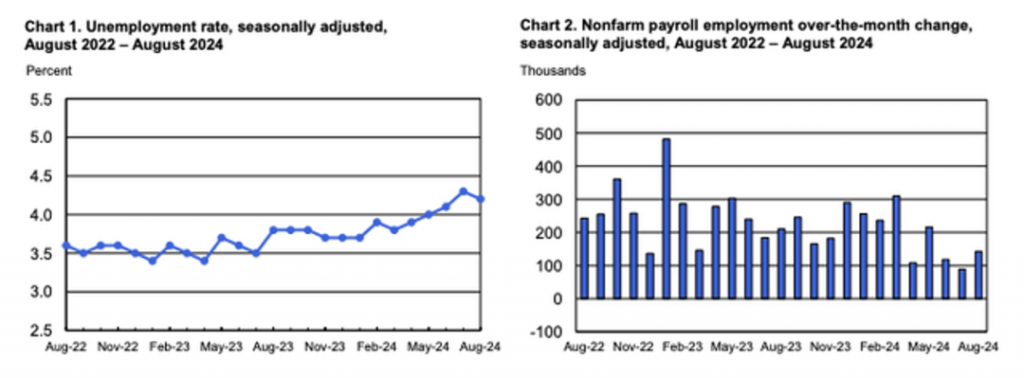

Despite a slight drop in the unemployment rate, the latest labor market report shows a broader weakening trend. In August, the unemployment rate fell from 4.3% in July to 4.2%, but this figure is still higher than last year’s 3.8%.

The non-farm payrolls increased by 142,000, which, although an improvement from the 114,000 reported last time, is still far below the 2023 average increase of 202,000 per month. These figures clearly indicate that the labor market is slowing down, especially in high-paying manufacturing sectors.

Increased Likelihood of Economic Slowdown

With the unemployment rate holding steady above 4% for four consecutive months, the average unemployment rate for 2024 so far is 4%. According to the Federal Reserve’s forecast, this unemployment rate aligns with an expected GDP growth rate of 2.1% for the fourth quarter of 2024. However, an increase in unemployment is generally associated with slower GDP growth. According to Okun’s Law, if the unemployment rate stays at 4.2%, GDP growth for the fourth quarter might drop to 1.5%. Therefore, if the Federal Reserve doesn’t take swift action to adjust interest rates, an economic slowdown seems almost inevitable.

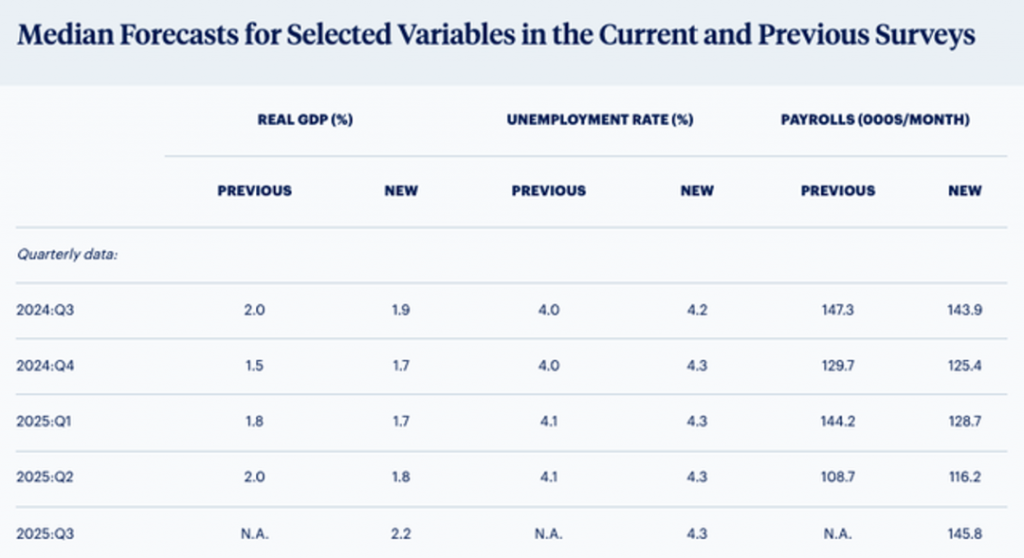

Additionally, a survey by the Philadelphia Federal Reserve indicates that professional forecasters expect GDP growth rates of 1.9% and 1.7% in Q3 and Q4 of 2024, respectively, below long-term trend levels, which aligns with expectations of a rising unemployment rate.

Interest Rate Outlook: Rate Cuts on the Horizon

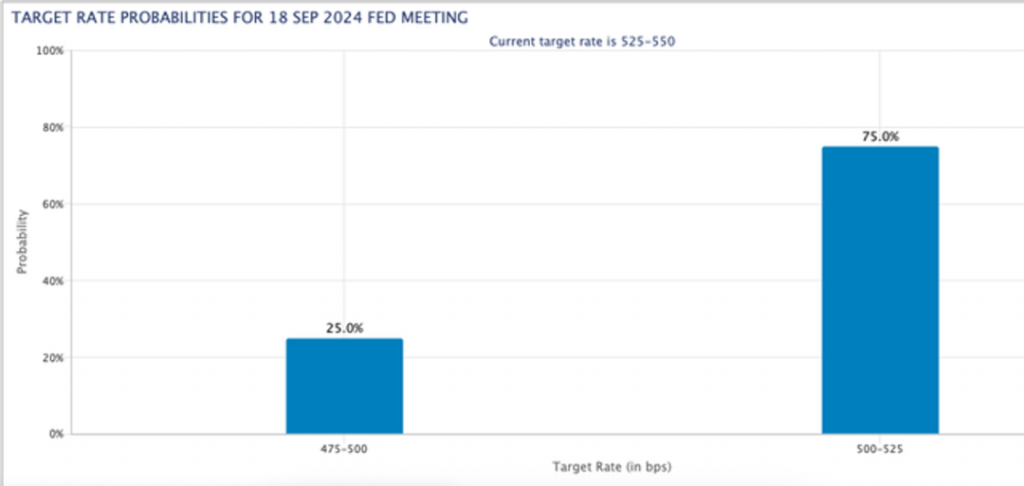

The market widely expects the Federal Reserve to cut rates by 25 basis points at the meeting on September 18. Interestingly, the market also assigns a 50% probability of a further 25 basis point cut in November and 40% for December. If the Federal Reserve opts for a more substantial rate cut (such as 50 basis points), the policy rate could drop by as much as 1 percentage point before the end of 2024. Current economic data supports a cautious approach by the Federal Reserve, but once the rate-cutting cycle begins, it is likely to continue.

Market Performance and Investment Opportunities

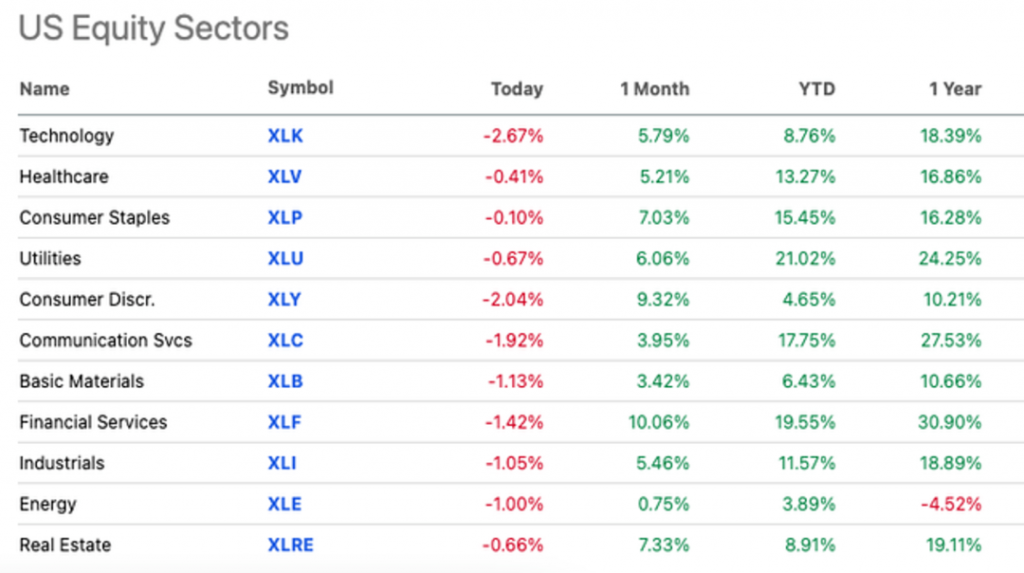

The news of a weakening labor market has led to a widespread drop in major stock indices, with all three major indices experiencing significant declines this week. However, from a long-term investment perspective, a slowdown in the labor market isn’t necessarily negative. The upward revision of GDP growth and the onset of a rate-cutting cycle indicate that the economy may not be severely impacted, and this could even create conditions for a soft landing.

In this context, cyclical sectors such as energy, consumer discretionary, and basic materials might benefit from this trend, even though these sectors have underperformed this year. For risk-averse investors, defensive sectors such as healthcare still represent relatively safe choices.

Overall View:

- Labor Market Softening but Not in Recession: Despite weak employment data, the slight decrease in the unemployment rate and positive job growth indicate that the labor market has not entered a full recession. Employment is still growing, especially in service sectors like healthcare and education.

- Economic Growth May Slow Below Trend Levels: If the unemployment rate remains above 4%, GDP growth could slow to around 1.5% in Q4 of 2024. This further reinforces market concerns about a potential economic slowdown, especially in light of weak manufacturing performance.

- The Federal Reserve’s Rate-Cutting Cycle Is Near: Although the market expects a 25 basis point rate cut in September, the likelihood of further rate cuts in the coming months is increasing. The Federal Reserve will focus on supporting the labor market and economic growth.

- Cyclical Sectors Could Be a Bright Spot: Although markets are responding negatively in the short term, cyclical sectors might outperform in the future, particularly in a declining interest rate environment. Energy, consumer discretionary, and basic materials sectors may provide good investment opportunities.

- Investment Strategy: Diversification and Defensive Investments:Given the economic uncertainty, investors are advised to look for opportunities in cyclical sectors while also allocating some funds to more defensive sectors like healthcare to reduce risk.

In conclusion, the trend of a softening labor market offers valuable insights into future economic growth and the Federal Reserve’s rate-cutting policies. At the same time, cyclical sectors could perform strongly in the future, making them worthy of attention during the current market weakness.

Currently, the U.S. economy shows signs of potential stagflation, marked by slow employment growth, high unemployment rates, and persistent inflationary pressures. The Federal Reserve’s main task is to achieve a “soft landing” with price stability and full employment, but key economic indicators (such as the Sahm Rule, JOLTS data, and the yield curve) all suggest risks of an economic slowdown and rising unemployment, with GDP growth expected to slow.

Economic Data and Trends:

- Weak Employment Data: According to the BLS, August added 142,000 jobs, which was below the expected 165,000, and employment data for June and July was revised down. The average monthly job addition over the past three months is just 116,000, showing weak growth.

- Stagflation Concerns: Although GDP performed well (Q2 annualized growth of 3%), the weak employment market has fueled concerns about stagflation. The Sahm Rule indicates that an increase in the unemployment rate of more than 50 basis points could signal the beginning of a recession.

- Federal Debt and Government Spending: Jefferies points out that government spending accounts for a third of GDP, and expansionary fiscal policies combined with a large Federal Reserve balance sheet could exacerbate inflationary risks in the future. Government spending is considered one of the primary drivers of current GDP growth.

Future Challenges (Grey Rhino or Black Swan):

- De-Dollarization: The U.S. attempt to “weaponize” the dollar through sanctions against Russia has led several countries to adopt local currency settlements. This de-dollarization trend could weaken the global dominance of the U.S. dollar.

- Oil Shock: Oil prices may face disruptions due to tensions in the Middle East. Additionally, the depletion of the U.S. Strategic Petroleum Reserve could cause energy prices to rise significantly, negatively impacting economic growth.

- Municipal Defaults: The pressure from immigration could increase the fiscal strain on some “sanctuary cities,” potentially leading to technical defaults.

- Geopolitical Risks: The escalation of the Ukraine war and rising tensions between the U.S. and China add uncertainty to the global economy.地缘政治风险:乌克兰战争升级以及中美紧张局势加剧给全球经济增添了不确定性。

Federal Reserve Policy:

The Federal Reserve currently faces a dilemma in balancing inflation and economic growth. While economic data suggests a slowdown and rising unemployment, inflation remains above expectations. The Federal Reserve may continue to try for a “soft landing” through moderate rate cuts, but it may have to tolerate inflation higher than the pre-pandemic 2% target. Current policy remains overly accommodative, which could lead to more severe inflation or an economic recession in the future.

- The U.S. economy faces risks of stagflation, characterized by slow growth and persistent inflation.

- Government spending makes up a large proportion of GDP, and fiscal policies present challenges for future economic stability.

- Geopolitical and macroeconomic risks are increasing, which could affect both the global and U.S. economies.

- The Federal Reserve faces tough policy choices and may need to make difficult decisions between inflation and growth.

Leave a Reply