The poor performance of Biden in the first debate has led to the perception that he is at a disadvantage in the election race against Trump, which directly caused the “Trump trade” to make a comeback.

As a result, the market has recently been focusing on the typical “Trump trade,” where the market is betting on a rate cut amid weakening economic data.

[Review of U.S. Economic Macroeconomic Data]

- Trump Trade vs. the Fundamentals

Last weekend, Biden’s poor performance in the first debate led to the resurgence of the “Trump trade,” which is characterized by a “strong dollar, weak U.S. bonds” phenomenon. However, as economic data like PMI showed weakness, the momentum behind the “Trump trade” began to lose steam, and by Friday, the nonfarm payroll data essentially sealed the deal. The fundamental economic data has started to prevail over the uncertainty of the election.

- Frequent Revisions in Employment Data

- Nonfarm Payroll Data: In June, nonfarm payrolls increased by 206,000, slightly exceeding the market expectation of 190,000, but this was a significant decline compared to the previous month’s 272,000. The data for the previous two months were also heavily revised down. In April, the initial reading of 165,000 was revised to 108,000, and in May, the number dropped from 272,000 to 218,000, totaling a reduction of 111,000.

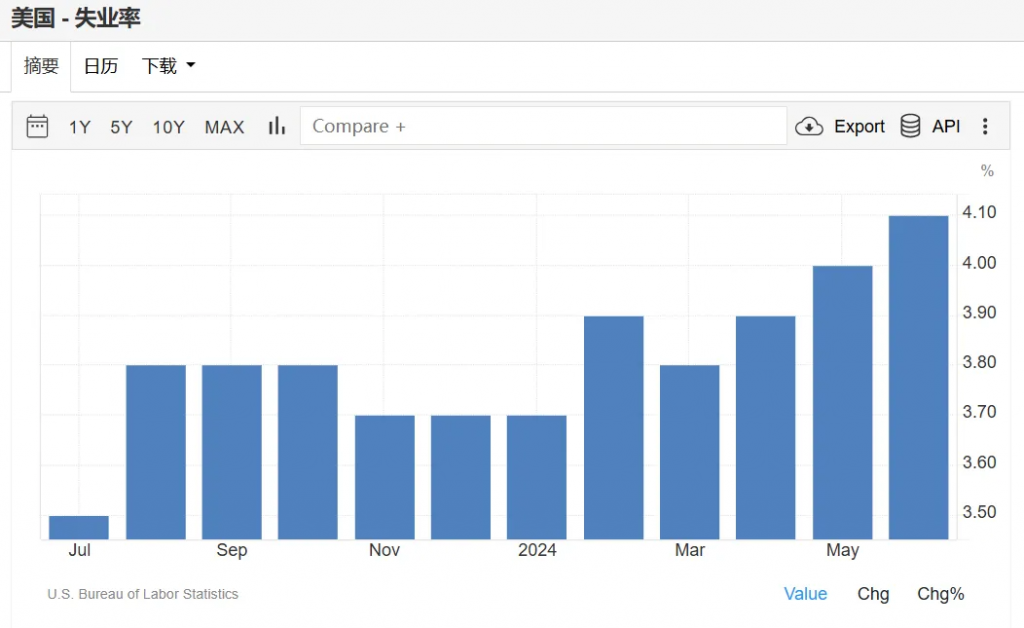

- Unemployment Rate: In June, the unemployment rate rose to 4.1%, the highest since November 2021. The market had expected it to remain at 4.0%, matching the previous month’s figure.

Over the past 16 months, 13 months of nonfarm payroll data were revised down, with only 3 months being revised upward. A key reason for these revisions is that the response rate for post-pandemic employment surveys has sharply declined. The response rate for the CES business survey fell to a historical low of 41.6% in June 2023, rising slightly to 43.5% in March this year, but still below the pre-pandemic response rate of around 60%.

Another reason for the downward revisions is the increase in public sector employment, which has compensated for the lack of private sector job growth. In June, the employment increase was heavily concentrated in construction, education, healthcare services, and government sectors, accounting for 86.9% of the total nonfarm payroll increase.

- Unemployment Rate and the “Sam Rule”

- Rising Unemployment Rate: The unemployment rate in June rose to 4.1%, exceeding market expectations of 4.0%. According to the “Sam Rule,” if the 3-month moving average of the unemployment rate is more than 0.5% higher than the lowest level in the past 12 months, the U.S. is considered to have entered the early stage of an economic recession. The average unemployment rate for the past three months is 4%, while the lowest point in the past 12 months was 3.57%, with a difference of 0.43%, close to the 0.5% threshold.

- Recession Signals: By May of this year, 21 out of 51 states and territories in the U.S. had triggered the “Sam Rule” recession signal.

- The Future Path of the Unemployment Rate and Potential Recession

- Demand Side: Wage growth and job vacancy data indicate that the labor market is cooling. Currently, for every unemployed person, there are 1.22 job openings, close to pre-pandemic levels (1.19). In June, the private sector wage growth dropped to a year-over-year rate of 3.86%.

- Supply Side: The labor force participation rate has increased, with immigration having a significant impact on the labor market. After the pandemic, sectors that rely on immigrant labor (such as accommodation, food services, and retail trade) saw high job vacancy rates and wage growth, attracting a large number of immigrants. Biden’s policy to limit immigration along the U.S.-Mexico border may affect labor supply.

- Market Response and Expectations of Rate Cuts

Following the release of these data, gold and U.S. stocks rose, U.S. Treasury yields dropped, and the CME FedWatch Tool showed that the probability of a rate cut in September rose to over 70%. Futures markets indicate that investors expect the Federal Reserve to cut rates twice this year.

Expert Opinion: Rubeela Farooqi, Chief U.S. Economist at High Frequency Economics, stated that slowing wage growth, rising unemployment, and a slower economic growth path strengthen the case for a rate cut this year. Seema Shah, Chief Global Strategist at Principal Asset Management, noted that the rise in unemployment and data revisions have increased the likelihood of a rate cut in September, but also expressed concerns about the U.S. economic outlook.

The continued weakness in economic data and rising unemployment have heightened market expectations for a rate cut by the Federal Reserve. If the economic slowdown continues in the next few months, the possibility of a rate cut in September will increase. These factors suggest that the Federal Reserve may begin to discuss and implement a rate cut at the upcoming FOMC meeting to support economic growth and ease pressure on the labor market.

[Strong Dollar, Weak U.S. Bonds: The Return of the Trump Trade]

The “strong dollar, weak U.S. bonds” phenomenon refers to the strengthening of the dollar while U.S. Treasury bond prices fall (and yields rise). This phenomenon was particularly prominent during Trump’s presidency, leading to the term “Trump trade”:

- Strong Dollar: A strong dollar occurs when the U.S. dollar appreciates against other major currencies, reflecting investor confidence in the U.S. economy and increased demand for the dollar. This usually coincides with expectations of higher interest rates, as higher rates attract foreign capital to the U.S. for better returns.

- Weak U.S. Bonds: Weak U.S. bonds refer to the decline in the price of U.S. Treasury bonds and the rise in yields, indicating concerns about the U.S. government’s increasing debt burden or expectations of rising future interest rates. Capital flows out of the bond market and into other more attractive investment opportunities, such as stocks or other high-yield assets.

Why Does This Occur? This phenomenon is largely attributed to Trump’s policies:

- Economic Policies:

- Tax Cuts: Trump’s administration implemented large-scale tax cuts, including the “Tax Cuts and Jobs Act,” which stimulated corporate profits and economic growth, attracting capital inflows into the U.S. and pushing up the dollar.

- Fiscal Stimulus: Massive government spending on infrastructure and military expenditures boosted the economy in the short term but also increased government debt, pushing up Treasury bond yields.

- Trade Policies:

- Trade Protectionism: Trump’s imposition of tariffs and trade barriers aimed at protecting U.S. manufacturing led to a strong dollar in the short term as tariffs reduced imports and increased demand for the dollar.

- Trade Uncertainty: Trade disputes with China and other countries heightened market uncertainty, with investors seeking safe-haven assets like the dollar.

- Monetary Policies:

- Interest Rate Policies: During Trump’s presidency, the Federal Reserve raised interest rates multiple times, strengthening the dollar. Higher interest rates attracted global capital inflows into the U.S.

- Geopolitical and Market Sentiment:

- Geopolitical Tension: Trump’s administration witnessed rising geopolitical tensions (such as with North Korea and Iran), increasing risk aversion and driving up demand for the dollar.

- Market Sentiment: Trump’s policies and rhetoric often led to market volatility, raising demand for the dollar as a safe-haven asset.

Impact of Trump’s Policy Proposals on the Market

Economic Stimulus and Debt Expansion:

Policy: The Trump administration stimulated the economy through tax cuts and increased government spending. This spurred short-term economic growth but led to higher fiscal deficits and government debt in the long run.

Market Impact: Initially, a strong dollar and high interest rates attracted capital inflows, but long-term debt concerns led to declining U.S. Treasury prices and rising yields.

Trade Protectionism

Policy: High tariffs and trade barriers were implemented to protect domestic industries.

Market Impact: In the short term, this boosted demand for the dollar but heightened global trade tensions, increasing market uncertainty.

Regulatory and Energy Policies

Policy: Deregulation, particularly in the financial and energy sectors, encouraged domestic production and investment.

Market Impact: Stock prices in related sectors rose, but it raised questions about environmental sustainability and long-term viability.

The “strong dollar, weak Treasuries” phenomenon associated with Trump’s policies was driven by a combination of economic stimulus, protectionism, interest rate policies, and market sentiment. While Trump’s policies bolstered the dollar and Treasury yields in the short term, they also raised concerns about fiscal deficits and debt in the long term. Monitoring policy changes and economic data is crucial for understanding and navigating these complex market conditions.

Core Aspects of Trump’s Trade Policy:

- Protectionism

High Tariffs:

- The Trump administration imposed substantial tariffs on a range of imports, particularly from China, including steel, aluminum, electronics, and household appliances.

- Aiming to reduce trade deficits and shield U.S. industries from foreign competition.

Trade Barriers:

- Besides tariffs, non-tariff barriers like strict import quotas and complex inspection protocols limited foreign goods’ entry into the U.S. market.

2. Bilateral Trade Agreements

Renegotiation and Withdrawal:

- Trump withdrew from key multilateral agreements like the Trans-Pacific Partnership (TPP) and renegotiated others, such as replacing NAFTA with the U.S.-Mexico-Canada Agreement (USMCA) to ensure more favorable terms for the U.S.

Bilateral Negotiations:

- Preference for bilateral trade talks aimed at securing more advantageous deals for the U.S.

3. Trade War with China

Tariff Battles:

- High tariffs were imposed on Chinese imports worth hundreds of billions of dollars, impacting various sectors from electronics to consumer goods.

- China retaliated with tariffs on U.S. goods, hitting agriculture and automotive sectors.

Technology and IP Protection:

- The U.S. accused China of forced technology transfers and intellectual property theft, using tariffs and other measures to push for change. Sanctions were placed on tech giants like Huawei and ZTE, restricting access to U.S. technology.

4. Reducing Trade Deficits and Reviving Manufacturing:

Trade Deficit Reduction:

- A primary goal was to curb trade deficits, seen as detrimental to the U.S. economy, by reducing reliance on foreign goods and fostering domestic production.

Manufacturing Reshoring:

- Tax incentives and deregulation aimed to bring manufacturing back to the U.S., focusing on steel and aluminum industries as crucial to national security.

5. Sanctions and Economic Pressure:

Sanctions as Leverage:

- Economic sanctions were used to force policy changes in countries like Iran, North Korea, and Venezuela, encompassing trade restrictions and financial sanctions like asset freezes and international transaction bans.

Economic Pressure:

- Tariffs and sanctions were tools to compel other countries to concede in trade negotiations, favoring U.S. trade conditions.

6. Impact and Reaction to Policy Implementation:

Domestic Effects:

- Short-term protection of U.S. industries like steel and aluminum was evident, but it also led to higher import prices, impacting consumers and downstream industries. Retaliatory tariffs affected sectors heavily dependent on exports to China.

International Response:

- Trade partners responded with countermeasures, escalating trade tensions.

- Some countries sought alternative markets, diversifying supply chains to reduce U.S. reliance.

Trump’s trade policies, characterized by high tariffs, bilateral negotiations, and economic sanctions, aimed to protect U.S. domestic industries, reduce trade deficits, and encourage the return of manufacturing. However, these policies also led to heightened international trade tensions, increased costs for domestic consumers, and negative impacts on certain sectors. In the long term, the full impact of these policies on the U.S. economy and the global trade system remains to be further observed and assessed.

Long-term Implications of Trump’s Trade Policies:

- Shifts in Global Trade Patterns

Reorganization of Trade Partnerships:

- High tariffs and trade disputes prompted countries to reassess their U.S. trade relationships, seeking new partnerships with regions like China and the EU.

Supply Chain Diversification:

- To circumvent tariffs, businesses might shift production to cost-effective countries like Vietnam, India, or Mexico, making global supply chains more complex.

2. Impact on the U.S. Economy:

Manufacturing Return and Investment:

- While tax cuts and deregulation may encourage some manufacturing to return, higher labor and production costs could limit this trend.

Rising Consumer Prices:

- Tariffs increased import costs, potentially reducing consumer spending and quality of life, particularly in sectors like electronics and daily goods.

3. International Economic Relations:

Spread of Protectionism:

- Trump’s trade policies could inspire other nations to adopt similar measures, increasing global trade barriers and hindering economic growth.

Challenges to Multilateral Trade:

- Doubts cast on multilateral trade deals weakened institutions like the World Trade Organization (WTO), complicating rule-making and enforcement.

4. Geopolitical and Strategic Effects:

Erosion of U.S. Leadership:

- The “America First” policy diminished U.S. global economic leadership and credibility, encouraging other nations to seek greater autonomy and leadership roles in international affairs.

5. Domestic Political and Social Impact:

Polarization and Division:

- Trump’s trade policies fueled debate, exacerbating political polarization and societal divides.

Job Market and Income Distribution:

- While manufacturing jobs may return, automation limits job growth, potentially affecting income equality as tariffs hit lower-income groups harder.

6. Corporate Strategy Adjustments:

Investment Shifts:

- Uncertainty surrounding trade policy may drive companies to favor investments in politically stable countries.

Localization and Diversification:

- Businesses may opt for local production and diversify markets to mitigate risks from policy changes.

Technology and Innovation:

- Policies limiting access to foreign technology could encourage domestic R&D but may restrict global competitiveness over time.

Trump’s trade policies had a significant short-term impact on the U.S. economy and global trade, but their long-term effects may be more complex and profound. From shifts in the global trade landscape and the impact on the U.S. economy to changes in international economic relations and geopolitical dynamics, these policies are poised to influence the global economic and political environment for years or even decades. In the long term, the sustainability of these policies and changes in the global economic context will determine the specific direction and extent of their impact.

Focus on Interest Rate Cycles and Tax Policies on Tech Stocks, Particularly SaaS.

Amid economic cooling, inflation easing, and the possibility of Fed rate cuts, increasing exposure to tech stocks is a prudent strategy. Investing in companies with strong profitability and innovative potential, and diversifying through tech-focused ETFs, allows investors to harness tech growth in a low-interest environment while maintaining a balanced portfolio for long-term stability.

It is advisable to continue focusing on major IaaS providers and application-side SaaS services. With the development and increasing adoption of AI technologies, IaaS and SaaS companies occupy a unique position to offer essential computing resources and platform services that support the AI transformation of enterprises. These companies can gain direct economic benefits from this trend and enhance customer success, deepening client relationships and achieving sustainable business growth. Looking ahead, AI is expected to be a key driver for further innovation and growth within the cloud computing and SaaS industries.

Leave a Reply