The U.S. stock market is cooling down.

Let’s start by discussing the market. Today, the market has seen a rare cooling off, with the recent hot Trump trade taking a brief pause, failing to rise against the trend. So, a question that must be asked is whether today’s trend is a precursor to a major retreat or just a buildup before a surge? With current high valuations in the US stock market, is it starting to show signs of strain?

To answer these questions, we need to first take a look at the current market layout. Today, Bank of America released its global fund manager survey. This survey was conducted last week, and because last week was the US election week, Bank of America specifically distinguished between changes before and after the election. Let’s start by looking at this table. It can be seen that the majority of the rightmost column reflects upward green arrows, and if there are double arrows, it indicates a significant rise. Therefore, we will focus on the sections with double arrows.

The top three lines are about the economy and inflation. It can be seen that in the survey conducted in October, institutions had negative views on both the economy and inflation, indicating that more people believed the economy would worsen and inflation would decline. However, such views significantly converged after entering November, and ultimately completely reversed after the election. Among them, the proportion of institutions believing that the U.S. economy would strengthen increased from a negative 22% to a positive 28%, while those believing that global inflation would rise changed from -44% to 10%. This shift is of great significance, indicating a change in institutional views, as they have abandoned the soft landing perspective and are now more inclined towards a no-landing judgment.

This optimistic economic sentiment is also reflected in investment allocation. After the election, institutions’ risk appetite showed a noticeable increase. As seen in the last two lines, 35% of institutions believe that small-cap stocks will outperform large-cap stocks, and 41% of institutions believe that high-yield bonds will outperform investment-grade bonds. These are typical manifestations of increased risk appetite. This sentiment is also reflected in the stock market, with 29% of institutions being overweight on U.S. stocks, a proportion that has reached a new high in the past 11 years. 6% of institutions chose to be overweight on Japanese stocks, while technology and stocks from developing countries have also become more favored. These are generally considered riskier assets.

Some viewers may ask, why are institutions so optimistic? Apart from a better economy and higher inflation, aren’t they afraid of the Fed raising interest rates? In surveys, institutions now also believe that rising inflation is the biggest risk, but it is not fully reflected in their positioning. How should we understand this? Aggie believes that this positioning indicates that institutions are more optimistic about the economy than the threat of inflation. As long as the economy remains strong, corporate profits will perform better, driving stock prices higher.

There is another noteworthy change in this survey. It is the institutions’ views on various assets next year. As shown in the chart, after Trump’s election, fund managers’ optimism about US stocks has significantly increased, while other asset categories have not shown such a significant change. This aspect also reflects the strong confidence that global institutions currently have in US stocks.

However, such consistent optimism, could it be a dangerous signal instead? It should be noted that the valuation of the U.S. stock market is already very high. According to Factset’s analysis, the forward price-to-earnings ratio of the S&P 500 has reached a new high in over three years, standing at 22.2 times. The last time it exceeded 22 times was back in April 2021, when the Federal Reserve was implementing unlimited quantitative easing, a far cry from the current close to 5% interest rate level. Many believe that such valuation levels are bound to reach a breaking point.

Aggie believes that the optimism of institutions has clearly increased the possibility of a future pullback in the U.S. stock market, which definitely needs to be guarded against, otherwise it would be blindly chasing highs. However, even if a pullback occurs in the future, I do not think it will be very deep. Instead, it may present an opportunity for us investors to buy in. Why do I say this? In fact, there is something that seems very reasonable in the analysis above, but has been repeatedly refuted. That is, a good economy will lead to higher inflation. The U.S. economy has been telling us for the past two years that even with a very good economy, inflation can also fall, but the boost to corporate profits from a good economy is certain. So, faced with a certain change and an uncertain change, the choice for investment is very clear. Of course, it must be emphasized here that one of the biggest risks for U.S. stocks is the rise in inflation leading to the Fed raising interest rates again, but this risk needs data support. Before there are clear signs of significant growth in inflation data, we should not be overly concerned.

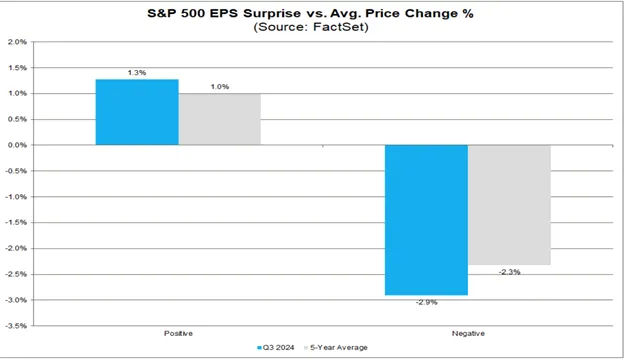

Furthermore, there is another phenomenon that can also indicate that although the current market sentiment is relatively high, it has not reached the point of mindless frenzy. That is the performance of this earnings season. From the chart, it can be seen that the current market is clearly rewarding and punishing, giving better gains to stocks that outperform expectations, but on the other hand, the punishment is more severe. If the performance is below expectations, there will be more significant declines. This actually represents the underlying nature of the current market, which still demands fundamentals and is not solely driven by FOMO sentiment, which is worth noting.

Reference article: WeChat Official Account “MeiTouinvesting”

Leave a Reply