【Weekly Market Overview】

- The release of the October Consumer Price Index (CPI) report last week alleviated concerns about the emergence of a new wave of inflationary pressure. While inflation remains uncomfortably high, the latest data indicates that consumer price pressures are gradually easing.

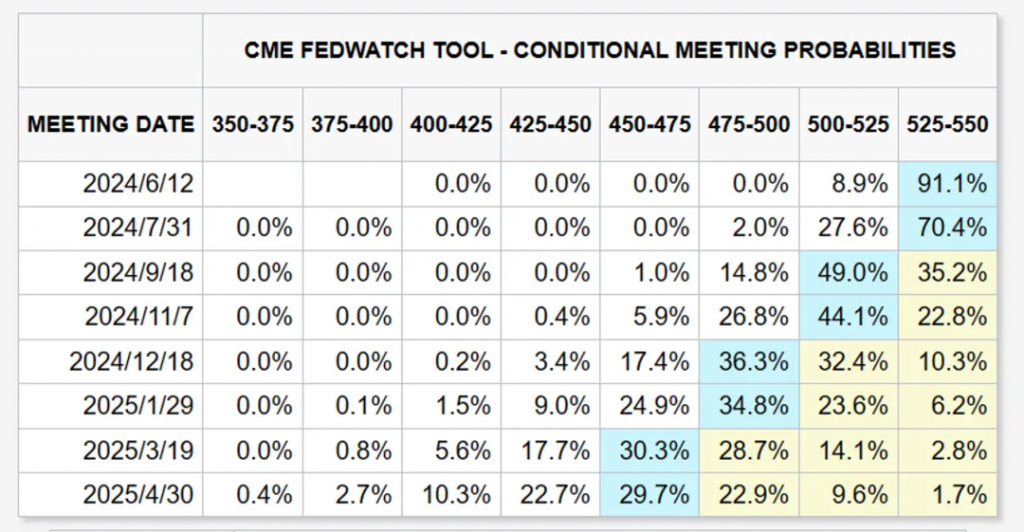

- Stocks rebounded and interest rates fell last week, driven by better-than-expected inflation (supporting the rationale for the Federal Reserve’s likely rate cut in September) and strong corporate earnings announcements.

- The stock market hit record highs last week. Although we anticipate more turbulence ahead as we progress, we believe this does not signify the market’s ultimate peak. The combination of sustained economic growth, rising profits, and less restrictive Fed policies continues to provide a positive backdrop for the ongoing bull market.

The Consumer Price Index (CPI) report for October, released last week, alleviated concerns about the emergence of a new wave of inflationary pressure. Despite inflation still being high, the latest data indicates that consumer price pressures are gradually easing. Inflation performed better than expected (supporting the possibility of a rate cut by the Federal Reserve at some point this year) and corporate profits remained strong. The stock market hit new highs last week. While we anticipate more volatility ahead, we believe this does not signify the market’s peak, as sustained economic growth, rising profits, and fewer constraints from the Federal Reserve provide a positive backdrop for the continuation of the bull market. We believe that the peak of inflation has passed, while the peak of the stock market lies in the future. Going forward, we need to see further support in areas such as housing prices, as a decline in commodity prices may offer less assistance. Meanwhile, the growth in corporate profits will support further gains in the stock market.

Key points:

- Inflation data eases market concerns.

- Last week’s release of the April Consumer Price Index (CPI) report alleviated concerns about a new round of inflationary pressure. Despite inflation still being on the high side, the data shows that consumer price pressures are gradually easing.

- Driven by better-than-expected inflation data and strong corporate earnings announcements, the stock market rose, and interest rates fell.

2. Stock market hits new highs:

- The stock market hit new highs last week. Although there may be volatility in the future, we believe this is not the ultimate peak for the stock market. With economic growth, increasing profits, and the Federal Reserve’s policy becoming more accommodative, the bull market is expected to continue.

- Stocks typically expand their gains after surpassing previous peaks.

3. The Relationship between Inflation and the Stock Market:

- The peak of inflation has passed, inflation is declining, and the stock market is rising. The market anticipates a possible interest rate cut by the Federal Reserve this year.

- The April CPI report shows that the overall core CPI has dropped to 3.6% year-on-year, the lowest in three years. While service prices remain high, commodity prices continue to decline, especially in automobiles and household goods.

4. Market Outlook:

- We expect inflation to continue easing. The results of the April CPI report have strengthened the market’s expectation of an interest rate cut by the Federal Reserve this year.

- Pay attention to changes in housing prices. Rental data in the coming months is expected to be helpful, but progress may be slow.

5. Stock Market and Corporate Earnings:

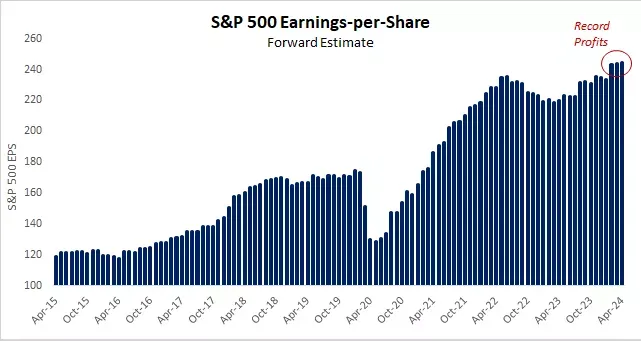

- The new bull market started in October 2022, and despite fluctuations, the S&P 500 index has risen by nearly 52% since then. It has risen by over 10% so far in 2024.

- The stock market’s rise is not only driven by the technology sector but also by more cyclical sectors (such as industrial and financial) and defensive and interest rate-sensitive sectors (such as utilities) showing strong performance recently.

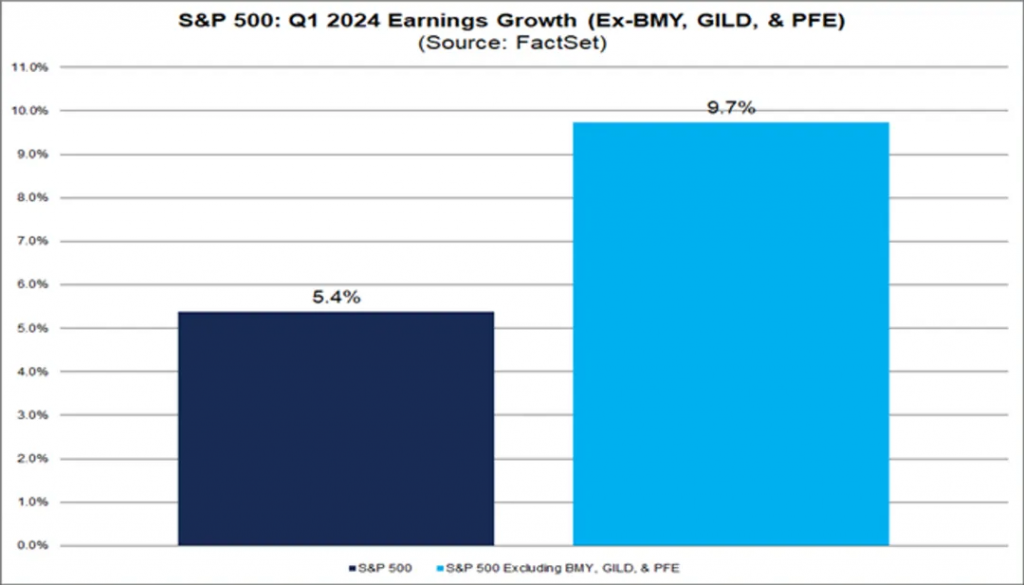

- Corporate earnings growth will be the main driver of future stock market gains, with double-digit earnings growth expected in 2024.

6. Dow Jones Industrial Average Breaks 40,000 Points:

- Last week, the Dow broke through 40,000 points for the first time. The significance of this number itself is not great; more importantly, it reflects the strong rise in stock prices over the past few months and years.

- Breaking through 40,000 points is mainly due to continuously improving financial data.

- Excluding Biogen, Gilead Sciences, and Pfizer, the blended earnings growth rate of the S&P 500 index will increase from 5.4% to 9.7%.

7. Interest Rates and Commodity Prices:

- We believe that the 5% level reached by the 10-year Treasury yield in October last year will be the peak of this Federal Reserve tightening cycle.

- Oil and gold prices are diverging. Oil prices have dropped by over 35% from their peak in 2022, while gold prices recently reached a new high of $2,400 per ounce.

8. Return of Speculative Assets:

- Last week, “meme stocks” like GameStop and AMC once again became hot topics, with their stock prices soaring. This indicates

Weekly market statistics

- Dow Jones Industrial Average: 40,004 (up 1.2%)

- S&P 500 Index: 5,303 (up 1.5%)

- Nasdaq Index: 16,686 (up 2.1%)

- MSCI EAFE Index: 2,381.35 (up 1.5%)

- 10-year Treasury yield: 4.42% (down 0.1%)

- Oil price: $79.53 (up 1.6%)

- Bonds: $96.81 (up 0.6%)

Leave a Reply