SpaceX, the world’s second most valuable startup, is on the verge of reaching a valuation of $210 billion, a development that has garnered widespread attention. According to insiders, SpaceX is set to sell its internal shares at a price of $112 per share, which is higher than the $200 billion valuation discussed last month.

The success of SpaceX is not only reflected in its breakthroughs in the field of commercial spaceflight but also in its unique business model and spirit of innovation. Founded by Elon Musk, the company’s main businesses include providing transportation services to the International Space Station, launching commercial satellites, and developing reusable rocket technology. These innovations have not only reduced the cost of space travel but also provided new possibilities for human exploration of the universe.

Financially, SpaceX’s valuation growth reflects the market’s recognition of its long-term development potential. According to the article “Pricing Analysis of Target Companies in Mergers and Acquisitions,” the core of a company’s value lies in its potential for growth and expectations for future profitability. SpaceX has attracted significant attention from investors by leveraging its leading position in space technology and continuous technological innovation.

Furthermore, SpaceX’s valuation is closely related to its performance in the capital market. According to the research “Investor Sentiment and the Cross-Section of Stock Returns,” investor sentiment has a significant impact on stock returns. SpaceX’s ability to maintain high activity in the capital market is partly due to its growing market influence and investors’ optimistic expectations for its future development.

In summary, SpaceX’s valuation reaching $210 billion is a comprehensive recognition of its technological innovation, market performance, and future development potential. As global interest in space exploration increases, SpaceX is expected to continue expanding its market share and driving the development of the entire space industry.

How is SpaceX’s current market valuation calculated?

SpaceX’s market valuation is primarily determined through its financing activities. In 2017, SpaceX completed an H round of financing, raising $351 million, which valued the company at $21.2 billion at the time. This valuation was assessed based on investors’ confidence in its future growth potential and business model. Generally, a company’s market valuation takes into account a combination of factors such as its financial condition, market performance, industry position, and potential growth opportunities.

Although the evidence mentions the valuation issues of SPACs (Special Purpose Acquisition Companies), this is not directly related to SpaceX’s market valuation calculation method. SPACs are a specific investment tool used for acquiring other companies, while SpaceX, as a mature company that has completed multiple rounds of financing, relies more on traditional financial analysis and market assessment methods for its market valuation.

What are SpaceX’s latest technological breakthroughs in the commercial space sector?

SpaceX’s latest technological breakthroughs in the commercial space sector mainly include the following aspects:

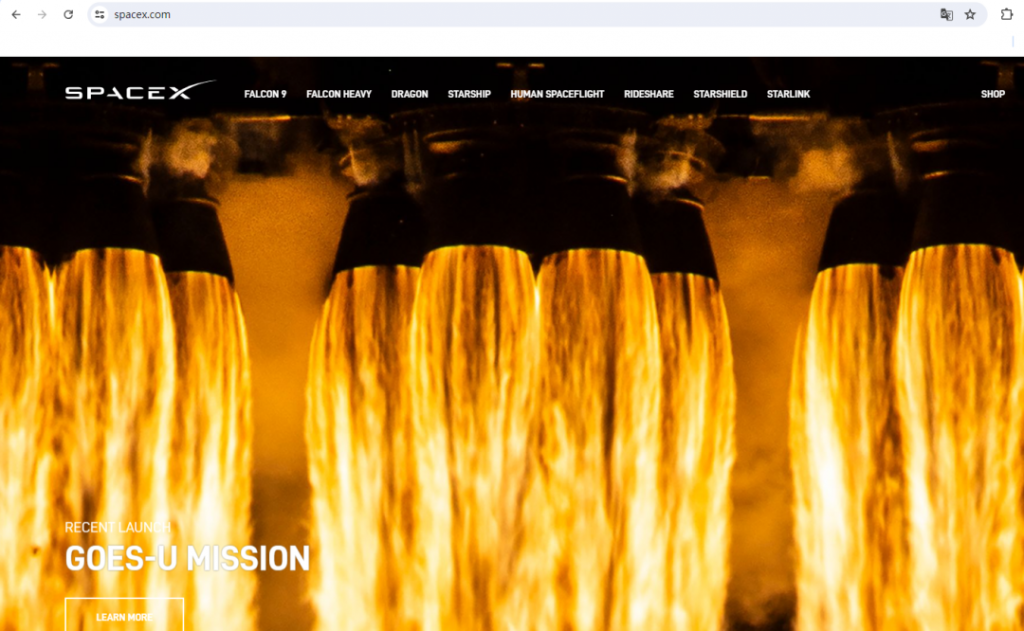

Reusability Technology: SpaceX’s Falcon 9 and Falcon Heavy launch vehicles have achieved multiple launches and recoveries, significantly reducing the cost of space missions. This technology not only increases the utilization rate of rockets but also reduces the need for manufacturing new rockets.

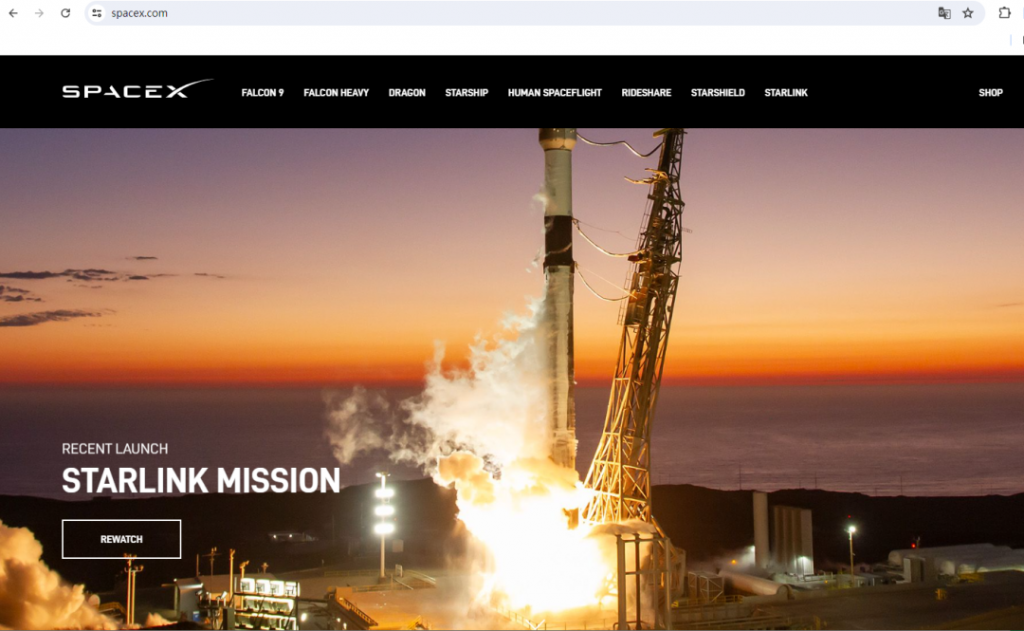

Starlink Project: By deploying a large number of small satellites, SpaceX is building a global satellite internet network. This step marks an important move by the company in providing global communication services.

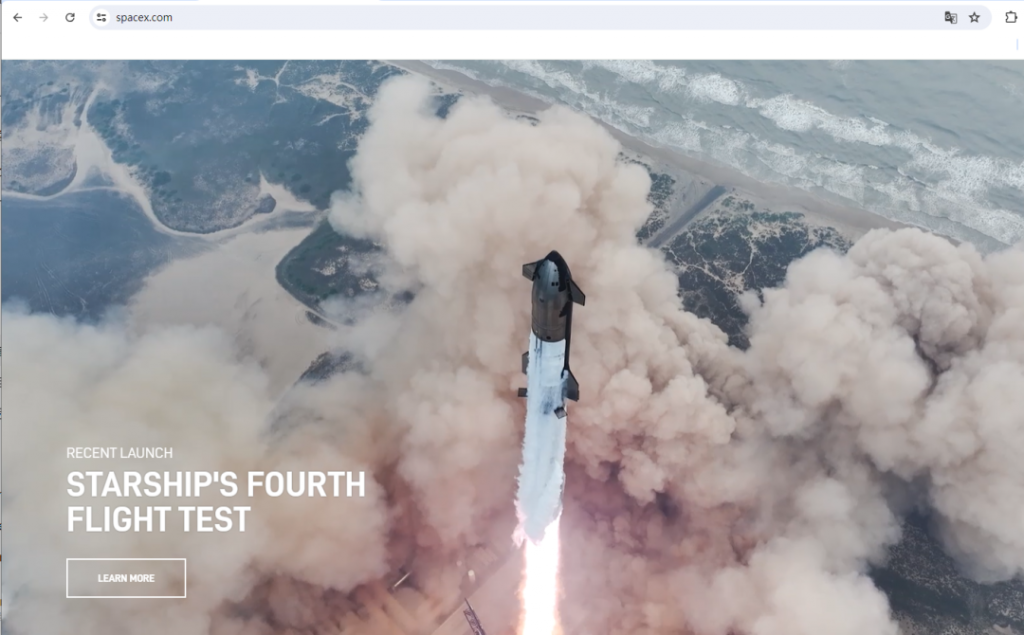

Starship Project: This is an ambitious project by SpaceX aimed at developing a vehicle capable of sending humans into deep space, including missions to Mars. The Starship design allows it to carry more payload and offers greater flexibility and cost-effectiveness.

Raptor Engine: This is a new type of rocket engine manufactured using 3D printing technology for SpaceX’s Dragon spacecraft and other spacecraft. The engine is designed to improve propulsion efficiency and reliability.

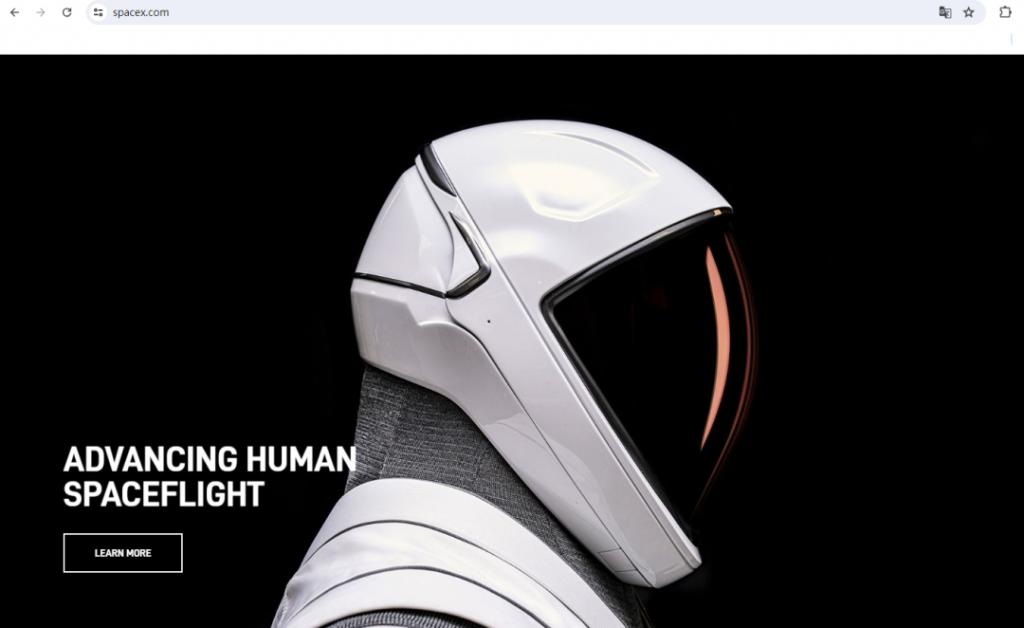

Crew Dragon: SpaceX successfully conducted an unmanned test flight of the Crew Dragon and plans for manned flights. This marks SpaceX becoming the second entity, after Russia, capable of independently sending astronauts to the International Space Station.

How does SpaceX impact the operations and future planning of the International Space Station (ISS)?

SpaceX has significantly impacted the operations and future planning of the International Space Station (ISS), mainly in the following aspects:

Promoter of Commercial Spaceflight: Since the early 21st century, with the retirement of the U.S. Space Shuttle, NASA faced challenges in cargo transportation to the ISS. To address this challenge, NASA initiated the Commercial Orbital Transportation Services/Commercial Resupply Services program and chose SpaceX as one of its partners. This marked a shift in U.S. manned spaceflight towards commercialization, and SpaceX’s success not only restored the ability to transport cargo to the ISS but also paved new ways for future manned space development.

Technological Innovation and Cost Reduction: SpaceX has significantly reduced the cost of accessing space through technological innovations in its Falcon 9 series of launch vehicles. This low-cost launch capability enables SpaceX to provide more frequent and economical access to space services, thereby enhancing its competitiveness in ISS operations.

International Collaboration and Conflict Management: SpaceX plays a crucial role in international space exploration, establishing cooperative relationships with multiple countries, regions, and organizations. These collaborations, though bringing conflicts and issues, have been successfully resolved by SpaceX through effective project management and knowledge sharing strategies. This cross-functional team approach and emphasis on diverse partnerships provide valuable experience for future international cooperation.

Attention to Space Weather: SpaceX’s Starlink initiative demonstrates the company’s high attention to space weather changes. For example, a minor geomagnetic storm led to the loss of 49 Starlink satellites, forcing SpaceX to adjust its launch strategy to launch satellites at higher initial orbits and reduce the payload per mission. This flexible response to space weather changes is crucial for ensuring the safety of the ISS and surrounding space activities.

Impact on Future Planning: SpaceX’s reusable launch vehicle technology, such as the recovery of the Falcon 9’s first stage, not only reduces the cost of space travel but also makes deep space exploration and Mars colonization possible. Furthermore, SpaceX’s global perspective and technological innovation capabilities position it as a key participant in future ISS expansion and international cooperation.

SpaceX, through its technological innovation, cost-effective services, international cooperation, and attention to space weather, has a profound impact on the operations and future planning of the International Space Station.

How has SpaceX’s performance in the capital market changed in recent years, especially in terms of stock price and market value?

As a high-tech company, SpaceX’s performance in the capital market has attracted widespread attention in recent years. Although my search focused on the market dynamics of SPacs (special purpose acquisition companies), we can infer some trends in the capital market that may indirectly affect the market performance of high-growth potential companies like SpaceX.

Looking at the rise and changes of SPACs, before 2020, SPACs accounted for a relatively small share of the U.S. IPO market, but in 2020, they reached a peak, with the financing amount of companies going public through the SPAC model exceeding that of traditional IPO models for the first time. This indicates that during the pandemic, investors were more open to seeking high-return investment methods, which may also provide a favorable capital market environment for high-tech companies like SpaceX.

However, it should be noted that although SPACs attracted a large amount of capital in the short term, they may lead to poor stock performance in the long term. According to a study, there is a characteristic of long-term weakness in the stock prices of SPAC-listed companies, mainly due to the decrease in investment returns and the increase in arbitrage of SPAC investors. This means that if SpaceX chooses to go public through the SPAC model, its stock price may face certain challenges.

In addition, both U.S. IPO activities and SPAC activities have increased in recent years, especially peaking in 2021, but declined in 2022. This volatility may pose risks to potential listing companies like SpaceX, as changes in market sentiment may affect investors’ interest in their stocks.

SpaceX’s performance in the capital market may have been affected by the dynamics of the SPAC market in recent years. Although SPACs provide a quick way to go public, there may be risks of poor stock performance in the long term.

What factors underlie investors’ optimistic expectations for SpaceX’s future development?

Investors’ optimistic expectations for SpaceX’s future development are mainly based on the following factors:

Technological innovation and market leadership: As a pioneer in the commercial space sector, SpaceX’s technological innovations and leading position in rocket technology, space transportation systems, and the Starlink initiative provide a solid foundation for the company’s future growth. Despite challenges such as the rocket explosion in 2016, these setbacks have not hindered SpaceX from continuing to advance its commercial space launch services.

Support from the capital market: Through financial instruments like Special Purpose Acquisition Companies (SPACs), SpaceX can quickly obtain capital from the capital market to accelerate its business expansion and technology development. Although SPAC mergers are usually accompanied by high expected growth rates, this also reflects the market’s recognition of SpaceX and its potential value.

Participation of institutional investors: According to research, high-quality investors participating in SPACs tend to bring higher success rates and announcement day returns. These investors typically have deeper industry knowledge and resources, and their involvement increases market confidence in SpaceX’s future development.

Market response and investor behavior: Despite concerns that SPAC information disclosure may mislead small investors, studies show that announcements containing more forecast information are associated with positive market responses, indicating that the market is optimistic about SpaceX’s future development.

Policy and regulatory environment: As global interest in space exploration increases, governments and international organizations around the world may introduce more policies and measures to support the development of commercial spaceflight, providing more development opportunities for companies like SpaceX.

Investors’ optimistic expectations for SpaceX’s future development are based on its technological innovation capabilities, the active support of the capital markets, the participation of institutional investors, and a favorable market and policy environment.

Leave a Reply