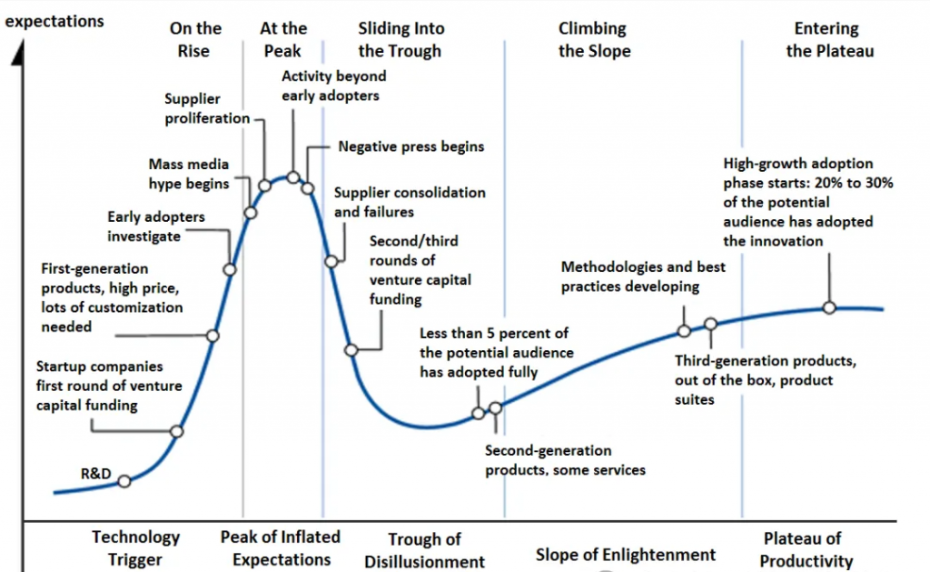

The author hopes that readers can learn from these experiences to avoid repeating the same mistakes in future investments. If investors want to invest in growth stocks, they can refer to the technology maturity cycle to assess the right time to invest. Investors can wait for the bubble to burst and then enter cautiously, instead of taking great risks to participate in the market’s carnival during the technology germination period and the expectation inflation period.

Gartner believes that a new technology or some innovation will go through the following five stages from development to final maturity:

1. Technology Trigger Stage: In this stage, the media reports extensively, irrationally, and the product’s popularity is everywhere. However, with the emergence of the technology’s shortcomings, problems, and limitations, there are more failed cases than successful ones. For example, .com companies experienced an irrational surge during 1998-2000.

2. Expectation Inflation Period: Excessive public attention in the early stage has led to a series of successful stories – of course, there are also many failed examples. For failures, some companies have taken remedial measures, while most companies remain indifferent.

3. Bubble Burst Trough Period: The technology that has survived the previous stages has undergone solid and focused experiments, and has an objective and practical understanding of the scope and limitations of the technology, and successful and viable business models gradually grow.

4. Steady Climb Recovery Period: In this stage, new technologies receive high attention from major media and the industry in the market. For example, the Internet and Web technology in 1996.

5. Production Maturity Period: In this stage, the benefits and potential of new technologies are actually accepted by the market, and the tools and methods supporting this business model have evolved through many generations, entering a very mature stage.

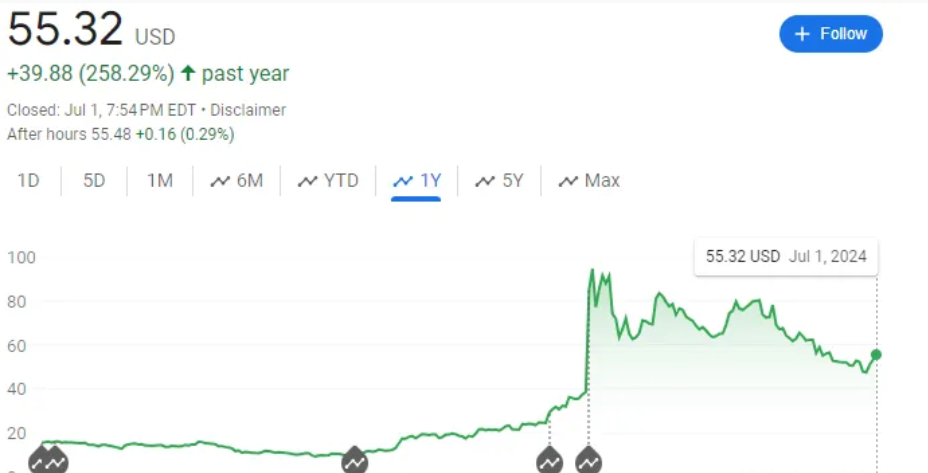

Finally, the author leaves a question for readers: Would you buy a stock like this?

VKTX: No business revenue, losses are expanding year by year, with a loss of $100 million in the latest year. The stock price soared to a maximum of $99 between February and March this year, and then slowly fell to about $55. Then please enjoy the optimistic evaluation of analysts at the end of 2023.

- Viking Therapeutics is a clinical development-stage biopharmaceutical company focused on the research and development of treatments for endocrine disorders and other metabolic diseases. The company’s product line features new therapies, which are either first-class or the best, and are designed as oral small molecule compounds.

- Oppenheimer analyst Jay Olson points out the potential of Viking’s main drugs VK2809 and VK2735, especially for metabolic diseases such as NASH and obesity.

- VK2809 showed a positive effect on reducing liver fat in phase 2b clinical trials, and the phase 2 trial for VK2735 to treat obesity is underway. Phase 1 trial data show that the candidate drug has good tolerance and acceptable safety under various dosing schemes.

- Olson gives VKTX an “outperform” rating, with a target price of $40, which means the stock has the potential to rise by 200% in the next year.

Leave a Reply