Corrections and volatility are both essential, and the key is to respond to them!

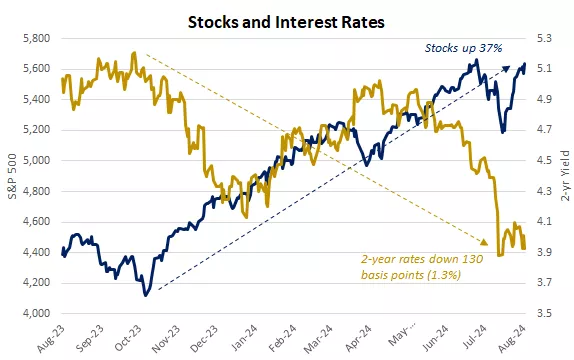

The stock market has recently experienced a significant fluctuation, which has made many investors uneasy. While such fluctuations can trigger panic, they are historically not uncommon and usually do not last long.

We discuss stock market corrections from multiple perspectives, focusing on helping investors stay calm during market volatility and avoiding irrational decisions due to short-term fluctuations:

- The psychological impact of market corrections versus the actual situation

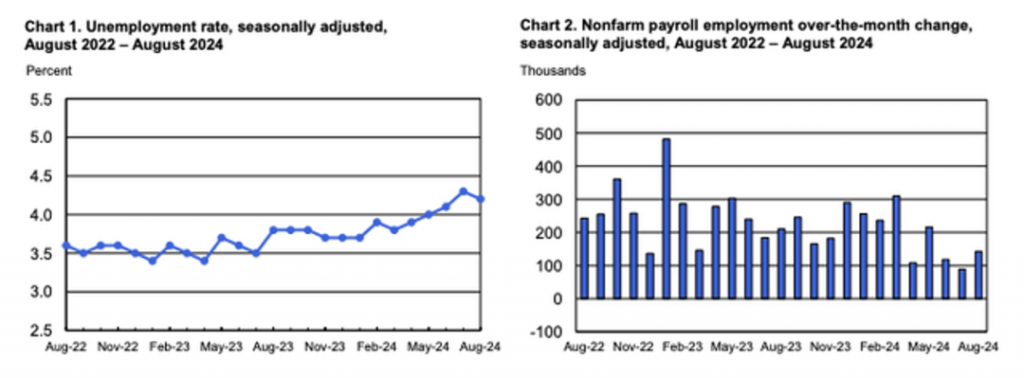

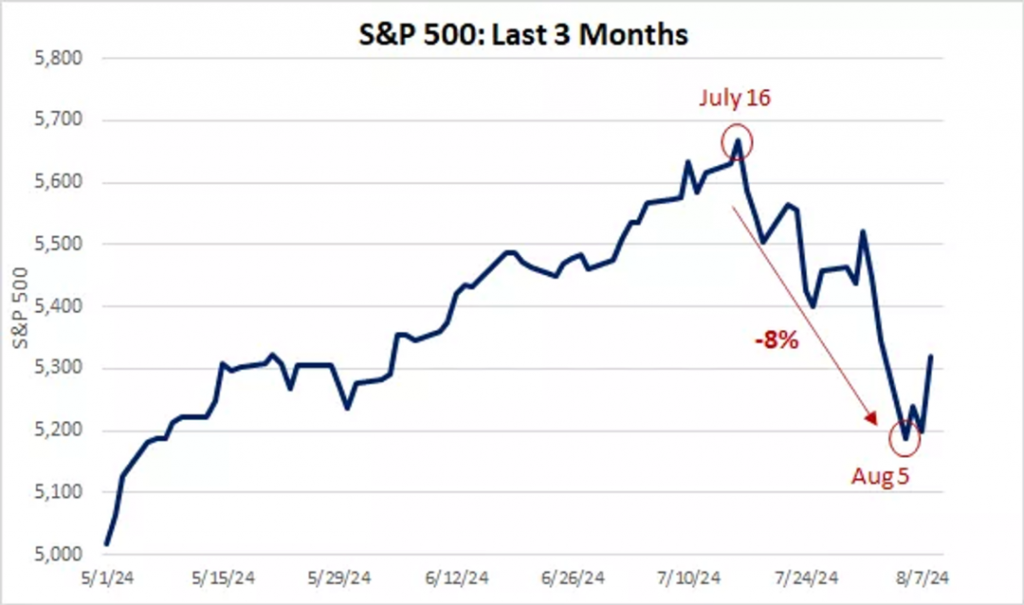

- Psychological effect: Violent market fluctuations often trigger emotional swings among investors, especially after a long period of market increases, sudden declines are more likely to cause panic. Last week, the Dow Jones Industrial Average fell by 1034 points in a single day. Although this drop was quite noticeable, it only accounted for 2.6% of the index’s total value. Compared to a similar drop on February 8, 2018, when the decline was 4.2%, this shows that while market fluctuations are eye-catching, their actual impact in a broader market context may not be as severe.

- Actual impact: By comparing historical data, similar significant declines are not rare in the history of the stock market. Although market declines can make investors uneasy, they do not significantly change the overall trend of the market from a long-term investment perspective.

- The universality and normality of market corrections

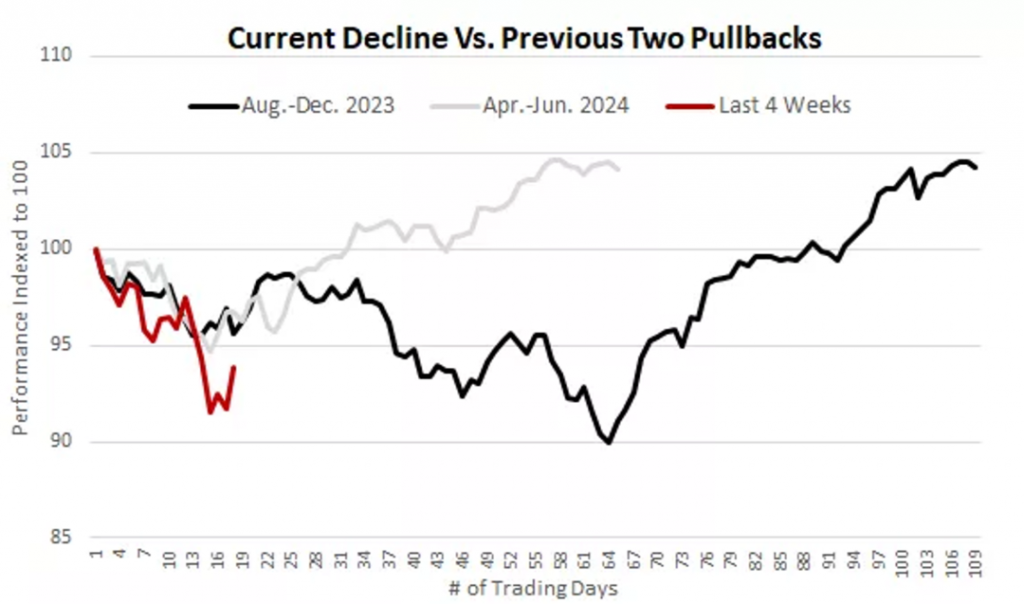

- Universality: Market corrections are very common, with an average of about three corrections exceeding 5% each year over the past 25 years. This means that market corrections are a normal phenomenon in the operation of the stock market, not an anomaly. Investors should recognize the universality of this phenomenon when facing corrections, thus avoiding overreaction or panic selling.

- Normality: Although market adjustments are frequent, most of the time, they do not have a significant impact on the long-term performance of the market. In fact, historical data show that rebounds often occur after market corrections, so investors should view corrections as part of the market cycle, not a prelude to market decline.

- The duration of market sell-offs and the speed of market recovery

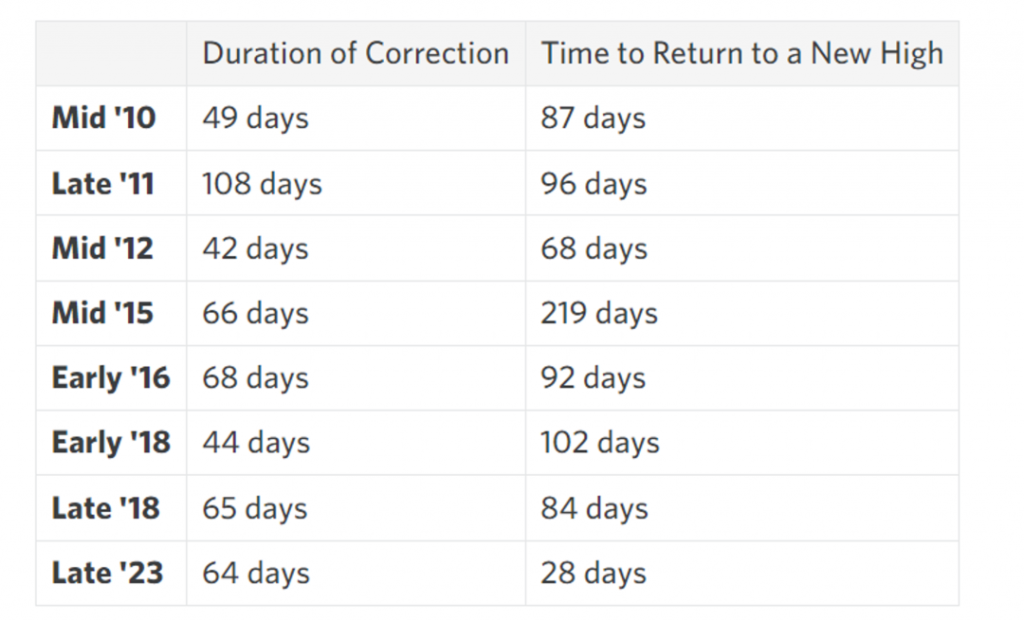

- Duration of sell-offs: Analyzing historical data, market sell-offs usually do not last long. For example, since 2010, a 10% market adjustment has averaged a duration of 63 days, while corrections between 5%-10% last even shorter. Although market adjustments seem lengthy, they usually end within a few months, and the market often recovers to new highs in the following months.

- Speed of recovery: Data on the duration of past market adjustments and the time it takes for the market to recover to new highs show that the market usually recovers to new highs in less than five months, which means that patience during correction periods is rewarding for investors. By taking a long-term view, investors can avoid making irrational investment decisions due to short-term market fluctuations.

- Investment opportunities and positive factors in market corrections

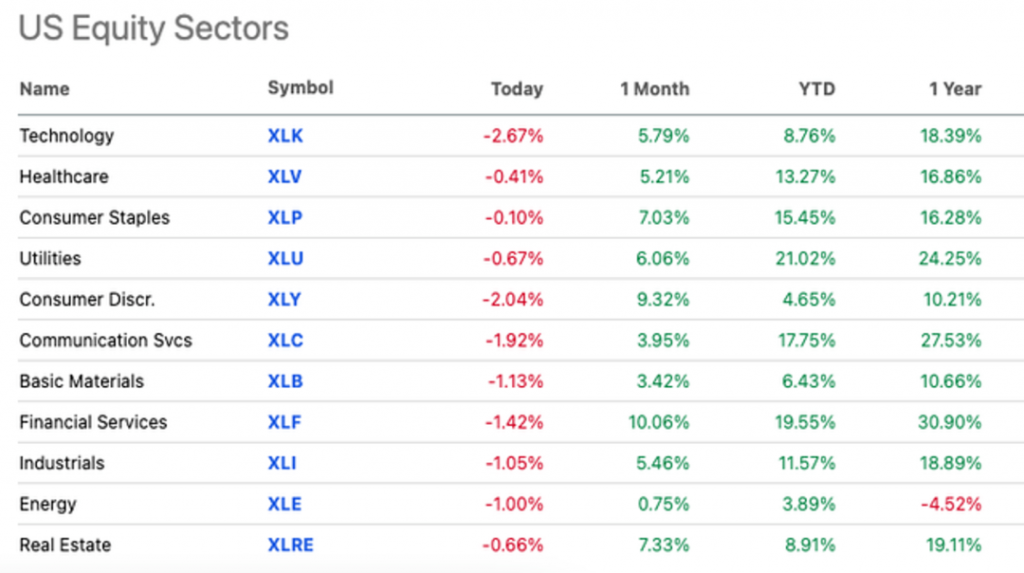

- Investment opportunities: Although market corrections bring some pressure to investors in the short term, they also provide opportunities to buy. Historically, after each market correction, the stock market has experienced a rebound. Therefore, corrections actually provide investors with the opportunity to enter the market at lower prices, helping to optimize the investment portfolio and enhance future returns.

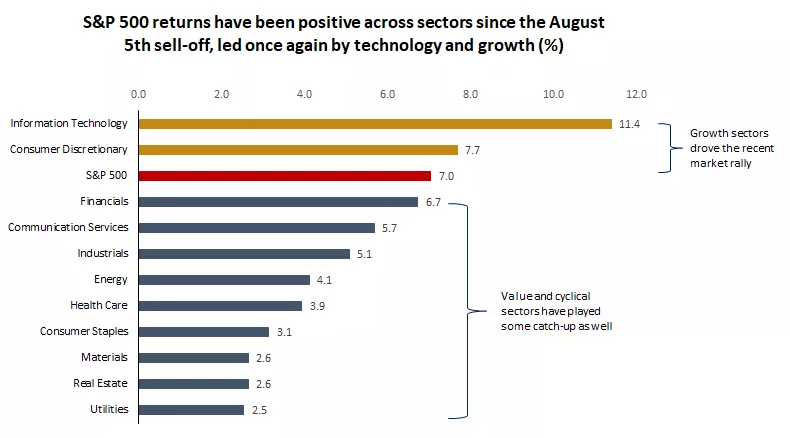

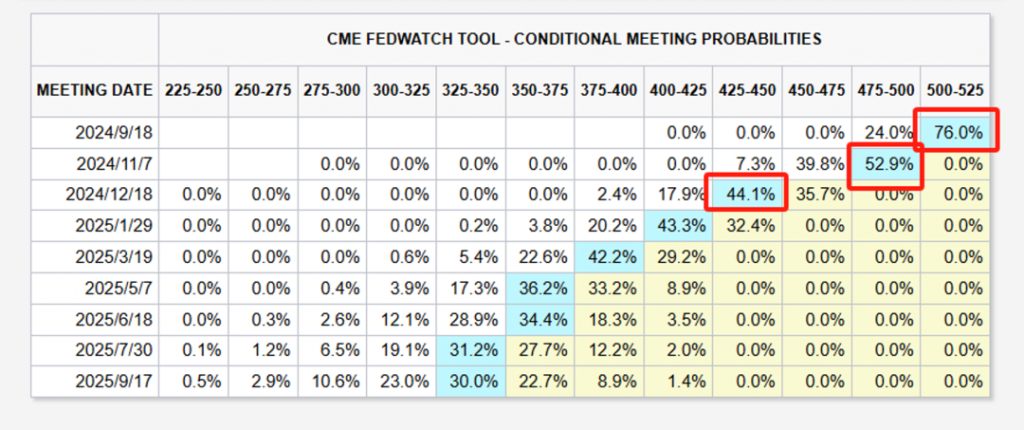

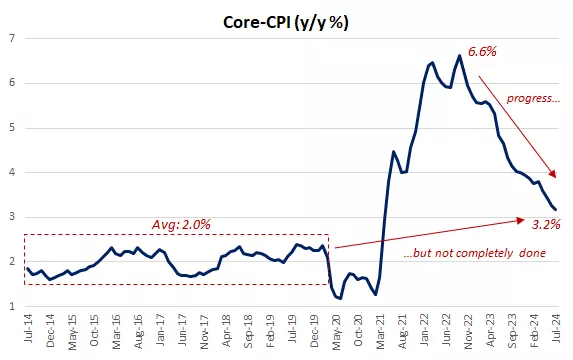

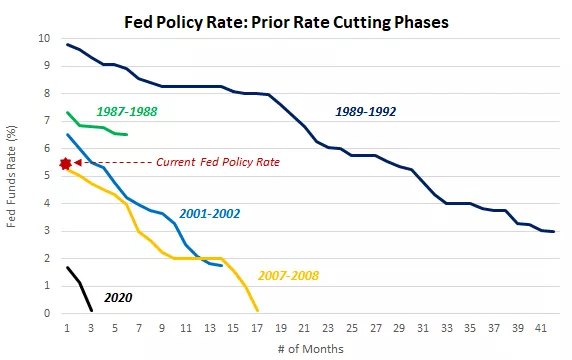

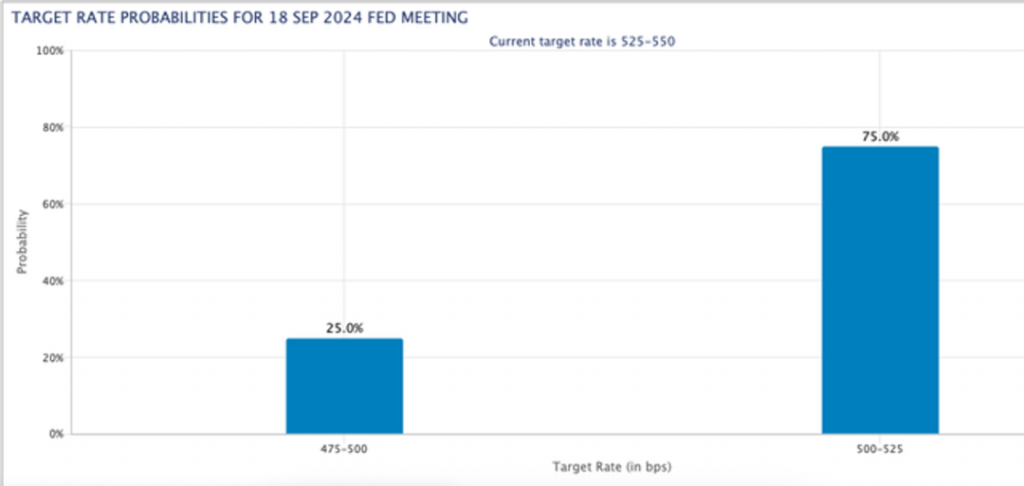

- Positive factors: The current market fundamentals and economic background remain relatively solid. Despite volatility, this does not mean that the market will enter a long-term down cycle. The Federal Reserve may be about to enter a phase of monetary policy easing and is expected to start cutting interest rates next month, which is a positive signal for the market. At the same time, the continued growth of corporate profits is also a key factor driving the market upward. Therefore, investors should focus on these positive factors and avoid missing long-term growth opportunities due to short-term fluctuations.

- Response to concerns about economic recession

- Economic recession possibility: Although the market has recently responded to concerns about an impending economic recession. Despite economic growth slowing down, I still believe that the possibility of a full-blown economic recession remains small. In fact, the slowdown in economic growth is a situation that the market has long anticipated, rather than a direct result of violent market fluctuations.

- Stable growth of corporate profits: The continued growth of corporate profits is seen as an important driving force for the market’s rise. Even during periods of market volatility, the growth in corporate profits still provides solid support for the market, indicating that the market fundamentals remain healthy. This also explains why rebounds usually occur after market corrections.

Through historical data and market analysis, an important message is conveyed to investors: market corrections are normal and common phenomena, and investors should not panic because of short-term fluctuations. Instead, investors should treat market corrections calmly, take advantage of the low prices during correction periods to optimize their investment portfolios, and ultimately achieve long-term returns.