Most U.S. stocks rose on Monday, mainly due to investors’ high expectations for tax cuts and deregulation policies that Trump might introduce after taking office, and the recent interest rate cut by the Federal Reserve also further boosted market sentiment.

Bitcoin Sets a New High, with market expectations that the Trump administration and Congress will support cryptocurrencies, this optimistic sentiment has pushed up the performance of cryptocurrency-related stocks. COIN and MSTR rose by more than 20%, and HOOD also surged by more than 10%.

The Dow and the S&P 500 were driven to historical highs, with the Dow leading the market, rising by nearly 0.7%, breaking through 44,000 points for the first time; the S&P 500 index also crossed the 6,000-point threshold. These two indices have just experienced their best week of the year, continuously setting new historical highs. The technology stock-dominated Nasdaq rose slightly by 0.06%, and small-cap stocks also performed well, with the Russell 2000 index climbing to its highest level since November 2021.

However, the performance of Nvidia, Apple, and Meta was slightly weaker, causing some drag on the overall increase.

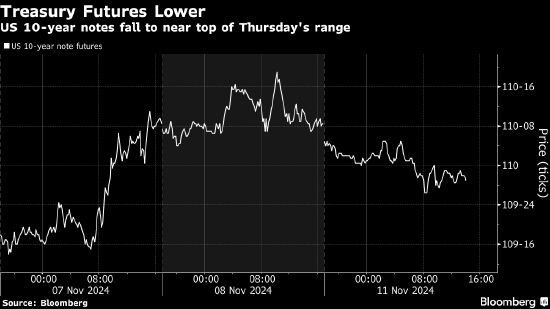

U.S. Treasury Yields Face Upward Pressure

As of 3:30 PM Eastern Time on Monday, the 10-year U.S. Treasury futures fell by about 11 basis points, with implied yields of about 4.35%. If this level continues when the Asian market opens on Tuesday, it means that the 10-year Treasury yield will rise by about 5 basis points from Friday’s closing.

The U.S. Stock Investment team believes that the continuous improvement of economic data, market expectations for the Fed’s possible dovish stance, and the release of more policy details by the Trump administration could push up Treasury yields. Unless there is unexpected negative economic data, yields will drop sharply.

Last Wednesday, U.S. Treasury bonds experienced a sharp decline, with the market widely betting that tax cuts and trade policies could increase price pressure, prompting investors to focus on the upcoming inflation data. The Federal Reserve is set to cut interest rates by 25 basis points in a few days, and the market’s reaction to inflation data will be key.

At the same time, Minneapolis Fed President Neel Kashkari mentioned in a speech over the weekend that the U.S. economy is still strong, although the Fed has made some progress in curbing inflation, but the task is not yet complete. The U.S. inflation data for October is scheduled to be released on Wednesday. The market generally expects the Fed to cut interest rates by 25 basis points at each of the next two meetings, and the probability of a rate cut in December is 60%.

The futures market suggests that once spot trading resumes, the Treasury yield curve may steepen further. Due to low trading volume on Monday, futures trading volume was about 32% of the average level of the past 20 days.

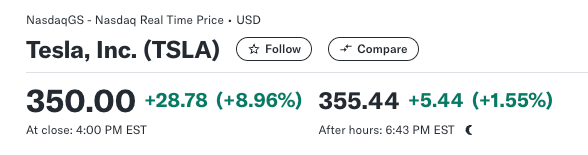

Tesla Breaks Through Trillion-Dollar Market Value

Tesla’s stock price rose by nearly 9% today, closing at $350, setting a new closing high in more than two years. This price is still about 18% higher than its historical peak of $414. Tesla’s current market value has broken through 1 trillion dollars, surpassing TSMC, and ranking seventh in the U.S. stock market.

Hedge funds that stand against Musk have suffered huge losses! According to data from S3 Partners, during the trading period from November 5th to November 8th, hedge funds shorting Tesla lost at least $5.2 billion on paper. Due to the strong rise in stock prices, many funds that previously held short positions have begun to withdraw. Hazeltree’s data shows that as of November 6th, only 7% of hedge funds were still net short on Tesla, while this proportion was 17% at the beginning of July.

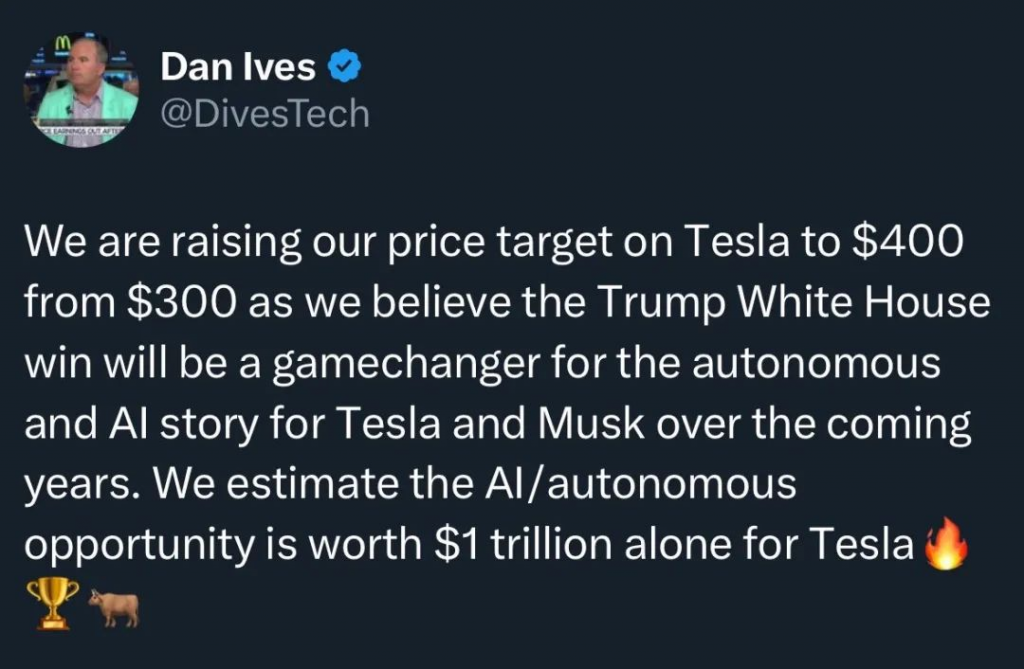

In terms of news, Wedbush analyst Dan Ives raised his target price for Tesla from $300 to $400 and maintained his “outperform” rating. He said, “We estimate that Tesla’s opportunity in the artificial intelligence/autonomous driving field alone is worth 1 trillion dollars.”

Leave a Reply