On Wednesday, “artificial intelligence trading” seemed to be in trouble, with the stock prices of the “Big Seven” experiencing their largest single day decline since October 2022.

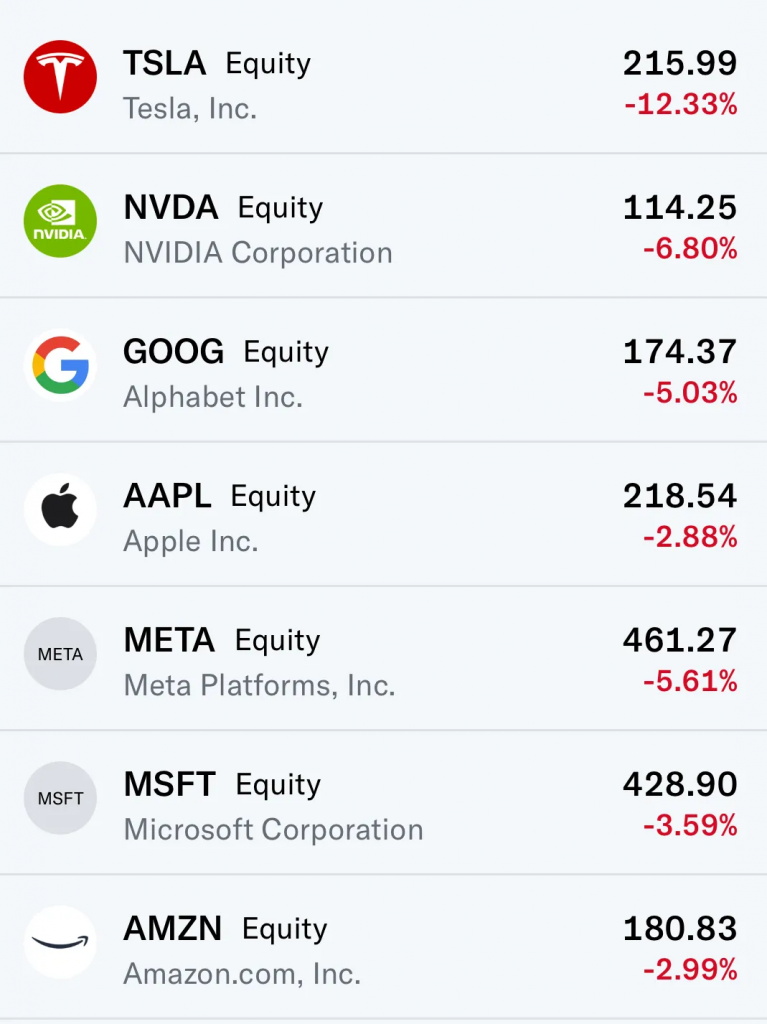

According to Dow Jones market data, the stock index of these seven companies weighted by market value fell by 4.1%, accumulating a 9.8% decline since the recent high on July 10th. During the same period, the Roundhill Magnificent Seven ETF has fallen more than 11%, entering a correction zone for the first time since October last year.

Since the lower than expected inflation report in July, market expectations for multiple interest rate cuts by the Federal Reserve before the end of 2024 have risen, with the first round of cuts expected to begin in September. Since then, the total market value of the “Big Seven” has evaporated by over $1.7 trillion.

As expectations of the Federal Reserve’s September interest rate cut heat up, small cap and value stocks quickly rose after falling behind the S&P 500 and Nasdaq Composite Index for most of 2024.

The selling pressure on major indices seems to be mainly concentrated in the technology sector, which has seen an increasing proportion in the market capitalization weighted S&P 500 index over the past year. Before the end of trading on Wednesday, the information technology sector of the index fell nearly 4%.

The sell-off on Wednesday was driven by the latest financial reports from Tesla (TSLA. US) and Google’s parent company Alphabet (GOOG. US).

Tesla reported a 40% decline in quarterly profits. According to Dow Jones data, its stock price fell more than 12% on Wednesday, marking the largest decline since January. On the other hand, although Alphabet’s profits and sales growth exceeded expectations, its YouTube advertising revenue did not meet analysts’ expectations.

Perhaps the most concerning detail in the financial reports of both companies is that Alphabet’s active investment in artificial intelligence may take longer to take effect. The company’s stock price has fallen nearly 5% in recent trading.

Kim Caughey Forrest, founder and chief investment officer of Bokeh Capital Partners, said, “Their investment returns may take longer, which is crucial for me.” In the past two weeks, the sell-off of the “Big Seven” stocks caught investors off guard, but there are already signs of this happening.

According to BondCliQ data, investors have been selling corporate bonds issued by members of the “Big Seven” over the past two weeks, despite these sales having little impact on yields.

As technology stocks fell, the small cap Russell 2000 Index and the value oriented Dow Jones Industrial Average also fell, but Wednesday’s decline was relatively small and strong since early June.

Other market sectors continue to remain strong, with utility and healthcare stocks performing particularly well. Meanwhile, approximately 217 S&P 500 constituent stocks continued to rise on the same day.

However, the strength of these stocks is not enough to prevent the S&P 500 from experiencing its first 2% decline in 356 days. The index closed down 2.31% to 5427 points, marking its worst performance since December 2022.

The tech dominated Nasdaq Composite Index fell 3.64% to 17342 points, marking its worst performance since October 2022.

Leave a Reply