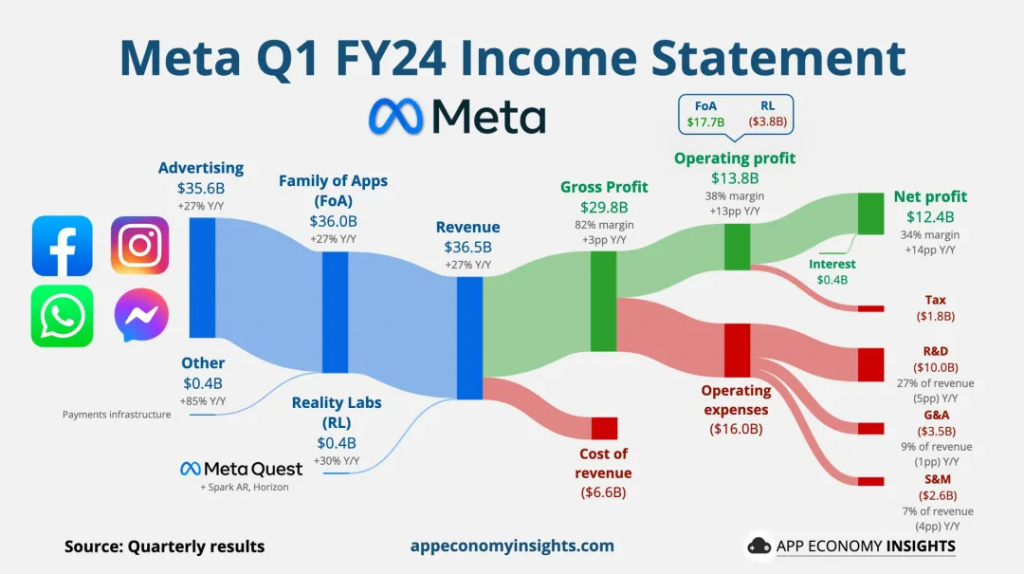

Meta’s performance is good, although the outlook is slightly worse, the stock price plummeted by 15% after hours.

The expected game is becoming increasingly important, with performance exceeding expectations skyrocketing directly to the target, and then adjusting significantly. If the performance falls short of expectations, the stock price will plummet directly. In the AI era, information mining is becoming more and more comprehensive, and quantitative trading with the help of AI is becoming more intelligent. The trading game in the market will become more and more significant.

Recently, the stock price trends of AMD and Lululemon have also fully illustrated this point. The impact of speculation on stock prices is becoming increasingly evident, especially in the short term, posing new challenges for investment management. Although in the long run, the fundamental trend determines the long-term performance of stock prices, the excessively volatile short-term fluctuations present a new severe test for asset management companies pursuing net asset value smoothing.

Even giant companies like Meta, Tesla, and Google often have to endure significant fluctuations in stock prices.

An important trend in the current financial market is that in the era of AI and big data, the processing and utilization of market information have become extremely efficient, leading to investors’ reactions to corporate performance expectations becoming more rapid and intense.

For large tech companies like Meta, the stock price changes after the release of financial reports are often closely related to market expectations.

- The Importance of Expectations: Market expectations play an increasingly crucial role in today’s stock trading. Investors not only focus on a company’s actual performance but also on how these results compare to market expectations. If the performance exceeds expectations, the stock price may experience a significant short-term increase; conversely, it may face a sharp decline if it falls short of expectations.

- The Impact of AI and Quantitative Trading: The advancement of AI technology has accelerated the development of quantitative trading strategies, which can analyze large amounts of data in a very short time frame to make trading decisions. This high-frequency, algorithm-based trading can amplify market reactions, sometimes leading to drastic price fluctuations within minutes of financial report releases.

- Adequacy of Information Mining: Modern information technology has made it easier and faster to extract information from various data sources. This includes social media, news reports, industry analyses, etc., all of which could influence market sentiment and expectations even before the public release of financial reports.

This environment requires investors not only to focus on fundamental analysis, but also to understand market sentiment and trading psychology, and how they may impact stock prices in the short term. At the same time, this also brings new challenges for regulatory agencies in ensuring market fairness and transparency.

A new era is unfolding, and the paradigm of investment must make corresponding adjustments.

The significant fluctuations in stock prices of giant companies such as Meta, Tesla, and Google can be attributed to various factors, but can be summarized into the following key points:

- High expectations and strict market expectations: These tech giants often bear extremely high investor expectations due to their innovation, market leadership, and rapid growth history. Market expectations set a very high standard, where even slight deviations in performance could lead to significant fluctuations in stock prices. For example, if their financial reports slightly miss analysts’ expectations or future revenue forecasts are lowered, stock prices may adjust rapidly.

- Market sentiment and speculative behavior: Tech stocks are usually greatly influenced by market sentiment. During optimistic market conditions, the stock prices of these companies may be excessively inflated; while during pessimistic or uncertain times, these stocks may also be oversold. Additionally, due to the visibility and liquidity of these companies, they become popular choices for speculators, further exacerbating stock price volatility.

- Macroeconomic and industry dynamics: Macroeconomic changes (such as interest rate fluctuations, inflation, economic recessions, etc.) affect all stocks, but have a particularly significant impact on tech giants. Furthermore, industry competition dynamics, technological innovations, regulatory changes, etc., also directly affect the stock prices of these companies.

- Global events impact: As these companies operate globally, any geopolitical events, international trade policy changes, or other global crises can affect their stock prices. For example, trade wars, data privacy issues, etc., have all impacted the stock prices of tech companies.

- Role of algorithms and quantitative trading strategies: The widespread use of AI and quantitative trading has made market reactions faster and more intense. These high-frequency trading strategies can amplify market reactions in a very short period, leading to increased stock price volatility.

Understanding the interaction of these factors is crucial for investors to make wise decisions when facing market fluctuations. Despite these companies typically having strong fundamentals and good long-term growth prospects, their stock prices may still experience significant volatility in the short term.

For asset management companies, the demands are increasing.

The stock price fluctuations of companies like AMD and Lululemon do reflect the market’s rapid response to various information in the short term, as well as the heightened strategic elements in investment strategies.

For investment management companies, these short-term sharp fluctuations do present new challenges, especially for those companies seeking smooth growth of asset net value, requiring more sophisticated and adaptive management strategies.

Strategies to deal with short-term fluctuations.

- The application of risk management tools: Using derivatives such as options and futures to hedge risks can help manage the uncertainty brought by market fluctuations. For example, purchasing put options can protect positions from significant downturns.

- Flexibility in capital allocation: Adjusting capital allocation in different market environments is crucial in dealing with short-term volatility. This may involve increasing cash holdings when market volatility intensifies, allowing for the opportunity to buy quality assets at lower prices after market corrections.

- Balancing short-term and long-term objectives: While pursuing long-term growth, it is important to set reasonable short-term goals and expectations. This includes accepting market fluctuations as part of investing and developing a long-term robust growth strategy based on this understanding.

- Integration of technical and sentiment analysis: While fundamental analysis is the cornerstone of long-term investment success, in the short term, technical analysis and market sentiment analysis are also crucial. Understanding market sentiment and technical indicators can help investors better comprehend and predict short-term price fluctuations.

- Continuous education and training: Asset management companies should enhance continuous education and training for their staff, especially in financial technology, market psychology, and advanced risk management strategies. This ensures that the team can utilize the latest tools and strategies to optimize portfolio performance.

Through these strategies, asset management companies can not only better cope with short-term market volatility, but also steadily increase the value of assets in the long term, achieving investment objectives.

In the long run, our investment paradigm must make long-term adjustments and changes.

In the current investment environment, it is indeed necessary to adjust traditional investment strategies. Here are a few strategic suggestions to help investors deal with market high volatility and rapid changes:

- Enhancing Fundamental Analysis: Even in highly dynamic markets, solid fundamentals remain the key to long-term investment success. Investors should delve into analyzing a company’s financial condition, industry position, growth potential, and the capabilities of its management team. A deeper understanding of a company’s fundamentals can help investors stay calm during market fluctuations, avoiding making impulsive decisions influenced by market sentiment.

- Diversifying Portfolio: Diversifying investments across different industries, regions, or asset classes can effectively reduce the impact of a single event on the entire investment portfolio. This strategy helps mitigate the negative effects of a single market or industry and provides more stable returns.

- Flexible Investment Strategy: Adapting flexibly to market changes, including using different investment tools and strategies. For example, one can consider using options strategies to manage risks or adjust stock holdings when necessary to cope with market fluctuations.

- Long-Term Perspective: Maintaining a long-term investment perspective and avoiding frequent trading due to short-term market fluctuations. Long-term investment holdings can often offset the negative impact of short-term volatility and benefit from a company’s growth.

- Improving Financial Knowledge and Skills: In today’s era of increasing popularity of AI and quantitative trading, investors need to enhance their financial knowledge and skills to understand how these new technologies affect market dynamics. This includes understanding algorithmic trading, market sentiment analysis tools, and how to use these tools to optimize investment decisions.

- Dynamic Adjustment of Expectations: Investors need to continuously adjust their expectations and strategies based on the latest market dynamics. This involves regularly evaluating the performance of the investment portfolio while paying attention to changes in macroeconomic conditions, industry trends, and specific company situations.

By implementing these strategies, investors can better adapt to the current complex and ever-changing market environment, while protecting and growing their investments.

Leave a Reply