Artificial intelligence giant SMCI. US saw its stock price drop 20.14% on Wednesday, August 7th, to close at $492.70 due to lower than expected performance. From its high of $1229 five months ago, its stock price has fallen by 60%!

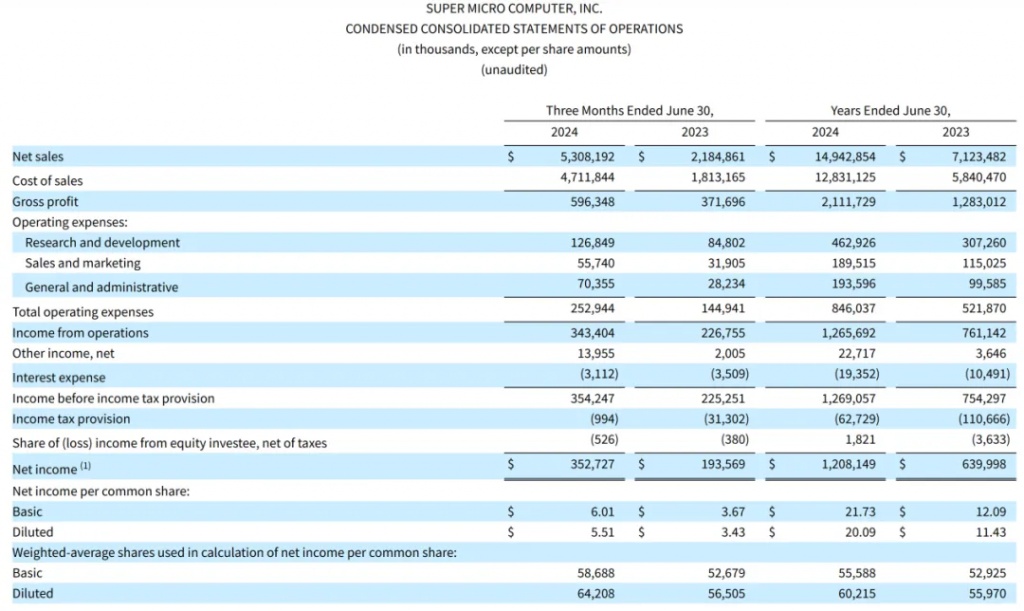

According to the latest financial report released by Supermicro Computer, the company’s adjusted earnings per share for the fourth quarter of the 2024 fiscal year ended June 30 were $6.25, far below analysts’ expectations of $8.07; The gross profit margin was 11.2%, far lower than the 15.5% in the previous quarter and below analysts’ expectations of 14.1%.

Supermicro Computer achieved a revenue of 5.308 billion US dollars in the second quarter, a year-on-year increase of 142.95%, roughly in line with market expectations of 5.3 billion US dollars; Non accounting standard diluted earnings per share increased by 78.06% year-on-year to $6.25, lower than market expectations of $8.07.

For the fiscal year ending June 30, 2024, Supermicro Computer’s annual revenue was $14.943 billion, an increase of 109.77% year-on-year. Non accounting standard diluted earnings per share increased by 87.04% year-on-year to $22.09.

Although the company’s revenue continues to grow, its profitability has declined. In the second quarter, the gross profit margin of Supermicro Computer decreased from 17.01% in the same period last year to 11.23%; Without considering the impact of stock for salary, the non accounting standard gross profit margin also decreased from 17.06% in the same period last year to 11.29%.

The management stated that the decrease in gross profit margin is mainly due to differences in product and customer mix. The company is now focused on winning strategic new designs at competitive prices, as well as the initial cost increase caused by the new DLC AI GPU cluster in the production ramp up. In the future, innovative platforms based on multiple new technologies will be introduced from strategic partners, and the production efficiency of their DLC solutions will be improved.

Leave a Reply