Original Article by Fei Mao Hui Fei, July 5, 2024, Guangdong

Warren Buffett, the master of value investing, has made his own bets in the past!

At the end of 2007, Warren Buffett made a famous bet with hedge fund manager Ted Seides, which was a ten-year competition.

Buffett believed that a low-cost S&P 500 index fund would outperform a group of carefully selected hedge funds over the course of ten years.

The Bet Begins on January 1, 2008:

- Hedge Funds: Seides selected five “fund of funds,” each of which contained multiple hedge funds.

- Index Fund: Buffett chose the Vanguard S&P 500 Index Fund.

The Outcome: By the end of 2017, the S&P 500 index fund significantly outperformed the hedge funds:

- S&P 500 Index Fund: Over ten years, the compound annual return was about 7.1%.

- Hedge Funds: The average compound annual return of the five “fund of funds” was about 2.2%.

Beating the S&P 500 is Hard!

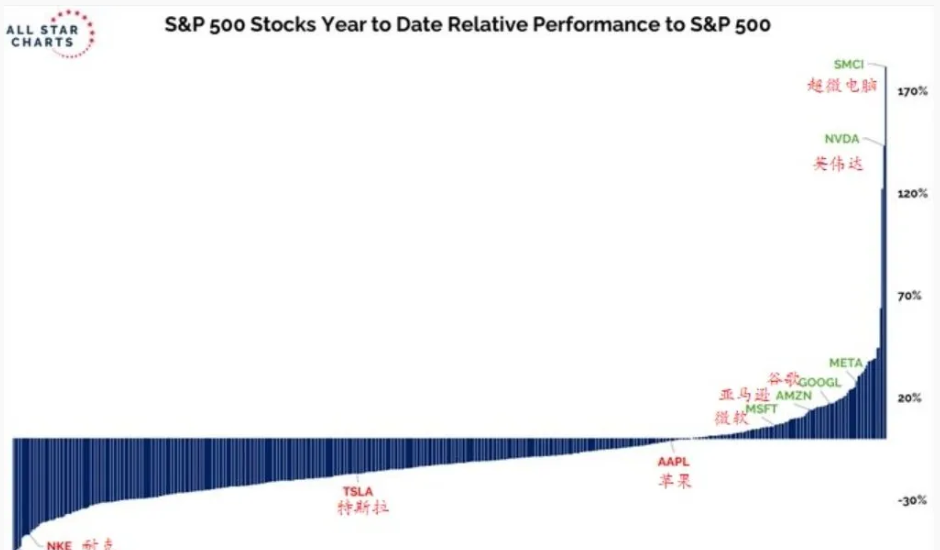

In the first half of this year, which S&P 500 constituent stocks managed to beat the market?

As of the U.S. Independence Day holiday (July 4th), the S&P 500 index had risen 16% this year. However, looking at individual stock performance, beating the market is not an easy feat. Only 22% of the constituent stocks managed to outperform the index.

Here are some popular stocks and their rankings among the 500 stocks, from the largest gainer, Advanced Micro Devices (AMD), to the biggest loser, Walgreens Boots Alliance (WBA.US). The vertical axis shows how much they outperformed or underperformed the S&P 500 index.

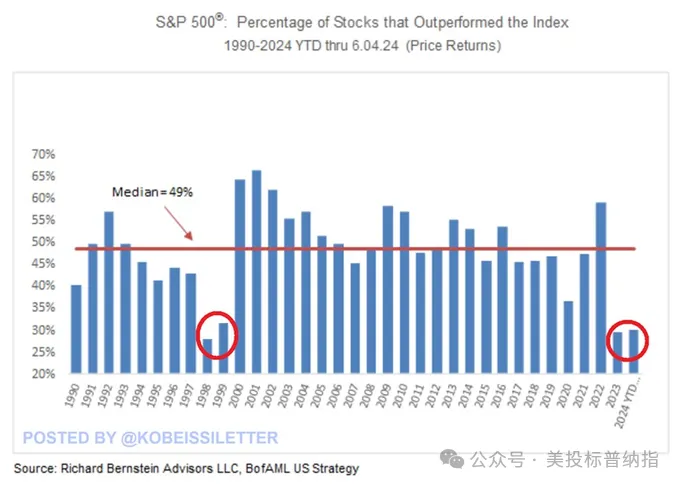

According to historical statistics, since 1990, the median historical percentage of stocks beating the market has been 49%, with the only exception being during the dot-com bubble of 2000, when the percentage was unusually low for two consecutive years.

As of June 17, it was estimated that about 30% of stocks were outperforming the market. However, just over a week later, this figure dropped to 22%.

From a mean reversion perspective, small-cap U.S. stock funds may outperform the S&P 500 in the future. This is because, in many respects, many high-quality small-cap stocks are currently at historically low prices compared to large-cap stocks.

This extreme figure indicates that today’s market is overly concentrated, and risks are accumulating!

How difficult is it to beat the S&P 500?

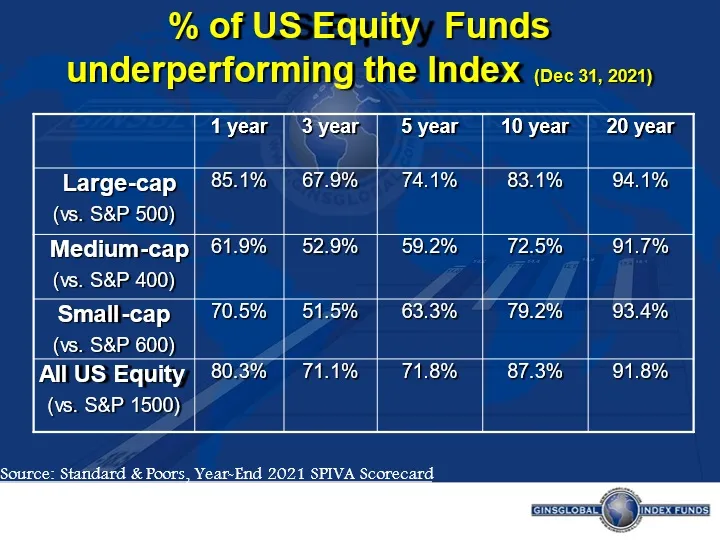

As of 2023, over the past 15 years, 88% of large-cap stock funds have underperformed the S&P 500, and this figure rises to 93% over the past 20 years.

According to data from GinsGlobal through 2021, 83% of fund managers underperformed the S&P 500 over the past 10 years!

In the past 20 years, 94% of U.S. fund managers failed to beat the S&P 500!

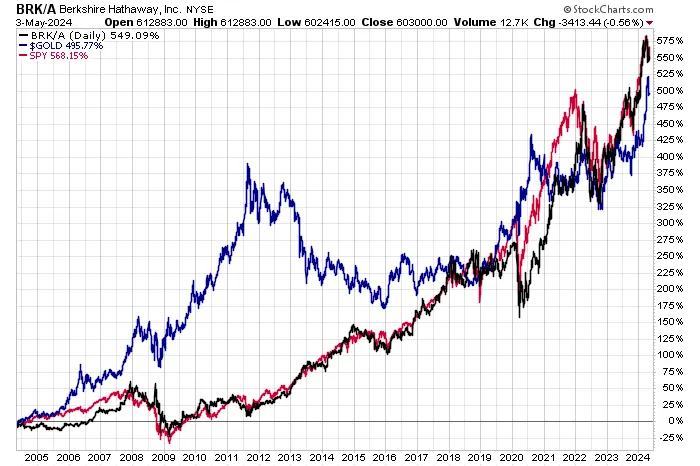

Even Warren Buffett, when compared to the S&P 500, especially since the launch of the first iPhone in 2007, has underperformed. From 2008 to the end of 2020, over the 13-year period, Buffett’s annualized return was 7.2%, while the S&P 500’s annualized return was 9.8%.

However, from 1965 to 2020, a span of 56 years, Buffett’s annualized return was 20%, compared to 10.2% for the S&P 500.

Long-term, Buffett’s investment portfolio has lower volatility, with a standard deviation of 13.67%, while the S&P’s standard deviation is 15.57%.

Buffett has repeatedly emphasized that most actively managed fund managers struggle to beat the S&P 500 over the long term. In his 2013 shareholder letter, he clearly stated that in his will, he would recommend that the trustee managing his wife’s assets invest 90% of the funds in a low-cost S&P 500 index fund, with the remaining 10% in short-term government bonds.

Recently, Buffett reaffirmed that it doesn’t matter—his investment philosophy will not change, and he doesn’t want others to worry about whether he can beat the S&P 500.

Since its inception in 1957, the S&P 500 index has delivered an annualized return of around 10.26%, including price changes and reinvested dividends.

To put it simply: since beating the S&P 500 is so difficult, why not just buy the S&P 500? No need for any further discussion!

Long-term, historically, among the financial products available to the average person—no connections, no need to fight for opportunities—there’s no asset that consistently beats the S&P 500!

In terms of long-term transaction costs, passive investments like index funds have lower management fees, which means less money spent on fees and more potential investment gains.

The average investor, who is busy with work and family, or trying to stay fit, simply doesn’t have the time to focus constantly on investments or do in-depth research!

Compared to the risks of concentrating investments in individual stocks, buying an index fund like the S&P 500 allows investors to diversify the risk of individual stocks.

For those with the risk tolerance, investing in the S&P 500 is essentially investing in the entire market. It’s not about you losing money while others make gains, and the investment experience is much clearer.

The simple and effective strategy is: if you can’t beat the S&P, then just join it!

Of course, an even simpler approach would be to have Buffett manage your money for you.

Since buying the S&P 500, I’ve realized that even Buffett isn’t that extraordinary!

P.S.

Finally, a sad note: the “best contrarian” in U.S. stocks has resigned!

Marko Kolanovic, JPMorgan’s Chief Global Market Strategist, is stepping down after 19 years. This well-known contrarian indicator has truly benefited many people. Before leaving, he predicted that the S&P 500 would fall nearly 25% by the end of the year and emphasized the “terrifying” lack of breadth in the U.S. stock market.

Leave a Reply