What are the reasons for the recovery of the US stock market? Who is manipulating from behind?

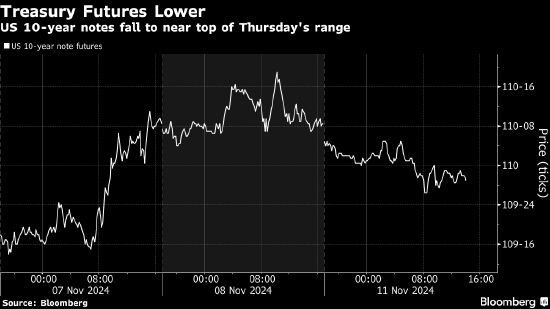

In early August, after falling nearly 10%, the US stock market quickly rebounded! Who is driving this recovery behind the scenes?

Although the global economy is facing uncertainty, the US economy continues to expand, with GDP growth in the second quarter revised up to 3%, indicating strong consumer demand and economic activity in the US providing support for the market;

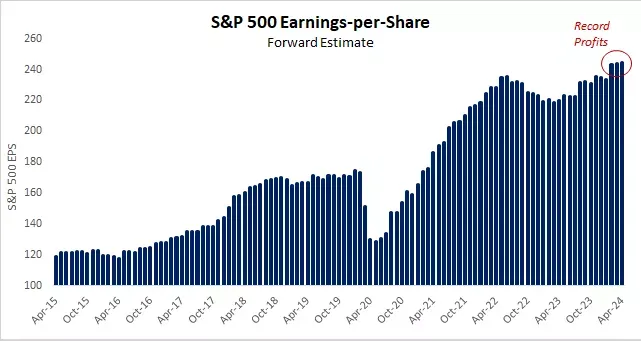

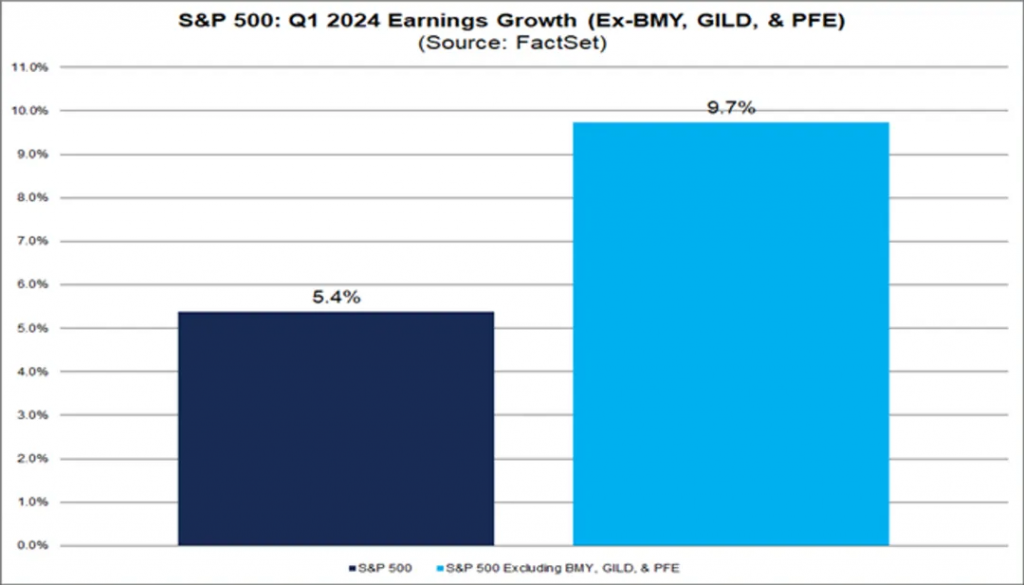

In the second quarter financial report, 80% of S&P 500 companies exceeded expectations with a profit growth of 11.4%. The data shows that the profits of these companies have steadily increased, injecting momentum into the stock market;

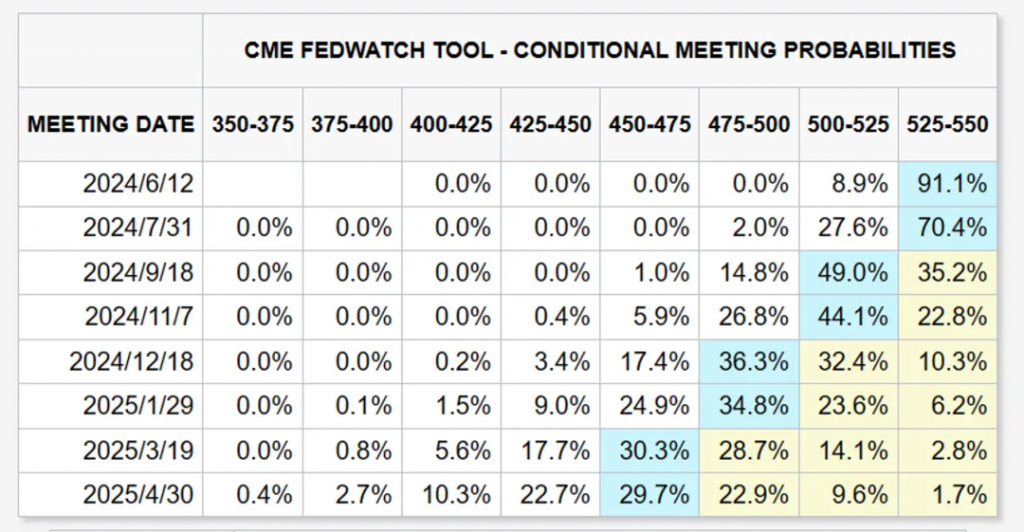

With the Federal Reserve preparing to initiate interest rate cuts and market expectations announcing its first rate cut in September, this policy shift has eased market concerns about liquidity tightening and boosted stock market confidence;

Tech giants used to lead the market for a long time, but now they face a dual challenge:

The pressure of high expectations: Taking Nvidia as an example, despite strong growth, market expectations are too high, and overvaluation becomes a resistance;

The rise of new market favorites: With the recovery of profits in other industries, sectors such as finance, healthcare, and utilities are performing outstandingly, and market leadership is shifting.

The driving force behind the recovery of the US stock market

In addition to the above five points, the Federal Reserve’s policy shift is one of the important driving elements of the current market:

As inflation approaches its target of 2%, the Federal Reserve is shifting from containment to support. Historical data shows that when facing an economy that has not yet fallen into recession, initiating interest rate cuts often has a positive impact on the stock market, which is also being validated in the market;

Although interest rate cuts may benefit the market, it is still necessary to be vigilant about potential risks in policy implementation. The Federal Reserve has repeatedly failed in policy adjustments throughout its history, and whether the current interest rate cuts can proceed as scheduled will have a significant impact on the future market trend;

In addition, despite the strong performance of the stock market in August, the next two months may face the following challenges:

Historically, the market usually experiences significant fluctuations from September to October. With the upcoming November elections, political uncertainty may exacerbate market volatility;

Although the current economy is expanding, any unexpected downturn in economic data (such as weak employment or consumption data) could reignite market concerns and pressure the stock market;

Under the current high valuation background, market sentiment is still relatively fragile. Although the expectation of interest rate cuts supports the market, if future corporate profits fall short of expectations or macroeconomic conditions deteriorate, the market will experience another significant correction.

What are the potential opportunities?

Pay attention to cyclical and value stocks

The market leadership has shifted from a few tech giants to a wider range of sectors, and the following areas are worth paying attention to.

Financial sector: Changes in interest rates may benefit financial institutions such as banks and insurance. If the Federal Reserve starts cutting interest rates, it will boost banks’ net interest margins and increase loan demand.

The industrial and materials sector: With economic expansion, industrial and materials companies typically perform well, especially driven by infrastructure construction and global economic recovery, which may benefit from government spending and the recovery of global supply chains.

Healthcare sector: These companies often perform well during periods of economic uncertainty, especially those providing essential medical services. In the current market volatility, healthcare may become a relatively safe haven.

Taking advantage of short-term market fluctuations

Seasonal market fluctuations and potential policy changes may bring short-term trading opportunities.

Buying on dips: During market downturns, buying high-quality stocks or sectors at low points may bring substantial returns, especially during periods of market volatility. If the stock prices of tech giants or other undervalued high-quality companies fall, it may be a good time to enter these companies.

Volatility trading: If market volatility increases, trading volatility derivatives (such as VIX options) may bring returns. In addition, when volatility is high, consider using option strategies (such as protective put options) to hedge the risk of existing investment portfolios.

Focus on sectors and companies with strong revenue growth

Non giant companies in the technology sector: While technology giants are facing pressure, some small and medium-sized technology companies still have opportunities, especially those with competitive advantages in cloud computing, network security, and AI fields.

New and clean energy: With the global transition to renewable energy, new and clean energy companies may benefit not only from policy support but also from long-term growth trends.

Consumer goods and necessities: In times of increased economic uncertainty, these companies typically exhibit stability, stable cash flow, and strong risk resistance.

Pay attention to Federal Reserve policies and macroeconomic data

The direction of Federal Reserve policy will directly affect market sentiment and asset prices.

Interest rate decisions and statements: Pay attention to the Federal Reserve’s interest rate decisions and policy statements at future meetings, especially the pace and magnitude of interest rate cuts. This will directly affect bond yields, stock valuations, and market sentiment.

Macroeconomic data: Pay special attention to employment data, inflation data, and consumption data, which not only affect the policy path of the Federal Reserve, but may also reflect the true health of the economy, thereby affecting market performance.

Global diversification and hedging strategies

Global diversified investment can help diversify risks and capture growth opportunities in international markets.

International markets: Pay attention to investment opportunities in other developed and emerging markets, especially in the context of loose monetary policy and accelerated economic recovery. The consumption growth and digital transformation in emerging markets also provide long-term investment opportunities.

Hedging strategy: consider adding hedging instruments, such as gold, treasury bond bonds or safe haven currencies, into the portfolio to protect the portfolio in case of market fluctuations or risk events.

Investors should respond flexibly by focusing on cyclical and value stocks, utilizing market volatility to find companies with strong earnings growth, and paying attention to policies and the economy to seek opportunities.

At the same time, global diversification and hedging strategies should also be part of the investment portfolio to address potential market volatility and uncertainty.

Disclaimer: The content of this article is for reference only and does not constitute investment advice. Investment carries risks, and caution is necessary when entering the market.