Don’t look for investment opportunities in junk stocks, but consider stocks that deal with waste.

In my recent articles “Why First-Mover Advantage Ruins Big-Name Stocks” and “5 Ways to Spot and Avoid Big-Name Stocks [Essential for US Retail Investors],” I discussed several junk stocks (PTON, VLDN, BYND, ROOT) with the aim of reminding readers not to invest their precious capital in these junk stocks.

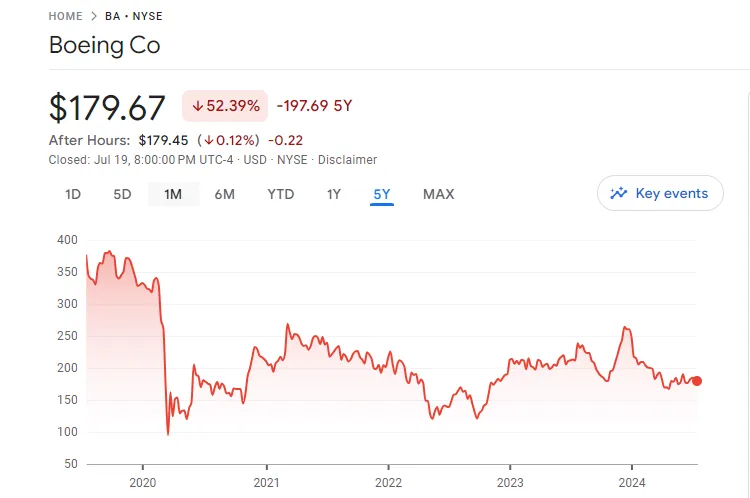

However, junk stocks are not limited to certain small-cap stocks; some large-cap stocks may also be considered junk. Recently, I noticed some people asking in stock review programs whether Boeing’s stock (BA) is worth investing in.

Although Boeing is one of the world’s largest aerospace manufacturers and has a glorious history and outstanding achievements, and I personally had the honor of visiting its huge factory in Seattle in 2017 and was quite fascinated by it.

In my view, Boeing has unfortunately been included in the ranks of junk stocks. The root cause lies in its decadent corporate culture and dishonest management.

In the early days, Boeing’s corporate culture was centered on an engineer culture, which was specifically reflected in the emphasis on engineering and technology, focusing on product safety, quality, and innovation. Engineers had a high degree of autonomy in the decision-making process, and innovation and technological breakthroughs were encouraged. The company focused on the sustainability of long-term projects and technological development, not just short-term financial returns.

However, over time, Boeing gradually shifted towards an earnings culture, prioritizing financial performance and focusing more on quarterly profits, shareholder returns, and stock prices. The company’s management is dominated by personnel with financial backgrounds, not engineers.

This shift has led to an increase in product quality and safety issues, the most notable example being the development of the 737 MAX. To cope with market pressure, Boeing adopted an “extremely compressed” timetable in the development of the 737 MAX, leading to design flaws in the MCAS system.

This system relied on a single sensor, leading to two fatal crashes that resulted in 346 deaths (in 2018 and 2019), shocking the world, and I believe many readers still remember this vividly. In addition to this, the 737 MAX had other quality issues that exposed Boeing’s negligence in quality control.

In recent years, several whistleblowers have accused Boeing of safety hazards, insufficient quality control, and problems in the production process. Disgracefully, these whistleblowers have been retaliated against, including being ostracized, demoted, and fired.

Among them, John Barnett, a former quality control manager, exposed safety issues with the 737 MAX aircraft, and Joshua Dean, a quality auditor for a Boeing supplier, exposed manufacturing defects in the 737 MAX. Both have recently passed away, drawing outside attention.

However, Boeing CEO Calhoun only admitted that “there was a problem,” but denied the existence of systemic retaliation. At a Senate hearing, when questioned about the retaliation against whistleblowers, his responses were either evasive or he directly avoided the issue.

Integrity and competence in management are one of the important criteria for Warren Buffett when evaluating companies. Buffett once said, “Never do business with people who are not honest, because even if you make an agreement with them, they may break their promises.”

For example, PTON’s CFO clearly stated during the Q2 2020 financial report that there would be no additional stock issuance, but soon after, the company did issue more stock, causing its stock price to fall by about 65% in the following six months, causing losses to many investors (including me, TAT).

This is mainly because it is generally difficult for ordinary investors to judge whether the management is honest and competent, but this does not mean that the quality and ability of the management are not important. Once there are signs of dishonesty in the management, ordinary investors do not need to waste time studying this company, because you cannot predict what kind of mine this company will explode, causing the stock price to plummet or even be halved, resulting in huge losses.

Although analysts from Goldman Sachs and other institutions (a total of 54) are optimistic about Boeing’s long-term prospects and maintain a “buy” rating (with Goldman Sachs analysts even giving a target price of $243), in my view, before Boeing completely turns around its earnings culture, ordinary investors should stay away from such companies.

Otherwise, in addition to aircraft safety and quality issues, the management may also plant mines in the financial reports. Boeing’s long-term debt soared from $19.96 billion in 2019 to $61.89 billion (with debt scales all less than $13.5 billion before 2018), and the debt-to-equity ratio skyrocketed from 0.65 in 2013 to 40.85 in 2018, and shareholders’ equity turned negative after 2019.

It is puzzling that Boeing turned from profit to loss from 2019 (net income of $8.458 billion in 2017, $10.546 billion in 2018, and a net loss of $636 million in 2019), but still spent a lot of money on stock buybacks ($18 billion in 2017, $20 billion in 2018, both higher than the net income of the same year), until the $20 billion new stock buyback plan was halted in 2019 due to the 737 MAX crisis.

It can be said that the management has hollowed out the company through the stock buyback plan, driving up the stock price and making themselves rich. The unhealthy financial situation and unreliable profitability left by the management for Boeing mean that any slight disturbance can cause violent fluctuations in the stock price.

In this article, I mainly warn readers to stay away from various junk stocks, but some stocks that deal with waste are worth the attention of ordinary investors, such as WM and RSG (note that the current price may not be suitable for purchase). Specific stock analysis will be shared with readers in the next article, so please continue to follow.

Leave a Reply