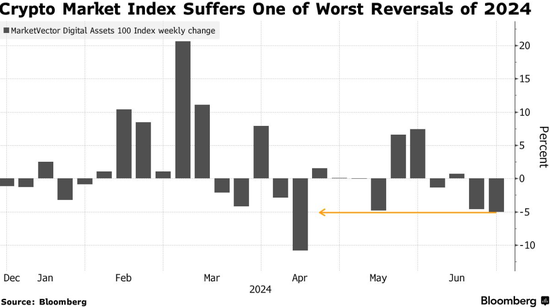

The cooling demand for Bitcoin exchange traded funds (ETFs) and uncertainty in monetary policy have led to increasing losses in the cryptocurrency market after hitting its second largest weekly decline since 2024.

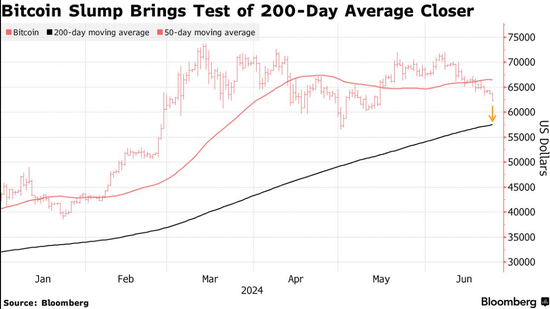

Bitcoin fell 8.1% to $58528 during trading on Monday, marking the largest intraday decline since April 13th. Due to two consecutive weeks of capital outflows from exchange traded products holding this cryptocurrency, the price of Bitcoin has been impacted.

According to data compiled by tracking agency Coinglass, over $210 million worth of cryptocurrency call option bets have been liquidated in the past 12 hours. According to data compiled by Bloomberg, the top 100 digital assets fell by about 5% in the seven days ending last Sunday, the largest decline since April.

The Japanese cryptocurrency exchange Mt., which was hacked over a decade ago The custodian of Gox announced that it will begin repaying Bitcoin and Bitcoin Cash in July, exacerbating concerns about increased selling pressure.

Given Mt Gox’s announcement, it seems that some market participants are starting to short, “said Stefan von Haenisch, head of trading at OSL SG Pte.” The cryptocurrency market is currently struggling to capture bids.

The cracks in cryptocurrency come at a time when people are questioning whether the Federal Reserve can quickly cut interest rates from a 20-year high. In the eyes of some analysts, the decline of digital assets is a warning signal for broader risk appetite.

David Lawant, head of research at FalconX, wrote in a report, “The current dynamics of the cryptocurrency market are characterized by low volatility and weak trading volume. When prices begin to move towards the edge of the range, the order book becomes imbalanced

The decline in some corners is particularly evident: Ethereum and Solana’s decline is the longest since last year and 2022, respectively. Moreover, this happened when the fund company was preparing to launch the first batch of US ETFs directly investing in Ethereum. Meanwhile, Solana has recently been favored by various digital asset hedge funds.

Bitcoin falls towards the 200 day moving average

Bitcoin set a record of $73798 in March, but fell behind traditional investments such as stocks, bonds, and gold this quarter.

The bearish sentiment seems to be forming, “said Caroline Mauron, co-founder of Orbit Markets, a liquidity provider for digital asset derivatives.” It’s difficult for the market to digest any large sell orders

Bitcoin investment products have seen outflows of approximately $600 million for two consecutive weeks, marking the largest outflow in two weeks since the approval of ETFs to hold this largest cryptocurrency in the United States in January.

According to data from CoinShares International Ltd., digital asset products experienced an overall outflow of $584 million in the week ending June 21. Bitcoin products accounted for the majority, with an outflow of $630 million the previous week and another $600 million this week.

Potential selling pressure of nearly 9 billion US dollars

Bitcoin suddenly faces a potential liquidity shock of nearly $9 billion, with its price plummeting $5000 in the past 24 hours to as low as $58300. This matter involves the early cryptocurrency exchange Mt. Gox. Since 2011, the platform has been hacked, with over 600000 bitcoins stolen, and went bankrupt in 2014. The team responsible for managing the remaining funds of Mt. Gox announced on the 24th that they will begin repaying cryptocurrency to creditors who lost their assets more than a decade ago starting in July, through Bitcoin and Bitcoin Cash payments.

According to Arkham Intelligence, as of Monday, the exchange held approximately 141687 bitcoins worth around $8.7 billion. Investors are concerned that creditors of Mt. Gox may choose to sell the bitcoin they received, putting pressure on the cryptocurrency as its trading price is much higher now than it was a decade ago.

It is worth noting that some investors of Mt. Gox stated earlier this year that they have received cash payments for some stolen assets, but repayments for Bitcoin and Bitcoin Cash will begin next month.

The person selling Bitcoin is considering the impact of over 140000 bitcoins entering the market in less than a month. Alex Thorn, the research director of Galaxy, said, “We believe that the repayment amount of these bitcoins will be less than people imagine, and the pressure it will cause to sell bitcoins will also be smaller than market expectations.” Thorn said that his research shows that 75% of creditors will receive compensation “early” in July, which means about 95000 bitcoins will be issued. Thorne believes that 65000 of them will belong to individual creditors, but he believes that these individuals may be more “diamond hands” (investors who firmly hold onto not selling) than most people expect.

He said one of the reasons is that they have resisted “convincing positive offers from claims funds” for many years, not to mention the capital gains tax involved due to Bitcoin’s 140 fold increase since bankruptcy.

Leave a Reply