Is there any hope for interest rate cuts as economic data continues to remain weak?

The sustained weak economic data has indeed increased the possibility of the Federal Reserve cutting interest rates. Combined with a series of recently released US economic data, we can see that the US economy has slowed down significantly. We can see several key factors and signs:

- Non farm employment data: Although the non farm employment growth in June was higher than expected, the data for the first two months was significantly lowered, and the unemployment rate rose to 4.1%, the highest level since November 2021. This indicates that the labor market may be slowing down.

2. ISM Manufacturing and Services Index: The June ISM Manufacturing Index was 48.5, below the expansion/contraction threshold of 50, indicating that the manufacturing industry is contracting. The service sector PMI also fell to 48.8, the lowest level in four years, further indicating a weakening of economic activity.

3. The yield of two-year treasury bond declined: the yield of two-year treasury bond declined significantly, reflecting the market’s concern about the future economic prospects and the enhanced expectation of the Federal Reserve’s interest rate cut. Although the yield of 10-year treasury bond has also declined, the range is small, which shows that the market is relatively optimistic about long-term economic growth.

4. Market expectation: According to Bloomberg data, the probability of the Federal Reserve cutting interest rates in September has risen to 81%, far higher than the previous 68%. This indicates that investors widely believe that the Federal Reserve may take interest rate cuts in the short term to address the economic slowdown.

5. Other economic indicators: Including initial jobless claims and ADP employment data, also indicate a slowdown in the labor market and overall economic activity. These data support the argument that the Federal Reserve may adopt a loose monetary policy.

The sustained weakness in economic data has strengthened market expectations for the Federal Reserve to cut interest rates. Although the specific timing and magnitude of the interest rate cut are still uncertain, the current economic situation and market expectations indicate that the Federal Reserve may take action in the coming months to support economic growth and address potential downside risks.

According to the latest June non farm payroll report released by the Bureau of Labor Statistics (BLS), total non farm employment increased by 206000 and the unemployment rate rose to 4.1%. The following is an analysis of key data and trends:

- Employment growth: The total non farm employment increased by 206000 in June, slightly lower than the average monthly growth of 220000 in the past 12 months. The government, healthcare, social assistance, and construction industries have contributed the majority of employment growth.

2. Rising unemployment rate: The unemployment rate has risen from 4.0% last month to 4.1%, the highest level since November 2021. The number of long-term unemployed (unemployed for 27 weeks or longer) increased by 166000, reaching 1.5 million, accounting for 22.2% of the total unemployed population.

3. Industry performance: Government employment increased by 70000, mainly concentrated in local governments (excluding education) and state governments. The healthcare industry added 49000 jobs, social assistance increased by 34000, and the construction industry increased by 27000. The employment changes in retail trade and professional business services are not significant.

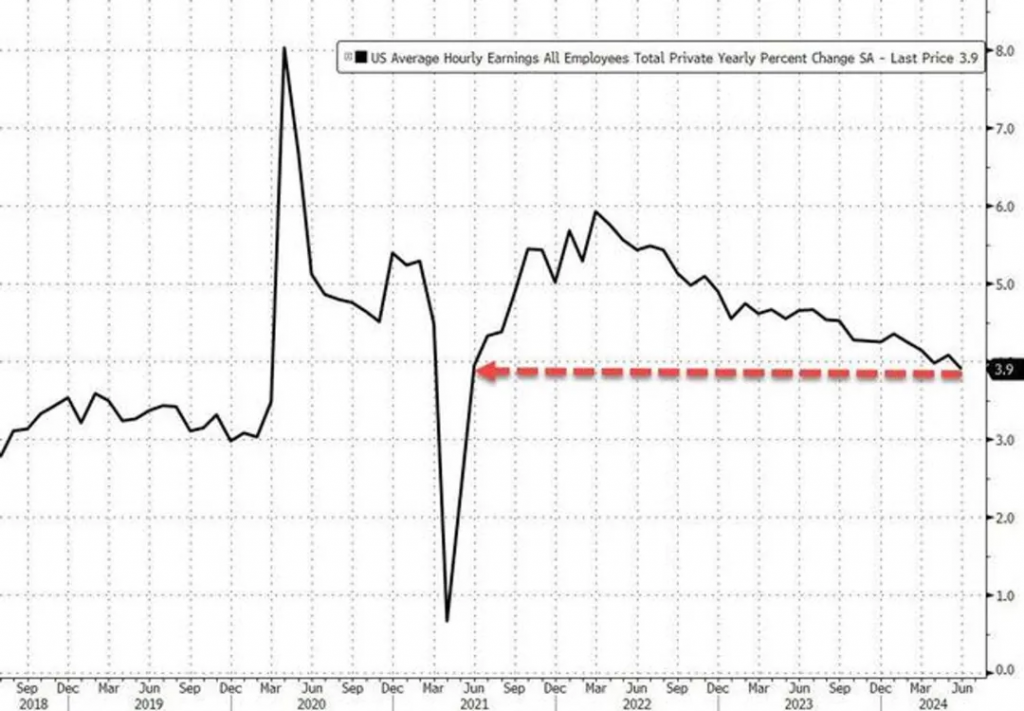

4. Wages and working hours: In June, the average hourly wage of all employees in the private non-agricultural industry increased by 10 cents to $35.00, a year-on-year increase of 3.9%. The average working hours in the manufacturing industry remained unchanged at 40.2 hours, while the average working hours in the private non-agricultural industry remained at 34.3 hours for the third consecutive month.

5. Economic outlook: Continued weak economic data, including sluggish manufacturing and service sector indices, rising unemployment rates, and lowered employment data for the first two months, further strengthen market expectations for the Federal Reserve’s interest rate cuts. According to market data, the probability of a rate cut in September has increased from 68% last week to 81%.

Overall, the weak economic data has increased the likelihood of the Federal Reserve cutting interest rates, which could have a significant impact on the market.

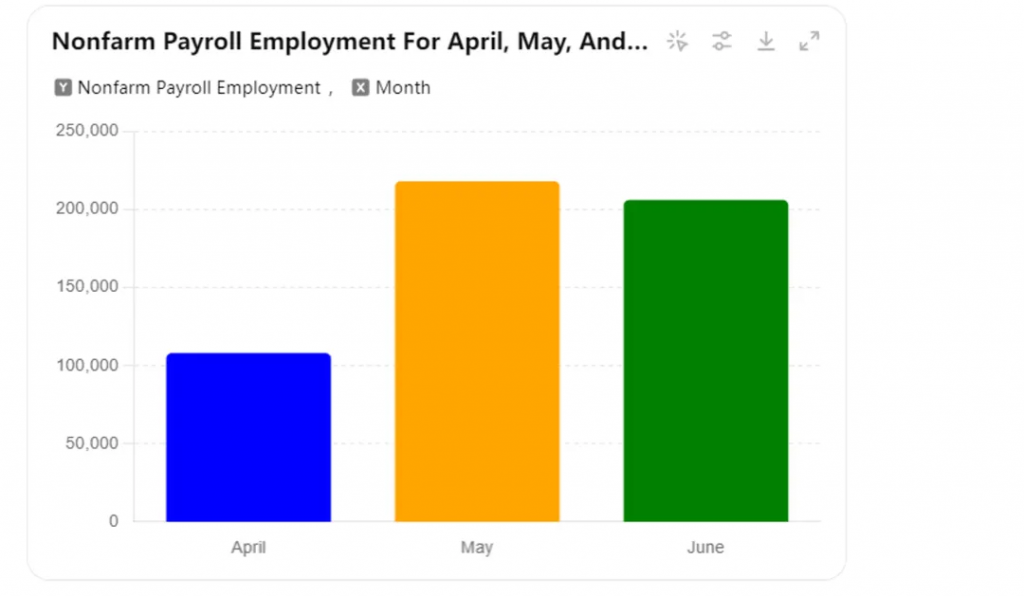

The number of new non farm employment in April was revised down from 165000 to 108000; The number of new non farm employment in May decreased from 272000 to 218000. After the revision, the total number of new jobs added in April and May decreased by 111000 compared to before the revision. In the past 5 months, the number of employed people has been revised downwards for 4 months. Regularly revised, if we consider the downward revision in April and May, the average number of employed people in the three months of April, May, and June has actually significantly declined.

After correction, the average number of non farm new jobs added in April, May, and June was 177333. This shows a significant decline in employment growth compared to the initial reported figures, with the 3-month moving average already showing a significant decline, and employment in the United States is continuing to decline.

The average hourly wage in June increased by 0.3% month on month, meeting expectations, but decreased slightly from the previous value of 0.4%; The year-on-year growth rate was 3.9%, unchanged from expectations, and fell below 4% for the first time since 2021.

The sustained weakness in economic data has indeed opened up greater operational space for the Federal Reserve to cut interest rates in the coming months. The Fed has seen the data and trends they want to see:

1. Non farm employment data and unemployment rate

- Non farm employment data: Although the non farm employment population increased by 206000 in June, exceeding the expected 190000, it still decreased significantly from 272000 in May. And the data for April and May have also been revised down to 108000 and 218000 people, respectively. These data indicate that the job market is significantly slowing down.

- Unemployment rate: The unemployment rate unexpectedly rose to 4.1% in June, the highest level since November 2021. The rising unemployment rate indicates increased pressure on the labor market, which may further drive the Federal Reserve to adopt loose policies.

2. Relieve the pressure of wage inflation

- Salary growth: The average hourly wage in June increased by 0.3% month on month, with a year-on-year growth rate of 3.9%, marking the first time since 2021 that it has fallen below 4%. This indicates that wage inflation pressure is easing, reducing concerns about inflation.

3. Labor force participation rate

- Labor force participation rate: The labor force participation rate slightly increased from 62.5% in May to 62.6% in June. Although the increase is limited, it shows some signs of recovery in the labor market.

4. Expectations of interest rate cuts

- Market reaction: After the data was released, the futures of the three major stock indexes in the US stock market rose in the short term, while the yields of US bonds fell across the board, and the US dollar index fell in the short term. These market reactions indicate that investors’ expectations for the Federal Reserve’s interest rate cuts have increased.

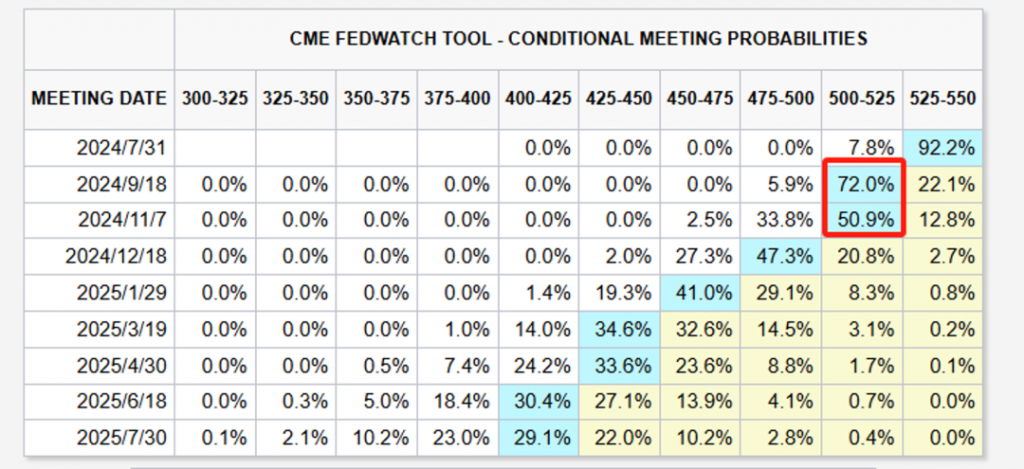

- Futures market: According to the Chicago Mercantile Exchange’s FedWatch tool, investors expect a 71.8% chance of the Federal Reserve cutting interest rates for the first time of the year in September, higher than the 66.5% before the report was released, and the possibility of the first rate cut in November has also increased.

According to the latest CME interest rate cut expectations, there will be a first rate cut in September and a second rate cut in December. The annual rate cut will be 50 basis points, and the market will officially enter the rate cut cycle trading in the third quarter.

Rubeela Farooqi, Chief US Economist at High Frequency Economics, stated that slowing wage growth, rising unemployment rates, and a slower growth path have strengthened the reasons for interest rate cuts, and the Federal Reserve may begin cutting rates in September Seema Shah, Chief Global Strategist at Principal Asset Management, pointed out that the downward revision of data and the rise in unemployment rate have increased the possibility of a rate cut in September, but also expressed concerns about the outlook for the US economy.

Overall, the persistently weak economic data and rising unemployment rate have strengthened market expectations for the Federal Reserve to cut interest rates. If economic data continues to show a slowdown in the coming months, the possibility of the Federal Reserve cutting interest rates in September will further increase. These factors all indicate that the Federal Reserve may begin discussing and implementing interest rate cuts at the upcoming FOMC meeting to support economic growth and alleviate pressure on the labor market.

How should we adjust our investment strategy when interest rate cuts come?

The impact of interest rate cuts on investment strategies is multifaceted, as different asset classes and industries respond differently to changes in inflation. Here are some key impacts and recommendations:

1. Fixed income market

Long term bonds

- Impact: When inflation decreases, the real interest rate (nominal interest rate minus inflation rate) increases, making the real yield of bonds more attractive. Bond prices typically rise as yields decrease.

- Strategy: Increase the allocation of long-term treasury bond and investment grade corporate bonds to capture the opportunity of price rise and obtain stable returns.

Inflation Protected Bonds (TIPS)

- Impact: Although TIPS’ returns are tied to inflation, their attractiveness may weaken when inflation expectations decrease.

- Strategy: Reduce the allocation of TIPS and shift towards traditional fixed income products.

2. Stock market

Growth stocks

- Impact: In a low inflation and low interest rate environment, growth stocks (such as technology stocks) typically perform well because the present value of future returns is higher.

- Strategy: Increase investment in high growth technology stocks and other growth stocks that have high profit potential in a low inflation environment.

defensive stock

- Impact: Defensive stocks, such as consumer goods, healthcare, and utilities, perform relatively stably during periods of economic uncertainty.

- Strategy: Maintain appropriate allocation of defensive stocks to balance risks in the investment portfolio.

3. Commodity market

gold

- Impact: Gold is often seen as a tool to hedge against inflation. When inflation expectations decrease, the attractiveness of gold may weaken.

- Strategy: Reduce direct investment in gold and shift towards other asset classes such as stocks and bonds.

Raw materials and energy

- Impact: A low inflation environment may suppress the rise in raw material and energy prices, affecting the profitability of related companies.

- Strategy: Invest cautiously in the raw materials and energy industries, focusing on companies with strong market positions and cost control capabilities.

4. Real estate market

Real Estate Investment Trusts (REITs)

- Impact: A low inflation and low interest rate environment is usually favorable for the real estate market, as borrowing costs decrease and demand for real estate increases.

- Strategy: Increase investment in REITs to obtain stable rental income and capital appreciation.

5. Overseas markets

emerging market

- Impact: Low inflation and a weaker US dollar may be beneficial for emerging markets as they can alleviate their external debt burden and stimulate capital inflows.

- Strategy: Increase investment in emerging markets, especially those countries with strong economic fundamentals and benefiting from global economic recovery.

6. Asset allocation and risk management

Diversified investment

- Impact: The cooling of inflation provides a more stable economic environment, which is conducive to the implementation of diversified investment strategies.

- Strategy: Maintain diversified asset allocation, covering stocks, bonds, real estate, and other asset classes to diversify risks.

dynamic tuning

- Impact: Changes in the economy and inflation require investors to flexibly adjust their investment portfolios to respond to market dynamics.

- Strategy: Regularly evaluate the investment portfolio, dynamically adjust asset allocation based on economic and market conditions, and ensure that the investment strategy is consistent with the market environment.

The impact of inflation cooling on investment strategies is mainly reflected in different reactions to fixed income markets, stock markets, commodity markets, and real estate markets. Investors should flexibly adjust their investment portfolios based on inflation expectations and market conditions, increase their allocation of growth stocks, long-term bonds, and real estate investment trusts, while maintaining diversification and dynamic adjustments to achieve stable investment returns. In a low inflation environment, investors can leverage a stable economic environment to achieve long-term wealth growth through refined asset allocation and risk management.

The entire text is complete.

Leave a Reply