I wrote in July: “I should have bought Berkshire Hathaway, but when the new funds from the Federal Reserve entered the Nasdaq market again, I felt that the timing was not right. If the inflation rate drops, then all the old Buffett companies will do well, but inflation will push things in another direction

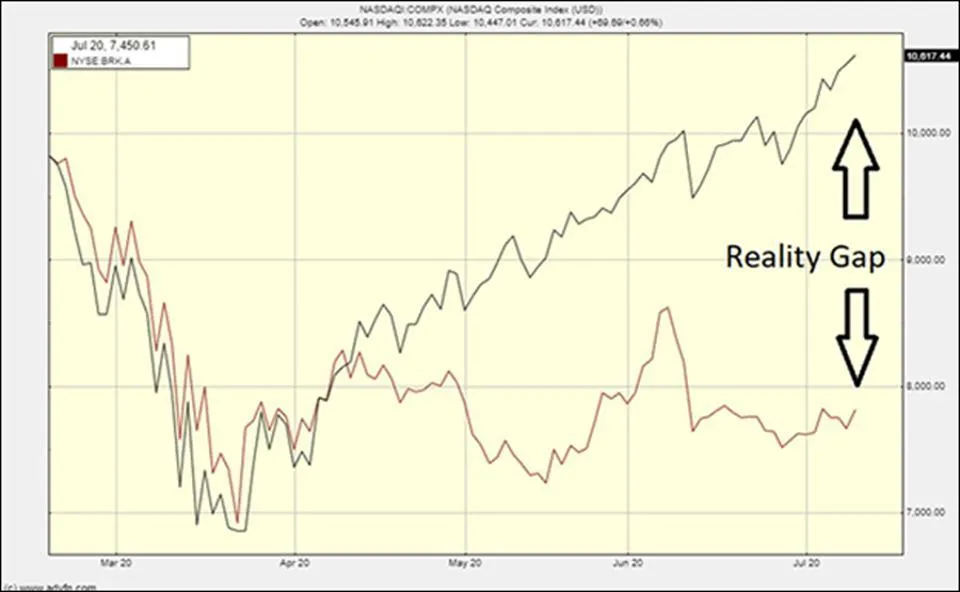

The chart at that time is shown below:

Now it looks like this:

The market was originally a highly efficient valuation mechanism, but it seems to have been broken. In short, companies of Berkshire Hathaway’s size should not operate by storing cash, and the stock market has indeed lost the ability to value companies.

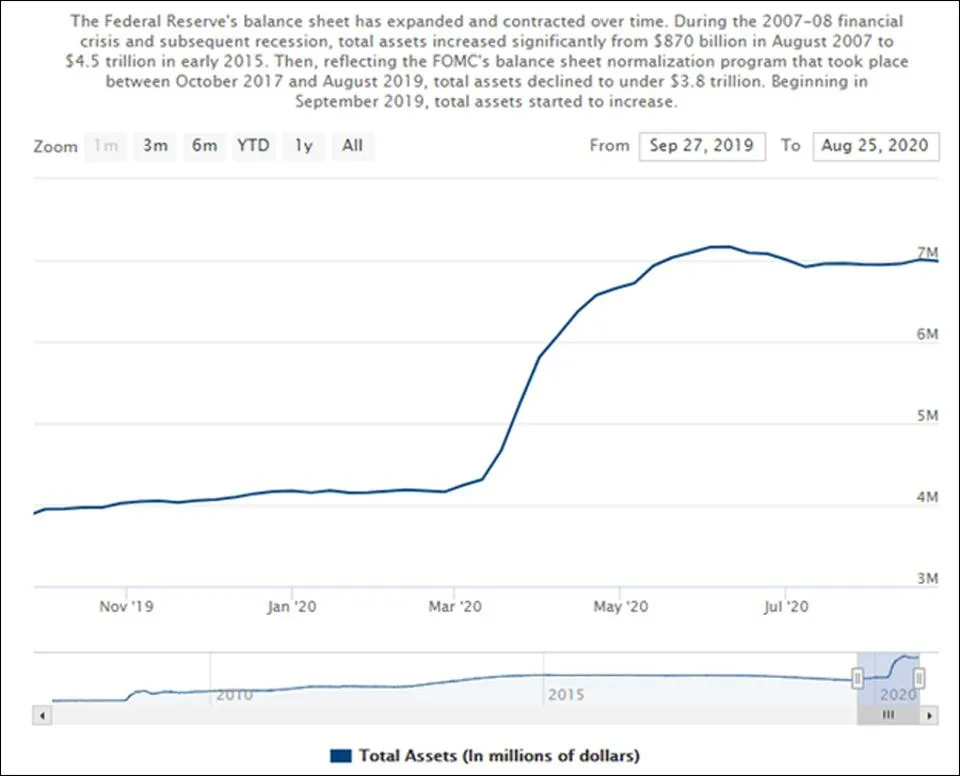

All of this can be traced back to the Federal Reserve and its bailout program, which also isolated most of the cash in the banking system. The bank has enough money to lend, but it won’t. This is understandable, because in this post apocalyptic economic environment, who would you want to borrow money from? However, money is like honey, it can flow wherever there is a small opportunity and quickly become ubiquitous. This money is escaping into stocks. It was originally a highly liquid Internet tycoon, but now it is moving down to most of the liquid sectors.

It is widely recognized that the following mechanism can be used to explain this rise. Due to the significant influx of cash into the stock market, the market has experienced a remarkable recovery, which has led to a surge in people buying on dips and FOMO (fear of missing out on opportunities), fueling a surge in options trading. Call option sellers sell call options and buy physical stocks to offset the risk of price increases; The sellers of call options (i.e. buyers who buy stocks to compensate for the sale of call options) push up the stock price, attracting more buyers of call options, thereby pushing up the premium and attracting more sellers of call options… The virtuous cycle rotates as the stock price continues to rise. If this is the cycle leading to the bursting of the foam, it will soon pay a price. However, this is not the only factor that works together. Warren Buffett himself also pointed out another driving factor: inflation. He has purchased Barrick Gold (GOLD), an obvious inflation hedge measure.

If the inflation rate is reasonable, it is beneficial for stocks, which means that the stock market will be a good place to store cash. If interest rates remain at the promised low level, even if the index is affected by inflation, the Federal Reserve (Fed) will provide the world with a simple arbitrage trade to borrow cash and buy stocks. If institutions can borrow money to buy stocks to raise them by 6% or 7% due to inflation, then they will definitely do so.

So where does the problem lie?

The problem is obvious. Although the crisis beneath the waterline is gradually emerging, they still taste delicious martinis in the bar. Although the speed of the ship sinking may have slowed down, it is still sinking. Before the world economy returns to pre pandemic levels, it will build up a mountain of debt. Restoring sustainability is a long road, and it will be difficult to get there without resetting.

Whether the market is heading towards a Ponzi scheme, a “water column” of bailout funds, or inflation expectations, these three factors will make the market exceptionally dangerous, which is what market trends tell you. Therefore, I am very frustrated with not following my own Berkshire Hathaway chart, although I hope some of you have done so, but this is just another of the many warning signs of the stock market getting out of control.

We are in the final stage of the foam. It must be emphasized that the foam can continue to run. But we must also understand that when the foam bursts, it will produce another disaster, and it will be severe. Without a doubt, assistance will be provided again afterwards. Whether this is sustainable is an unresolved issue, but it is clearly not conducive to low inflation.

This is a perfect trading market, and for FOMO investors, tempting returns will still be irresistible until they suddenly collapse. At the same time, investors who buy and hold will face a huge challenge, followed by another test of their determination. Personally, I can take risks, but it may not be enough. The trading on NASDAQ is already in place, and anyone can guess how high and fast it is, but I am not chasing after it.

After all, printing money does not directly cause inflation. The stock market has nothing to do with the economy

One last thing:

The Federal Reserve created this foam, and now it has stopped pumping water. Please pay close attention to their website.

Leave a Reply