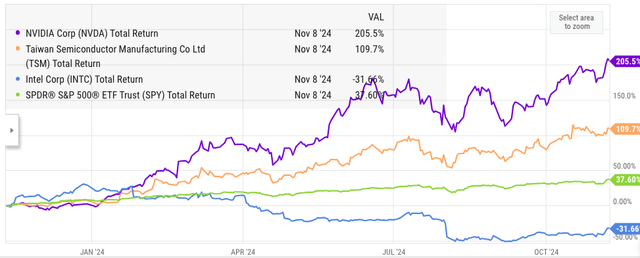

TSMC (NYSE:TSM) continues to deliver strong results, with sentiment on Wall Street improving despite headwinds such as the recent chip export ban.Year-to-date, TSMC stocks have returned 109% totally, compared to 37% for the S&P 500. In addition to the solid performance of recent earnings, TSMC also reported good news from its Arizona plant. According to Bloomberg, the output of the Arizona plant has already exceeded the output of similar factories in Taiwan. This should help the company gain strong support from the U.S. government. On the other hand, Intel faces a number of challenges and is currently delaying or canceling the construction of several factories in Germany, Poland and other regions.

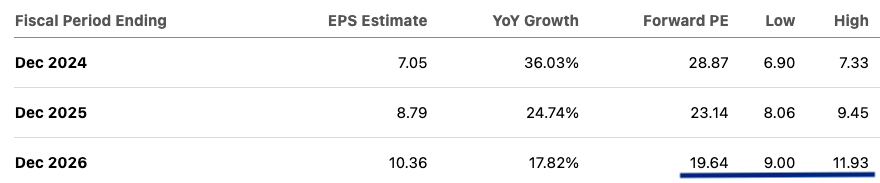

TSMC is gaining momentum, and its EPS growth forecast for the next two years is quite strong.EPS for the fiscal year ending December 2026 is forecast at $10.36 and the forward price-to-earnings ratio is 19.6. When we look at the company’s moat and its role as a major supplier to many big tech companies, the figure is fairly modest.

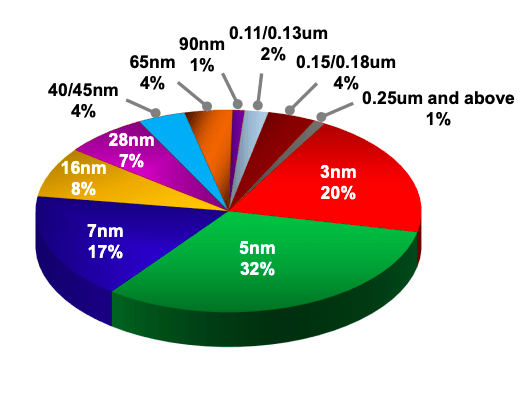

TSMC beat EPS and revenue expectations in this earnings report. Nearly 70% of total revenue comes from the 7nm node or lower, demonstrating the company’s rapid progress over the past few quarters. It is now the exclusive supplier to several major big tech companies, making it an integral part of the supply chain.

We’ve heard of hyperscalers investing huge capital expenditures in AI chips. Most of these chips are manufactured by TSMC, which has shown strong revenue growth potential due to strong demand for AI.

So far this year, TSMC’s stock has led the way with a total return of 109%. With the exception of Nvidia, this is one of the stocks with the highest returns, far outperforming many other competitors.

Intel wants to invest heavily in the foundry space to gain market share. Over the past two years, the company has invested nearly $25 billion a year to build different plants. However, Intel is now facing significant headwinds due to Wall Street’s concerns about the company’s ability to perform well in the near term. This has led to a sharp year-to-date correction in Intel’s stock price. Intel has delayed the construction of many new factories in Germany, Poland and elsewhere. Intel continues to face production challenges at lower nodes and plans to slash capital spending to calm investor jitters. Samsung’s chip production capacity is also challenged and it has ceded market share to TSMC.

Intel’s weakening competition will improve TSMC’s market sentiment, and since the company controls a huge market share, it is likely to see higher profit margins for the company in the coming quarters.Nvidia’s stock has been performing better than TSMC so far this year, but analysts believe TSMC has a better moat. Nvidia faces competition from AMD and other tech giants who are building their own AI chips. Most chip manufacturing is done by TSMC. There is a good chance that Nvidia will lose market share in the AI space, but TSMC’s total revenue may not be negatively impacted, as TSMC is the primary supplier of manufacturing facilities to most of its competitors.

TSMC’s EPS growth momentum continues to be strong. For the fiscal year ending December 2025, EPS is expected to be $8.79 and the stock is trading at an expected price-to-earnings ratio of 23.14. For the fiscal year ending December 2026, EPS is expected to be $10.36 and the stock is trading at an expected price-to-earnings ratio of just $19.64. In terms of growth runways, moats, and operational efficiencies to deliver good earnings, the numbers are quite modest.

TSMC’s earnings profile is stable.As we can see from the chart above, for the fiscal year ending December 2026, the EPS low forecast is $9, while the EPS high forecast is $11.93, which is 33% higher than the low forecast. This is a fairly narrow range for expected EPS forecasts, which indicates confidence in future earnings growth. Many other big tech companies, such as Nvidia, also have large differences in their expected earnings per share forecasts.

For the fiscal year ending January 2027, Nvidia’s high EPS forecast is 4 times higher than its low EPS forecast. This difference is due to expectations of the company’s market share, margins, and revenue growth. In terms of the consensus EPS forecast for the fiscal year ending January 2027, Nvidia shares are trading at 30 times. This is significantly higher than TSMC’s expected price-to-earnings ratio of less than 20 for the fiscal year ending December 2026.

As a result, TSMC may be a better investment for investors looking for stable EPS growth momentum and more certain future EPS forecasts.

TSMC has achieved strong results in the financial report and continues to show good growth momentum. The company also announced good production at its Arizona facility, which will help it gain more support from the U.S. government. On the other hand, competitors such as Intel and Samsung are facing significant challenges and have announced the cancellation or postponement of the construction of new factories.

TSMC has a better moat than many other big tech companies because it provides manufacturing facilities for all major players. Any change in market share in the field of artificial intelligence or other businesses will not affect the demand for TSMC facilities. We can see this clearly in the narrow forward EPS range for many analysts. In the next 2 fiscal years, TSMC’s forward P/E ratio is less than 20, while Nvidia’s P/E ratio is close to 30. Lower valuation multiples and the certainty of forward EPS forecasts make TSMC a good choice for investors.

Leave a Reply