Due to market speculation that the Federal Reserve will cut interest rates about twice this year, the S&P 500 index hit its 36th new high since early January. Bloomberg data shows that analysts also predict that US companies’ earnings for the second quarter are expected to grow by around 9%, the highest level since the first quarter of 2022.

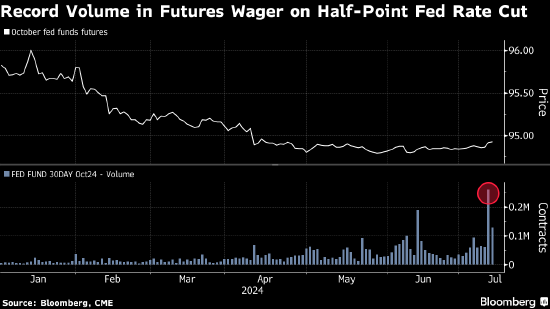

Compared to betting on the standard 25 basis point rate cut in September, traders are increasing their bets that the Federal Reserve will cut interest rates by 50 basis points in September.

This is fully reflected in the federal funds futures market. The weaker than expected inflation data released on Thursday sparked a buying frenzy in October, which continued on Friday. The contract expiring on October 31st has fully absorbed the expectation of decision-makers to cut interest rates by 25 basis points at the September 18th meeting.

Any buying at a higher price level means that more people are expected to believe that the Federal Reserve may initiate its first easing cycle in years with a ‘big bang’.

The position also benefited from the expectation of a 25 basis point interest rate cut on July 31st and September 18th, but traders gave up hope for a rate cut in July a few weeks ago, and no major Wall Street bank predicted a rate cut in July.

The open interest data of futures on the Zhishang Exchange indicates that Thursday’s buying has brought new risks. The trading volume was slightly lower than 260000 contracts, setting a record for the trading volume of contracts expiring in October. Interest in buying remained high on Friday, with a trading volume of nearly 150000 as of 10:30 am New York time.

On Friday, there was little change in the market’s implicit expectations for the Federal Reserve’s policies. Compared to Thursday’s Consumer Price Index (CPI) data, the Producer Price Index (PPI) released earlier on Friday had little impact on the market.

The settlement value depends on the swap contracts determined by the Federal Reserve’s policy decisions, which fully digest the expectation of a 25 basis point rate cut by the Fed in September and a total of 60 basis point rate cuts by the end of the year – this means that there will be two 25 basis point rate cuts within the year, and the probability of a third 25 basis point rate cut is 40%.

Goldman Sachs begins to be bearish

Scott Rubner, Managing Director and Strategist of Goldman Sachs’ Global Markets Division, released a report on Monday stating that the US stock market will experience two consecutive painful weeks starting from early August as a large amount of funds flow out of the stock market. Rubner said, “Painful trading has shifted from upward to downward. The best trading day of the year has passed, buyers are already full, and ammunition is running out

Rubner believes that the threshold for corporate performance is high because these high expectations have already been formed, which means that the earnings season is no longer a tailwind period for the stock market. The most important thing is that the positions of systematic funds have reached such a high level that any surge in volatility or lower than expected returns, especially from “large holdings of market value weighted stocks, may force non fundamental sellers to reduce risk”.

From a historical perspective, August was the month with the worst inflow of funds into passive investors and mutual fund stocks. Rubner wrote that there is no expected inflow of funds in August, as investors have already deployed funds for the third quarter after hitting the second largest stock inflow on record in the first half of 2024.

His analysis of data since 1928 shows that the S&P 500 index reached a “local peak” in mid July and then entered the typically fifth worst two weeks of the year in early August.

He wrote, ‘We are ending the best trading period of the year.’ Rubner also said that for now, this is his last bullish view of the US stock market.

It is worth noting that there have been more voices of bearish sentiment towards US stocks recently.

Morgan Stanley strategist Mike Wilson said that as uncertainty surrounding the US presidential election, corporate earnings reports, and Federal Reserve policies intensifies, traders should be prepared for a pullback in the US stock market. I think there is a high possibility of a 10% correction between now and some point during the US election period

David Kelly, Chief Global Strategist at JPMorgan Asset Management, believes that although the latest non farm payroll data shows a gradual slowdown in US economic growth and the Federal Reserve is expected to cut interest rates twice in 2024, he is not optimistic about US stocks because they may face the risk of a significant pullback.

Legendary Wall Street investor John Hussman recently stated that by some standards, the S&P 500 index seems to be the most overvalued since before the 1929 stock market crash. Hussman even stated that a 70% drop in the US stock market is not surprising.

Leave a Reply