On Wednesday (November 13), the U.S. Bureau of Labor Statistics reported that inflation rose in October, but the increase was broadly in line with Wall Street’s expectations.

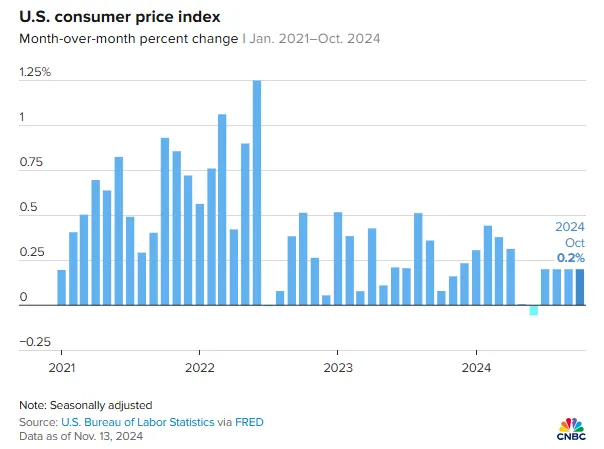

The Consumer Price Index (CPI), which measures the cost of a broad range of goods and services, increased by 0.2% in October.

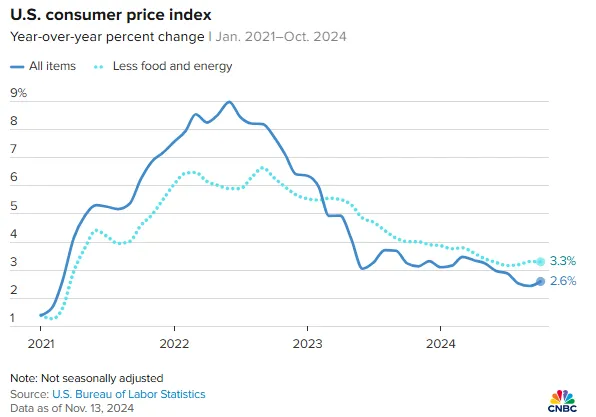

This brought the annual inflation rate to 2.6%, up 0.2 percentage points from September. Core CPI, which excludes food and energy prices, saw a more notable rise. The core CPI rose by 0.3% in October, bringing the year-on-year increase to 3.3%, which also matched expectations.

Following the data release, traders significantly raised the odds of the Federal Reserve cutting its benchmark interest rate by 0.25 percentage points in December.

Energy costs, which had been falling in recent months, remained flat in October, while food prices rose by 0.2%. Compared to the same month last year, energy prices fell by 4.9%, while food prices increased by 2.1%.

While inflation eased in other areas, housing costs remained the main driver of CPI growth.

The housing index, which accounts for about one-third of the CPI’s overall weight, rose by 0.4% in October, double the increase in September, and was up 4.9% year-on-year. According to the Bureau of Labor Statistics, housing prices contributed to more than half of the total CPI increase.

Used car prices also rose, up 2.7% from the previous month, while motor vehicle insurance dropped by 0.1%, though it still rose by 14% year-on-year.

Airline fares increased by 3.2%, while egg prices dropped by 6.4%, but were still 30.4% higher than the previous year.

In another report, the Bureau of Labor Statistics stated that inflation-adjusted average hourly wages for workers rose by 0.1% in October, up 1.4% compared to the same time last year.

This data further diverges from the Fed’s 2% inflation target and could complicate the Federal Reserve’s future monetary policy, especially with a new government set to take office in January.

Morgan Stanley Wealth Management’s Chief Economic Strategist, Ellen Zentner, commented: “The CPI data wasn’t a surprise, so the Fed should still be on track to cut rates again in December. However, given the uncertainty around President Trump’s policies, the situation next year will be different. The market is already weighing the possibility that the Fed may reduce rates less frequently than previously expected in 2025, and they could pause as early as January.”

The economic plans of the elected President, Donald Trump, could further exacerbate inflation. Despite a cooling of inflation from its peak in mid-2022, inflation continues to pose a serious challenge for U.S. households.

As a result, traders have recently reduced their expectations for Fed rate cuts. The Fed has already lowered its benchmark lending rate by 0.75 percentage points and is expected to implement more aggressive cuts.

However, traders now anticipate that by the end of 2025, the Fed will have only cut rates by 0.75 percentage points, about half a percentage point less than pre-election expectations.

Leave a Reply