The themes of weak inflation and improved economic data have complemented each other, jointly driving the recovery of the market. As inflationary pressures ease and economic data steadily improves, market sentiment has gradually recovered from previous concerns, and investors’ optimism about the future has further strengthened. This double-edged benefit has brought new momentum to the market and laid a solid foundation for future growth.

Fed Policy Path: Is the Interest Rate Cut Cycle About to Begin?

With the softening of inflation data and the improvement of economic data, market expectations for the Federal Reserve to start an interest rate cut cycle at the FOMC meeting on September 18 have gradually strengthened. Although the market speculates that the Fed might cut interest rates by 50 basis points at once, the current economic data does not indicate the need for such an aggressive monetary policy adjustment. Therefore, the Fed may choose a more cautious approach, adjusting policy through small interest rate cuts step by step.

The Fed’s Path

Perhaps one of the key questions facing the market now is whether the recent inflation and economic data will affect the Fed’s and interest rates’ trajectory. We believe that the soft inflation data, combined with the rising uncertainty in the labor market, lays the groundwork for the Fed to start cutting rates from the current 5.25% to 5.5% at the FOMC meeting on September 18. Although there is speculation that the Fed might implement a 0.50% cut, which is more than the traditional 0.25%, we believe that the recent better economic data does not mean there is an urgent need for a more substantial cut.

Remember, the Fed will hold its annual Jackson Hole Symposium from August 22 to 24, and Fed Chairman Jerome Powell plans to comment on Friday, August 23. Historically, the Fed uses this meeting to signal policy changes, and if Fed speakers anticipate a shift at the September 18 Fed meeting, we may hear their opinions. The Fed may also outline the trends they see in inflation and the labor market and whether these trends bring them closer to the start of a rate cut cycle. Although the market expects two to three rate cuts this year, any confirmation or signal from the Fed could be welcome news.

In-Depth Analysis: The Fed’s Rate Cuts Will Have a Profound Impact on Financial Markets, Especially Given the Current Market’s Optimistic Expectations for Future Economic Growth. Rate cuts will not only reduce corporate financing costs but also boost market sentiment and drive stock market gains. However, the Fed’s rate cut policy may also lead some investors to re-evaluate their asset allocation strategies, particularly for high-risk, high-return growth assets. Therefore, the future direction of the Fed’s monetary policy will be a focal point of market attention.

Market Outlook: The Breadth of Gains Continues to Expand, and a Diversified Leading Pattern May Form

Against the backdrop of slowing inflation and improving economic data, the market has seen a significant rebound recently, particularly in technology and growth sectors. With the Fed potentially starting a rate cut cycle, market leadership may expand from the previous large-cap tech stocks to more industries, such as industrials and utilities. Over the next 18 months, the diversification of market leadership may become a new theme, bringing broader opportunities for portfolios.

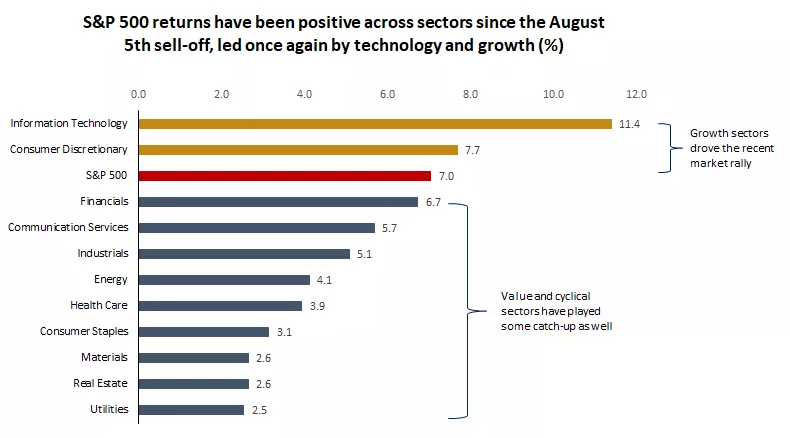

The market has undoubtedly welcomed the recent slowdown in inflation and better-than-expected economic data. Financial markets have rebounded from the sell-off on August 5, with the S&P 500 index rising more than 6.5%, and the 10-year Treasury yield, which briefly dipped to 3.66% during market volatility, has since climbed to around 3.9%. This indicates a recovery in confidence in the overall economy. Additionally, the VIX volatility, known as Wall Street’s fear gauge, surged to 65 on August 5, the highest level since 2020, but has since fallen back below 15, in line with the average over the past year.

The recent recovery in the stock market has once again been led by tech and growth sectors, which suffered the most significant declines during the recent correction. As the Fed’s rate cut cycle approaches and inflation continues to slow, with earnings growth expanding beyond growth and tech, we believe the broadening of market leadership may also re-emerge. If the theme of the past 18 months has been narrow leadership (large-cap tech leading the way higher), we believe the theme for the next 18 months will be diversification, with portfolios performing well in both the growth and value/cyclical parts of the market. We continue to favor large-cap and mid-cap stocks, seeing industries such as industrials and utilities continuing to catch up with tech and AI-driven sectors.

Overall, history tells us that if the Fed starts cutting rates and the economy remains stable (i.e., a “soft landing”), the market can continue to perform well in this context. While we know that market volatility is normal, especially as we enter the seasonally weak months of September and October, followed by the US election, we will use these periods of volatility and correction as opportunities, particularly as we continue to see better inflation trends and economic growth cooling but still positive.

Historical experience shows that if the Fed starts cutting rates and the economy achieves a soft landing, the market typically performs well. Investors may shift from over-concentrated tech stocks to other value and cyclical sectors. Therefore, investors should focus on diversification opportunities during future market volatility, particularly in sectors benefiting from economic recovery and inflation slowdown, such as industrials, utilities, and finance. As market uncertainty gradually subsides, a diversified investment strategy will help manage future risks and seize potential profit opportunities.

It is evident that the current optimistic sentiment in the market has a solid foundation. With the continuous improvement of inflation data, stable economic growth, and the gradual reduction of uncertainty in Fed policy, the market may enter a new recovery cycle.

Leave a Reply