1. Federal Reserve Policy: The Easing Cycle is About to Begin

As inflation moves in the right direction, Federal Reserve officials are now more sensitive to the downside risks in the labor market. The unexpected rise in the unemployment rate in July has strengthened expectations of a rate cut in September, with the possibility of further cuts later this year. Over the past two and a half years, inflation has been the core guiding policy, but as the Fed approaches its goal of price stability, it has become increasingly focused on maximum employment.

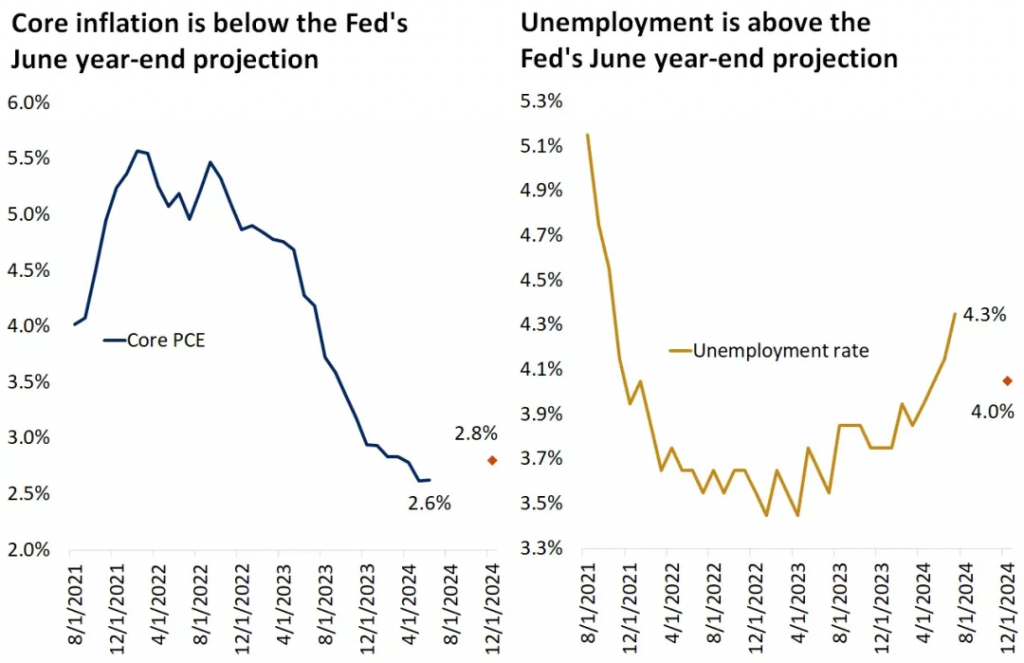

Last week, the Fed kept the policy rate unchanged at 5.25% – 5.50% but adjusted its statement to reflect the potential for a rate cut in September. Chairman Powell stated at a press conference that although work on inflation is not finished, the Fed can begin to gradually ease the restrictions on policy rates. With inflation moving in the right direction, officials are more sensitive to labor market risks and expect the Fed to cut rates two to three times this year. Since June, inflation has been below the Fed’s 2.8% year-end forecast, while the unemployment rate has risen to 4.3%, above the 4.0% forecast.

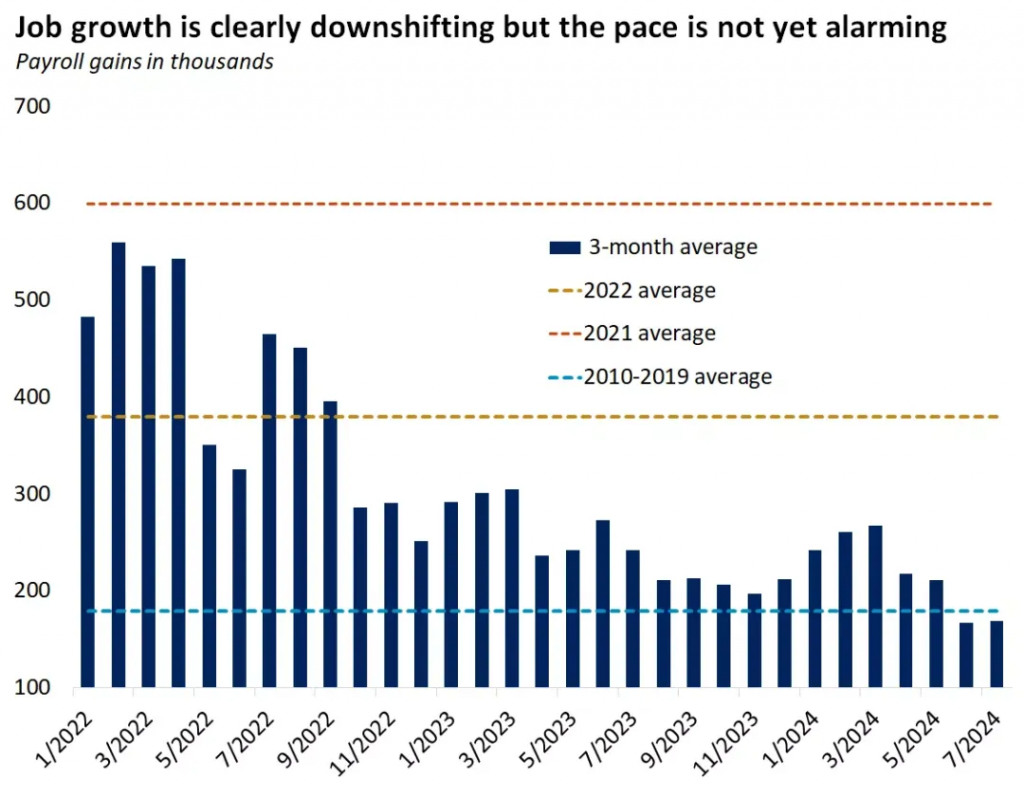

2. Labor Market: Jobs Are Still Being Added, But July’s Weak Report Raises Doubts

The U.S. labor market has been cooling for several months, but this slowdown is seen as a normalization of an overheated situation, which has been welcomed by the market. However, the July employment report showed that the U.S. economy added only 114,000 jobs, lower than the expected 175,000, while the unemployment rate rose to 4.3%, and wage growth slowed to 3.6%, the smallest increase in over three years. We believe the labor market is adjusting to slower economic growth, and the July data suggests this adjustment may be happening more quickly than expected, reinforcing expectations for a rate cut in September.

It’s important to note that the rise in the unemployment rate to 4.3% is not just a part of monthly fluctuations—it triggered the “Sahm Rule.” According to this rule, a significant rise in unemployment could signal the onset of a recession. This further strengthens the market’s expectations that the Fed will cut rates in September and beyond.

Nevertheless, the 4.3% unemployment rate is still historically low, and the rise in unemployment is largely due to an increase in the labor force, not a reduction in employment. Moreover, job vacancies still far outnumber unemployed individuals. Despite these changes, we still describe the labor market as healthy.

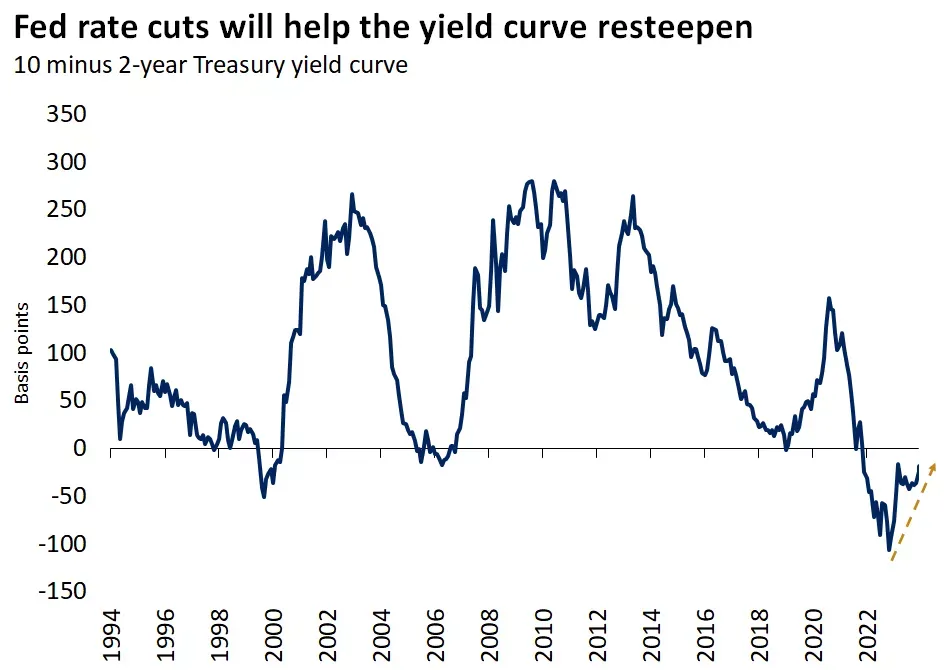

3. Yield Curve: Bonds Are Making a Comeback, and the Longest Inversion in History May End Soon

The yield curve has been inverted for more than two years, which is typically a negative signal for the financial market, indicating that short-term bond yields are higher than long-term bond yields. The Fed has hinted at easing rate restrictions, and last week’s data highlighted downside risks to the economy. The bond market has begun to price in a more aggressive easing cycle, driving bond prices up and yields down. We believe the decline in short-term yields will outpace that of long-term yields, helping the yield curve normalize.

We recommend slightly increasing the duration relative to investment-grade bond benchmarks, with a preference for medium- and long-term bonds. Although short-term certificates of deposit and money market rates may still be attractive in the near term, as the Fed enters a rate-cutting cycle, yields will gradually decline, so investors should be mindful of reinvestment risks.

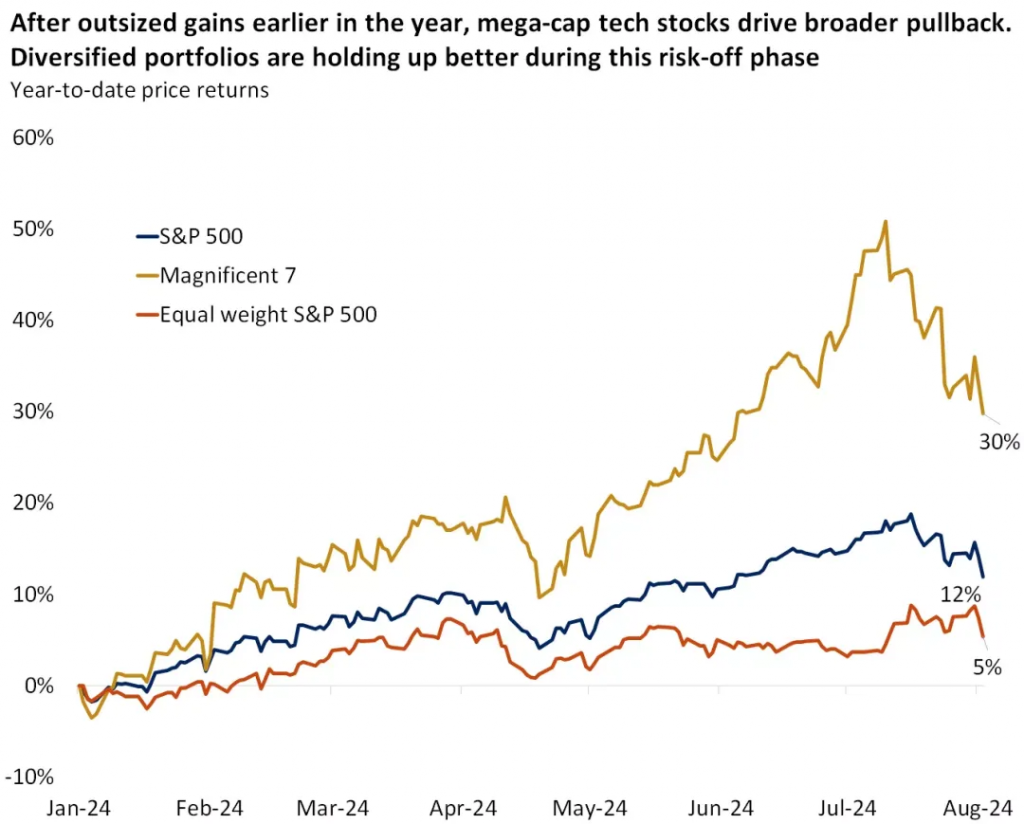

4. Market Leadership: AI Will Continue to Thrive, but Technology Is No Longer the Only Game in Town

Tech giants reported strong growth this week, but due to high expectations, their prices failed to continue rising, and the tech and semiconductor sectors are undergoing adjustments. The Nasdaq has entered a correction zone, and investors are growing impatient with the returns on massive AI spending. We believe artificial intelligence will experience rapid growth over the next five to ten years, bringing returns to companies that are heavily investing today.

Beyond the tech sector, earnings growth for the S&P 500 index is expected to accelerate, with the biggest positive surprises coming from cyclical and defensive sectors. These shifts align with our expectations that leadership will broaden as the Fed’s rate-cutting cycle approaches. We recommend focusing on defensive sectors that are inversely related to bond yields during risk-off periods to provide portfolio stability while maintaining proper diversification.

5. Volatility: Even as Market Volatility Increases, the Bull Market Could Continue

Volatility was low in the first half of the year, but it has significantly increased in the first few weeks of the second half. Last Thursday, the stock market experienced the largest intraday volatility since the end of 2022. The S&P 500 rose 0.8% in the morning but then dropped 2% before partially recovering. Concerns about the Fed cutting rates too late and election-related uncertainties could be catalysts for increased volatility.

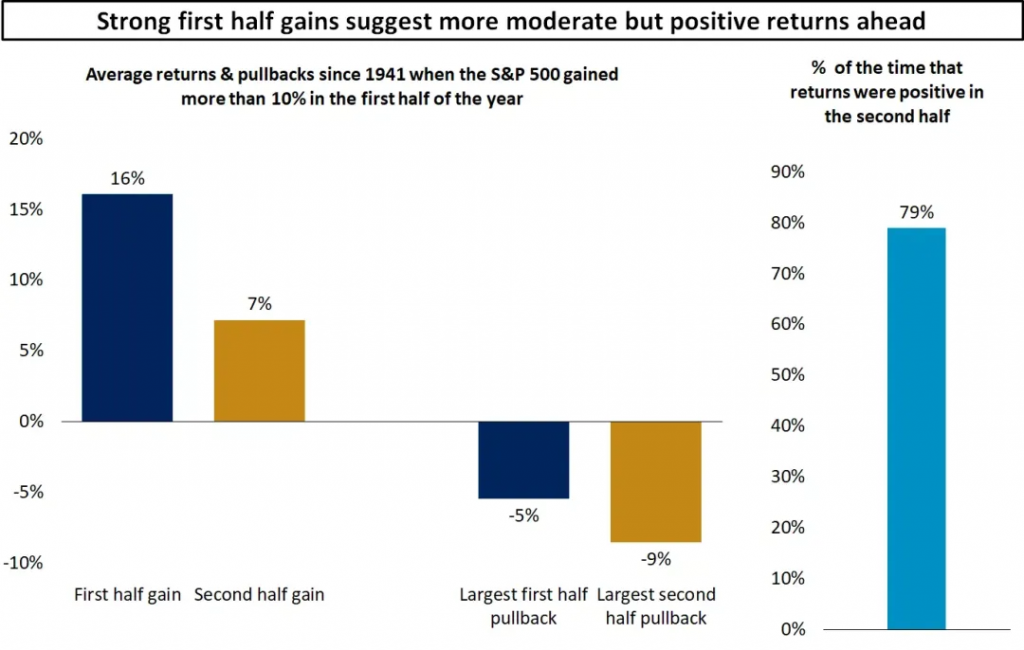

Historically, August to October is the worst period for stock market performance, but in a strong upward trend, the negative seasonal effects are smaller. When the S&P 500 has risen by 10% or more in the first six months, it has averaged a 7% gain in the second half. We believe that although volatility may reach a turning point, short-term pullbacks will not change the relatively positive outlook. Inflation is close to the target, the economy continues to expand, albeit at a slower pace, productivity is rising, and corporate earnings are increasing, so the bull market is likely to continue.

As these shifts in Fed policy, the labor market, the yield curve, market leadership, and volatility unfold, these factors will determine the market’s performance in the coming months and quarters. We recommend taking advantage of pullback opportunities for rebalancing, diversification, and deploying new capital to mitigate the impacts of these turning points.

Leave a Reply