The Federal Reserve is about to embark on a “non-typical rate cut”!

This rate cut is merely to ease tightening rather than to address a crisis!

The Jackson Hole conference has always been an important venue for global monetary policymakers. Although the conference itself does not make policy decisions, it usually sets the tone for the upcoming policy meetings. This year’s conference has sparked widespread discussion in the market about the Federal Reserve’s rate cut, especially Chairman Powell’s speech, which provided some key insights into the impending policy changes.

Here are my three main points:

- The Wait is Over, Officially Starting a New Round of Rate Cuts in September

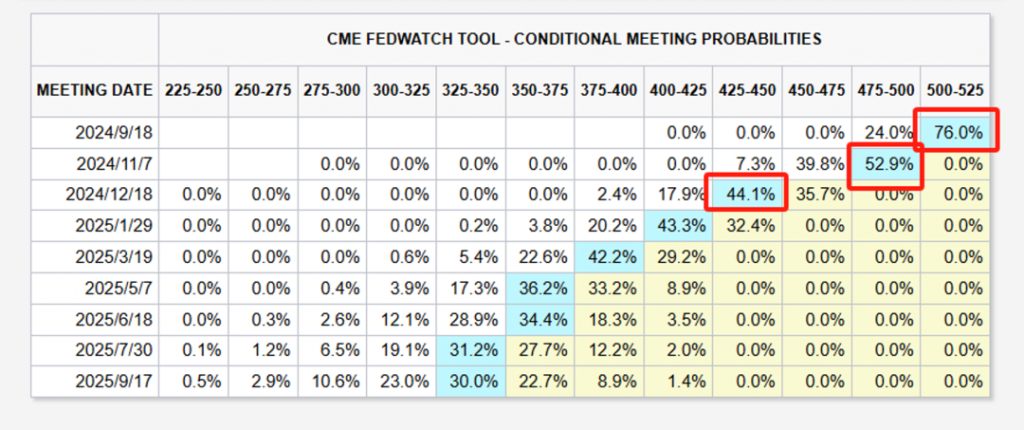

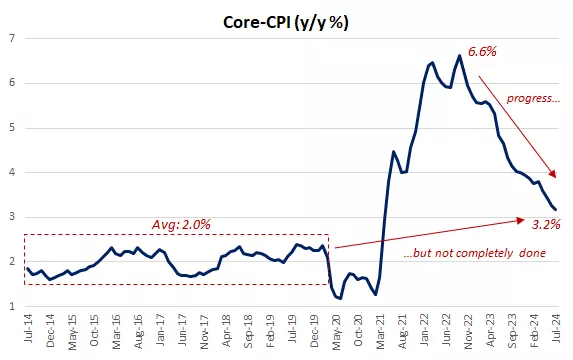

The official start of rate cuts in September: For over a year, the market has been focused on the timetable for rate cuts. According to Powell’s remarks, the Federal Reserve is likely to begin cutting rates in September this year. Although inflation has not been fully controlled, core CPI has fallen for four consecutive months, showing significant progress. Moreover, with signs of a weakening job market, the Federal Reserve’s focus will be more balanced to support the labor market and the economy.

It’s not just about inflation anymore: Over the past two years, the Federal Reserve’s policy has focused on reducing inflation. However, with changes in inflation and employment trends and a weakening economy, the Federal Reserve’s attention will gradually shift to supporting the economy and the job market to avoid a significant slowdown.

- This is Not a Typical Rate Cut Cycle, Merely to Ease Tightening Rather than to Address a Crisis

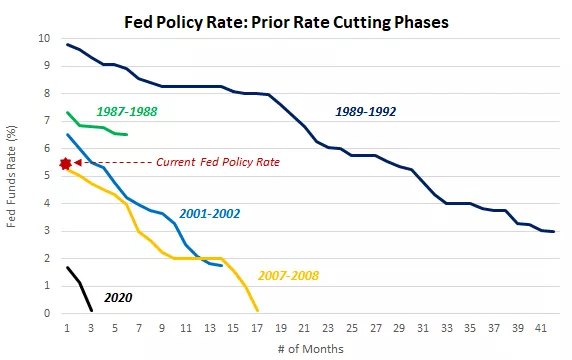

A different starting point: Traditionally, the Federal Reserve initiates rate cuts during economic recessions or financial crises. However, the current economic conditions are relatively stable, and the rate cut is more like easing tightening policies rather than stimulating a weak economy. Therefore, this rate cut cycle is expected to unfold in a smaller and gradual manner, with each rate cut of 25 basis points, adjusting monetary policy to a neutral stance step by step.

Non-linear rate cut path: Powell emphasized that future policies will be highly data-dependent, which means the rate cut path may not be a straight line but will be adjusted based on inflation and economic data, possibly alternating between rate cuts and pauses.

Not dramatic: We expect this rate cut cycle to start gradually and continue. Unless there are sharp and unexpected changes in the inflation or unemployment path, we believe the Federal Reserve will gradually reduce the policy rate by 25 basis points (0.25%). The last rate cut was in March 2020, when the Federal Reserve made emergency cuts of 50 and 100 basis points to address the impact of the COVID-19 shutdown. The policy easing cycle that began in 2007 started with significant rate cuts (0.50%), including multiple substantial cuts as we dealt with the collapse of the housing market and the global financial crisis. Similarly, the easing cycle following the tech bubble burst and the 2001 9/11 events included multiple 50 basis point cuts. We believe that the Federal Reserve does not need to take significant measures at this stage, and in the absence of any particularly weak upcoming employment reports, we believe a series of 25 basis point rate cuts may be adopted, as the Federal Reserve seeks a neutral stance on its policy rates.

Not predetermined: One point emphasized from Chairman Powell’s speech last week is that the Federal Reserve will be highly data-dependent when making the upcoming policy changes. Our interpretation is that the Federal Reserve does not view this rate cut cycle as a path from now to a future destination but will assess the upcoming inflation and economic data and make corresponding adjustments. We suspect this means the rate cut path may be inconsistent, with rate cuts and pauses interspersed in meetings this year and next.

Compared to previous crisis-driven economic recessions, we expect the scale of rate cuts to be smaller and more gradual.

- Rate Cuts are Usually Beneficial to the Market, and This Time May Not Be an Exception

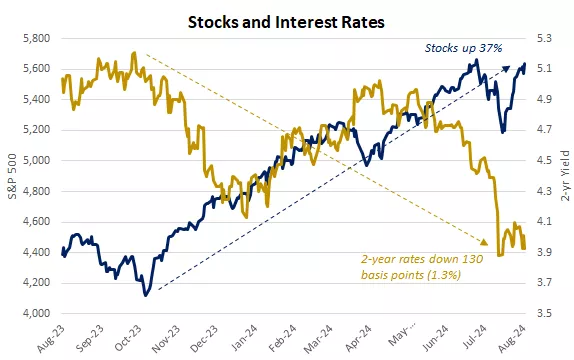

Market rebound: The market has already partially reacted to the upcoming rate cuts this year, with significant declines in short-term and long-term yields, and the stock market has risen nearly 40% since last October. Despite this, the actual start of future rate cuts may still provide further impetus for the market, especially if the Federal Reserve can achieve an economic soft landing.

Market volatility: Although rate cuts are usually beneficial to the market, historical data show that the market tends to be more volatile at the beginning of rate cuts. Uncertainty may increase market volatility in the coming months, including factors such as weak economic data, the U.S. presidential election, and geopolitical risks.

Historical performance: Looking back, the Federal Reserve’s rate cuts have often led to positive market performance in the next one to two years, especially when not accompanied by a recession, such as in 1987, 1995, and 1998. This also supports the view that the market will continue to perform well in the context of future economic expansion.

The historical and current starting points deserve our positive outlook: Rate cuts are not a panacea, but we do believe that reducing restrictive policies is good news. Although this will not reintroduce 3% mortgages or provide a lot of monetary stimulus, it is a step to alleviate the burden of borrowing costs for consumers and businesses. Lower interest rates can also support stock market valuations and bond market returns. We believe that the broader performance of the stock market within one and two years after the start of rate cuts largely proves this point, as shown in the table below. Recognizing the weakness caused by the bursting of the internet bubble and the 9/11 events and the global financial crisis, which far exceeded the start of the rate cut cycle, we believe that in the latter period, history is on the side of investors.

Looking at periods such as 1987, 1995, and 1998, when rate cuts were not accompanied by an ensuing economic recession, the returns in the following one to two years were particularly strong. As we have pointed out, the possibility of a recession cannot be completely ruled out, but we believe that the economic expansion will continue. We believe that the Federal Reserve’s decision to start rate cuts based on current employment, consumer spending, and overall GDP growth supports this outcome and also supports a generally positive view of future financial markets. The broader market performance after the first rate cut is often positive.

In summary, although the path of future rate cuts is uncertain, we believe that more accommodative monetary policy will support the market in the next one to two years, while being vigilant about short-term market volatility and potential risks. We should be prepared for the rate cut cycle!

Leave a Reply