This is a story of a true investment legend, a tale of how an investor earned a hundredfold return in 11 years through deep insight and unwavering conviction.

On June 5th, Eastern Time, Nvidia’s stock price surged by 5%, with a total market value reaching $3.01 trillion, surpassing Apple’s $3 trillion market value and becoming the world’s second most valuable company, just behind Microsoft.

Today, let’s look at an investment legend about Nvidia, how an ordinary investor earned a hundredfold return in 11 years through deep insight and unwavering conviction.

First Encounter with Nvidia

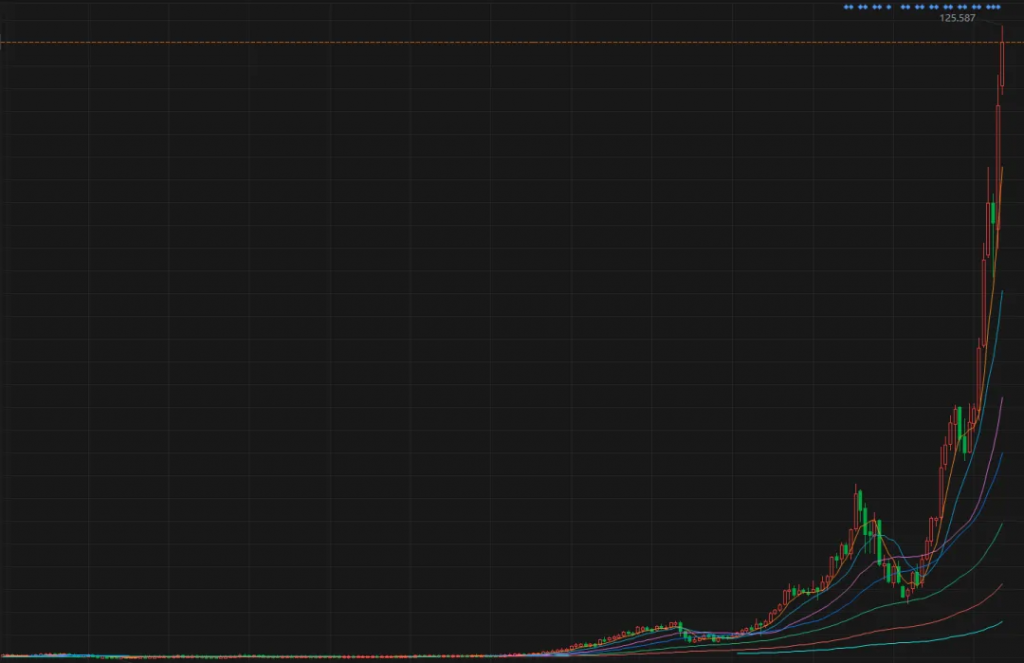

In April 2013, Peter O’Keefe, founder of O’Keefe Stevens Advisory, first bought Nvidia (NVIDIA) at a price of $3.10 per share. At that time, the company was primarily considered a GPU provider that enhanced computer gaming effects. O’Keefe decided to invest in Nvidia because he valued the company’s dominant position in the GPU market and its solid financial condition. However, he did not foresee that Nvidia would become a hundredfold stock at that time.

Fluctuations and Persistence in the Investment Journey

During the 11 years of holding Nvidia, O’Keefe experienced many fluctuations. For example, Nvidia’s stock price once fell by 67% in less than a year. However, O’Keefe overcame these challenges with a deepening understanding of the company and keen market insight, successfully increasing his position at crucial moments. For instance, in May 2015, he saw in Nvidia’s annual report that the company discussed not only its computer gaming chips but also fields like autonomous driving and deep learning. Realizing “we have a very special investment,” he continued to increase his position at about $5 per share.

Key Turning Point

For O’Keefe, a conference call on May 12, 2016, was a significant turning point. Nvidia announced strong financial performance and clarified its enormous potential in deep learning and artificial intelligence fields. A few weeks later, foreseeing the vast prospects of Nvidia, O’Keefe decided to continue holding and observing its development.

Inevitable Fluctuations and Another Surge

In October 2018, due to fluctuations in the cryptocurrency market, Nvidia’s stock price fell by more than 57% in just two months. However, O’Keefe saw it as an opportunity to build a position and continued to hold. Subsequently, Nvidia’s stock price rebounded rapidly, nearly tenfold, over the next three years. In March 2019, Nvidia announced the acquisition of Mellanox, further consolidating its market position.

Driving the AI Revolution On November 30, 2022, the release of ChatGPT pushed the enthusiasm for artificial intelligence to new heights, driving Nvidia’s stock price to climb continuously. Tech giants like Microsoft, Google, and Apple joined in, further driving up Nvidia’s market value. By June 2023, Nvidia became the world’s second most valuable company, with a total market value of $3.01 trillion.

Reflection and Summary

In a letter to holders last August, O’Keefe summarized this successful investment experience, emphasizing the following points:

- Continuous Learning and Self-Correction: Continuously repositioning and recognizing the value of the company during the holding process helped him overcome short-term fluctuations and persist in holding.

- Long-Term Perspective: Viewing investments as long-term assets rather than short-term speculation.

- Focusing on the Core of the Business: Grasping the key factors of the enterprise and ignoring short-term data and market fluctuations.

- Concentrated Investing: Allowing the investment portfolio to become unbalanced over time, capturing the huge returns brought by market winners.

Through his investment in Nvidia, O’Keefe demonstrated how to achieve substantial returns in an uncertain market by continuously learning and adjusting. His story is not just a legend about wealth but also an inspiration about wisdom, persistence, and insight.

Leave a Reply