Four normalizations to watch: Economy, Employment, the Fed, and the Market

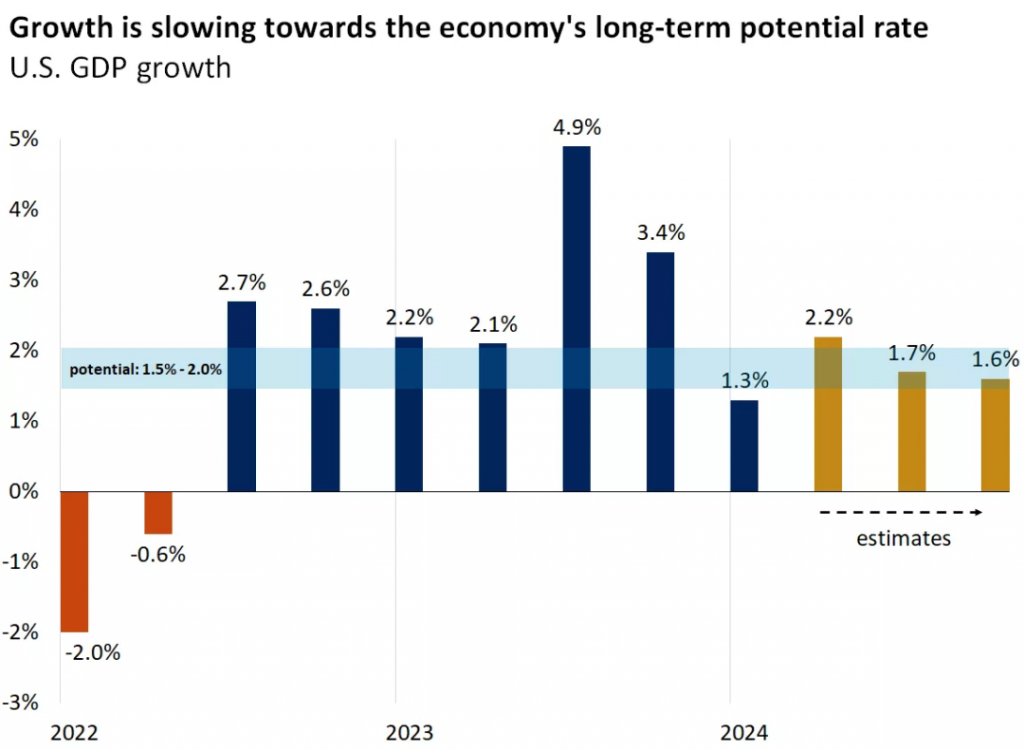

First, Economic Normalization:

- Current Status: Despite high inflation and the Federal Reserve’s tightening policies, the economy has grown over 2% in the past six quarters.

- Future Outlook: As high borrowing costs gradually filter through the economy, low and middle-income consumers begin to feel the pressure. Although wage growth has outpaced inflation in the past year, real wage growth (adjusted for inflation) slows as the labor market cools, affecting disposable spending. Housing and manufacturing activities have recently been volatile, but the outlook remains optimistic.

- Conclusion: The economic slowdown has somewhat eased inflationary pressures, and the scenario of a soft landing is quite feasible.

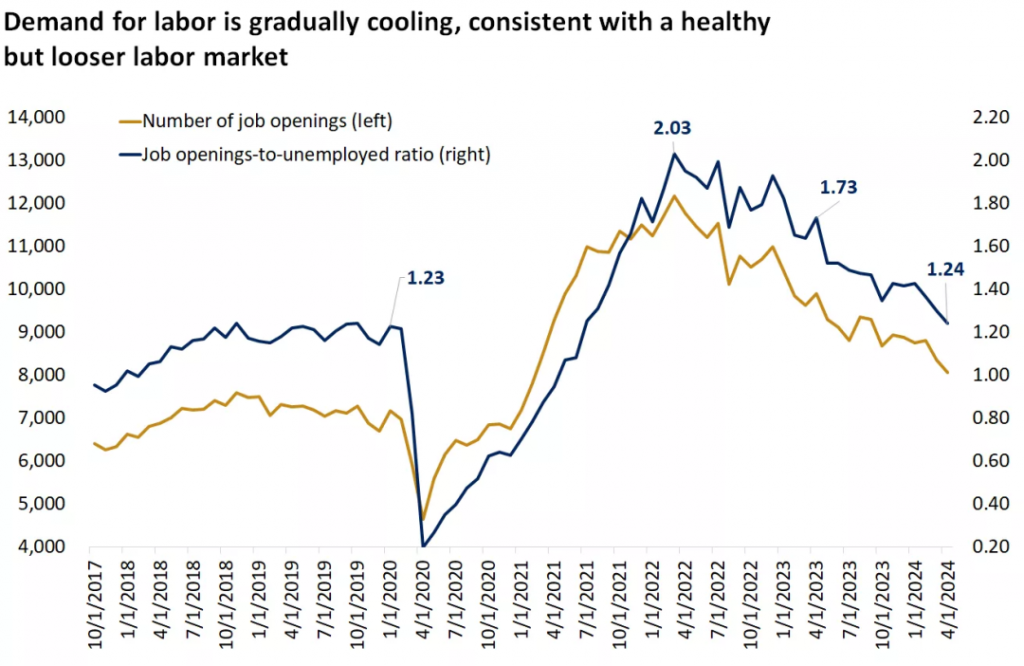

Second, Labor Market Normalization:

- Current Status: The U.S. added 272,000 jobs in May, but the unemployment rate rose from 3.9% to 4%. Despite the job market remaining strong, the level of tension is diminishing.

- Future Outlook: The resilience of the job market has eased stagflation concerns, allowing the Federal Reserve to possibly keep policy unchanged through the summer. Hiring is expected to slow in the future, but significant layoffs are not anticipated.

- Conclusion: The cooling of the labor market should lead to slower wage growth, thereby reducing inflationary pressures in the service sector.

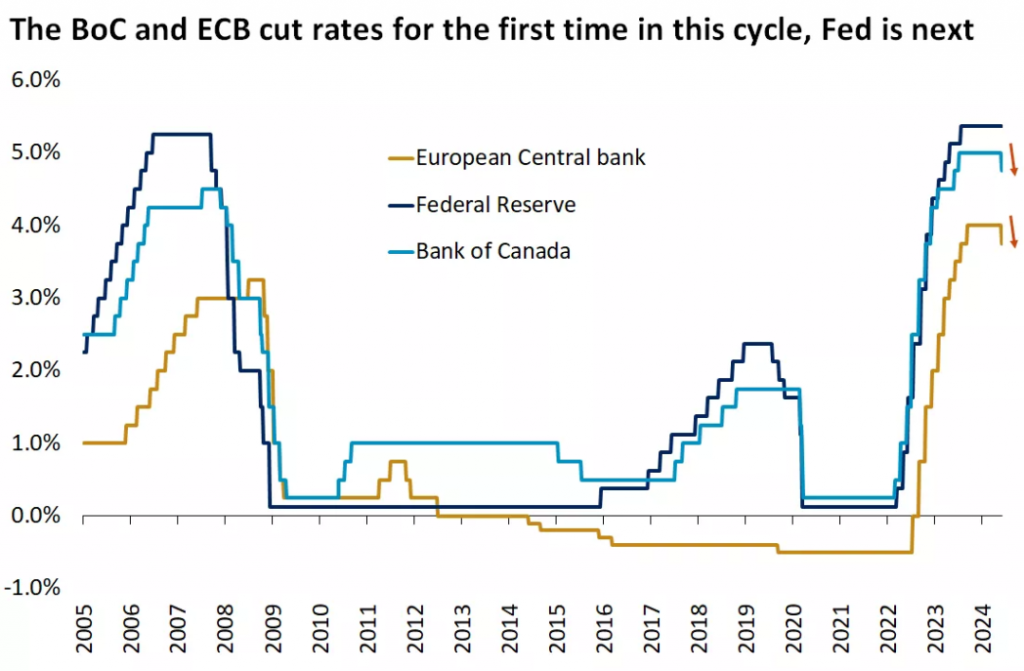

Third, Monetary Policy Normalization:

- Current Status: The Bank of Canada and the European Central Bank have begun their rate-cutting cycles. The Federal Reserve is expected to keep interest rates unchanged at the June meeting and may start cutting rates in September.

- Future Outlook: Global interest rates may have already peaked and will gradually decline over the next 12 months.

- Conclusion: Investors should consider reevaluating the cash and fixed-income allocations in their portfolios to avoid reinvestment risks.

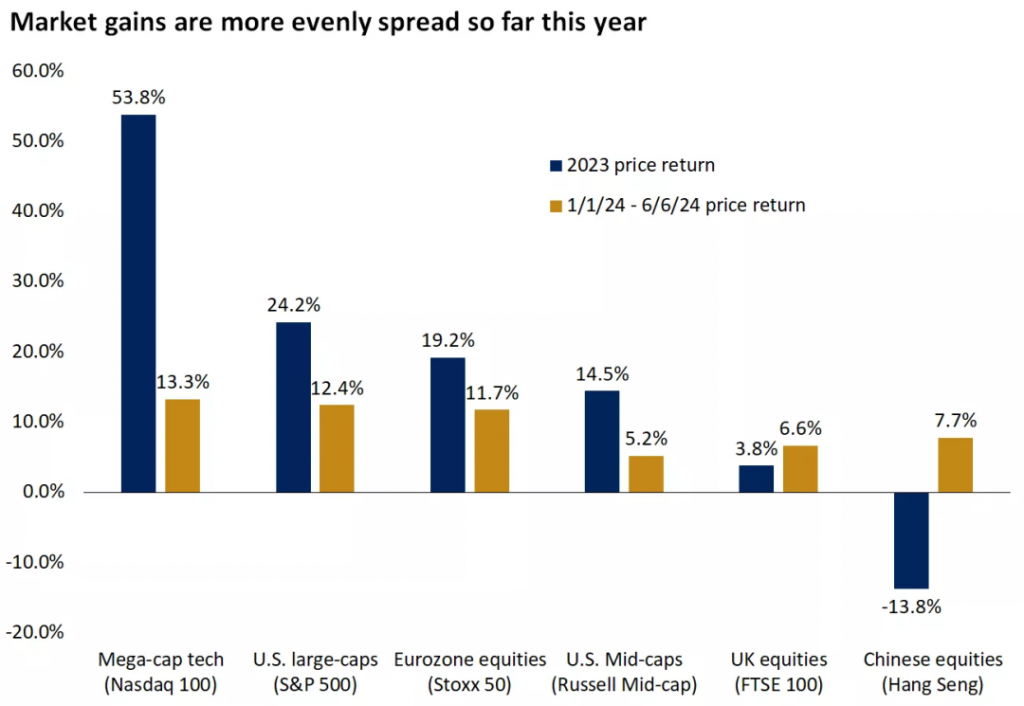

Fourth, Market Breadth Normalization:

- Current Status: AI companies like NVIDIA are driving the market, but more sectors, asset classes, and regions have participated in the market’s rise.

- Future Outlook: AI technology will grow rapidly over the next 5 to 10 years, but diversified investments still hold value. The future phase may benefit from companies that apply AI to enhance productivity.

- Conclusion: It is recommended to complement cyclical and value investments in addition to growth stocks.

The gradual normalization of the economy and labor market indicates that the time for interest rates to slowly normalize is not far off. Such trends help maintain a bull market and bring more balanced investment portfolio returns.

Leave a Reply