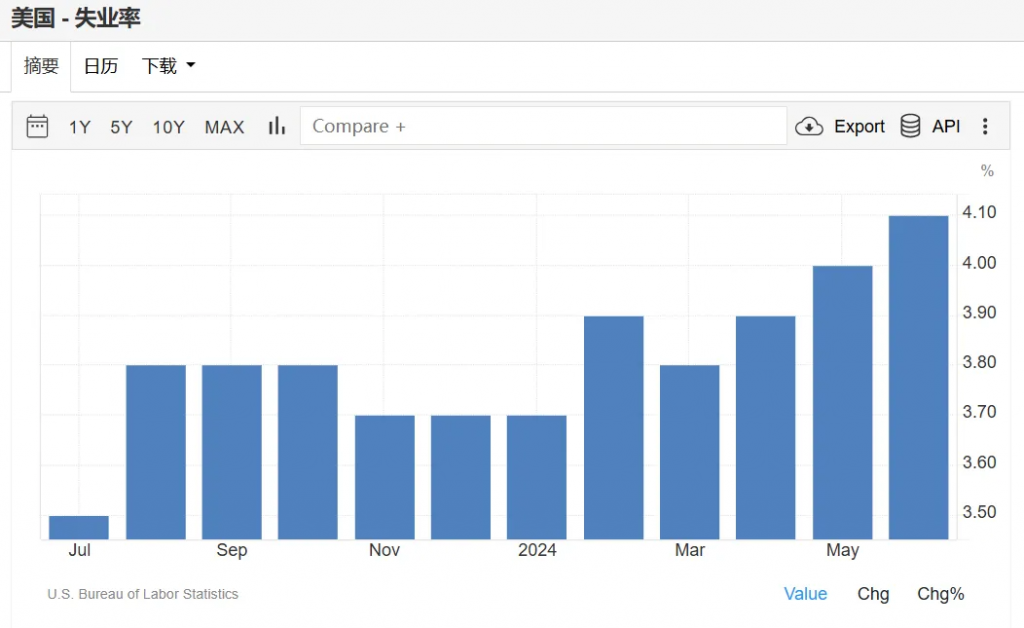

The initiation of a global rate cut cycle is usually an important signal of macroeconomic adjustment, which has a profound impact on the rotation of major asset classes. To understand how these assets rotate, it is crucial to conduct a deep analysis of the macroeconomic background, interest rate changes, inflation trends, and market sentiment.

Based on historical references, the typical asset rotation path during a global rate cut cycle is as follows:

Stock Market: From Defensive to Growth

Early Stage (Defensive Sectors Lead):

- When a rate cut cycle begins, market sentiment may still be cautious, and funds initially flow into defensive sectors, especially companies with stable cash flows and high dividends. Common defensive sectors include utilities, consumer staples, and healthcare.

- During this phase, investors tend to look for stocks that provide stable returns, particularly when inflation remains high and economic growth has not yet shown a significant rebound.

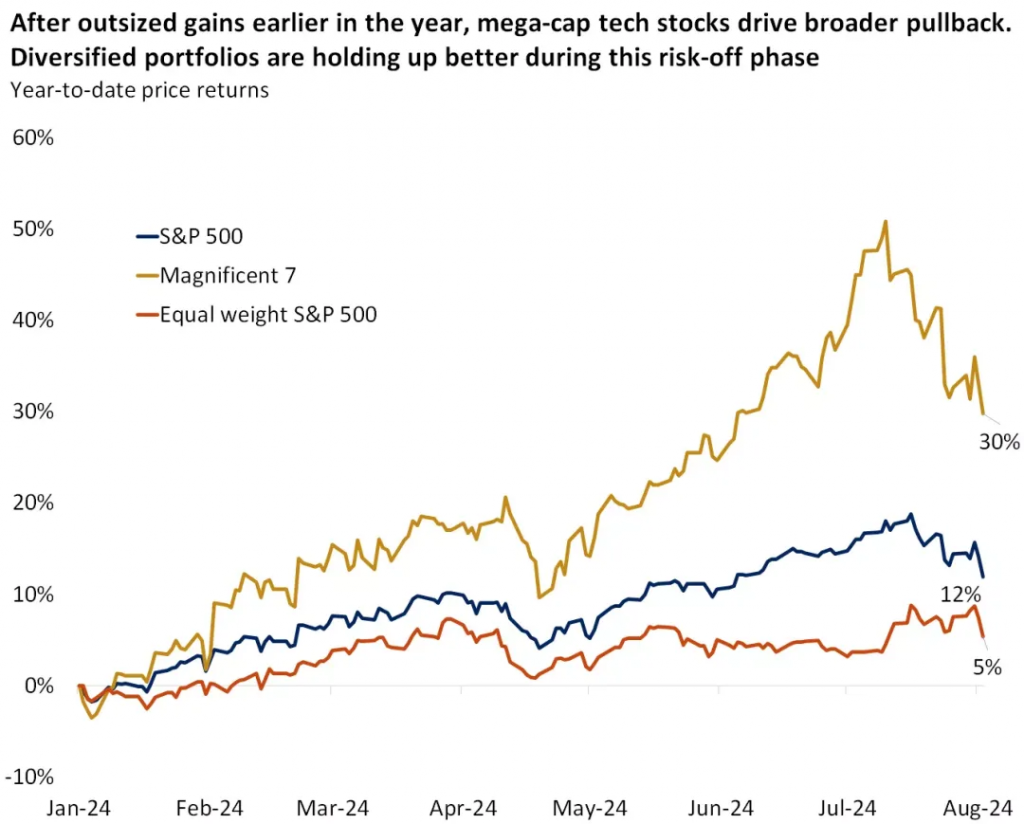

Mid Stage (Growth Sectors Begin to Perform):

- As the rate cut policy gradually transmits to the real economy and financing costs decrease, business and consumer activities begin to recover, and growth sectors (such as technology and consumer discretionary) start to benefit.

- In a low-interest-rate environment, the future cash flow discount rate for growth companies is higher, which leads to faster valuation increases. The technology sector, in particular, benefits because its high growth and innovation capabilities make it more attractive in a low-interest environment.

Late Stage (Cyclical Sectors Rise):

- If the rate cut policy successfully stimulates economic recovery, cyclical sectors (such as finance, energy, and industrials) will begin to lead the market. Economic activity strengthens, demand increases, especially driven by capital expenditure and consumer recovery, which enhances the profitability of cyclical sectors.

- During this stage, investors start to gradually exit defensive sectors and shift toward cyclical stocks that directly benefit from economic expansion.

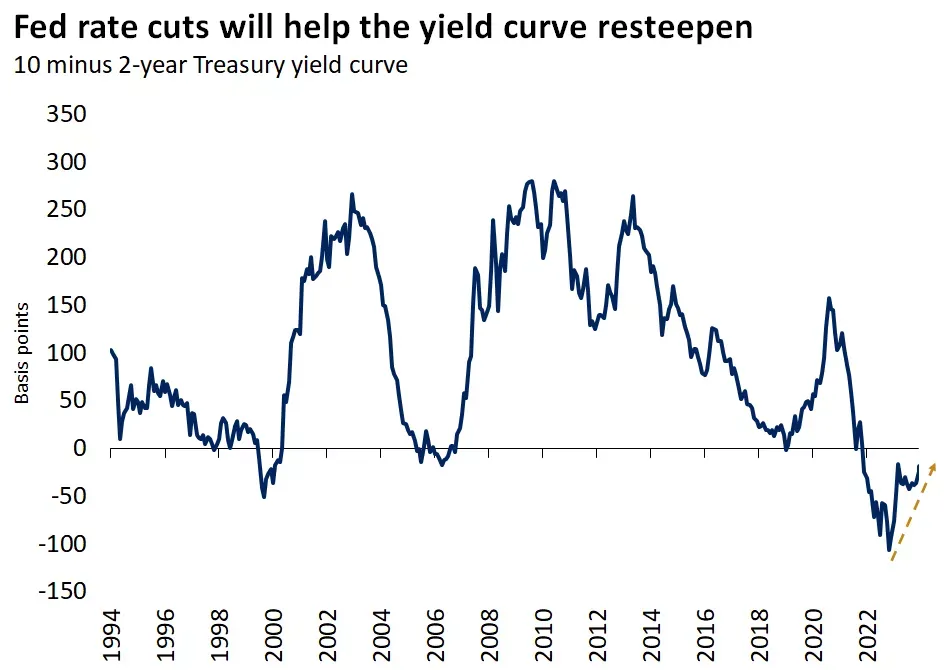

Bond Market: From Long Bonds to Short Bonds

- Long-Term Bonds Benefit First:

In the early stages of a rate cut, the bond market often performs better than the stock market, especially long-term government bonds. As interest rates fall, long-term bond yields decrease, and their prices rise, making them the preferred choice for risk-averse investors. - High-Yield and Corporate Bonds Rise:

As the market grows more optimistic about economic recovery, investors may be more willing to take on risks, and funds shift from government bonds to high-yield bonds and corporate bonds in pursuit of higher returns. Due to lower interest rates, corporate financing costs decrease, credit spreads narrow, and the appeal of credit bonds increases. - Short-Term and Floating-Rate Bonds Become More Attractive:

Towards the end of the rate cut cycle, as the market expects future interest rates to bottom out or even rise, investors gradually turn to short-term or floating-rate bonds to reduce the price risks caused by interest rate fluctuations.

Commodities: Rotation from Precious Metals to Industrial Metals

- Precious Metals (e.g., Gold) Lead the Way:

In the early stages of a rate cut cycle, especially if the rate cuts are accompanied by currency depreciation, investors often turn to precious metals like gold for hedging. Low interest rates and a weak dollar typically push up gold prices because the opportunity cost of holding gold decreases, and it is priced in dollars. - Energy and Industrial Metals Follow:

As the global economy gradually recovers and demand rises, the demand for energy and industrial metals also increases. The prices of commodities closely linked to industrial production, such as oil and copper, begin to rise. - Agricultural Products and Other Soft Commodities:

Economic recovery drives consumption growth, particularly in developing countries, which may push up the prices of agricultural products. Additionally, global rate cuts may stimulate global consumption, thereby increasing demand for commodities and driving up related prices.

Forex Market: US Dollar Weakens, Non-USD Currencies Strengthen

- Dollar Depreciation Expectations:

A global rate cut cycle is typically accompanied by an expansionary monetary policy. If the Federal Reserve enters a rate cut cycle, the US dollar may weaken. A weaker dollar boosts the relative strength of other major currencies, such as the euro, yen, and Swiss franc. - Opportunities for Emerging Market Currencies:

Currencies of emerging market countries may benefit from capital inflows as investors seek higher returns in high-yield markets. Particularly for those emerging markets with relatively high interest rates and stable economic fundamentals, their currencies may strengthen. - Flow of Funds to High-Interest Differential Currencies:

Investors may tend to hold currencies with higher interest rate differentials (such as the Australian dollar or New Zealand dollar), as these currencies can still offer relatively high yields in a rate cut environment.

Real Estate Market: From Residential to Commercial Real Estate

- Residential Real Estate Benefits First:

Rate cuts directly drive down mortgage rates, increasing demand for home purchases. In the early stages of a rate cut cycle, the residential market (especially first-time and upgrading housing markets) generally recovers first. - Commercial Real Estate Follows:

As the economy recovers, business activity increases, and the demand for commercial real estate (such as office buildings, retail space, and industrial properties) rises. Commercial real estate markets, particularly those sensitive to interest rates, may see significant growth.

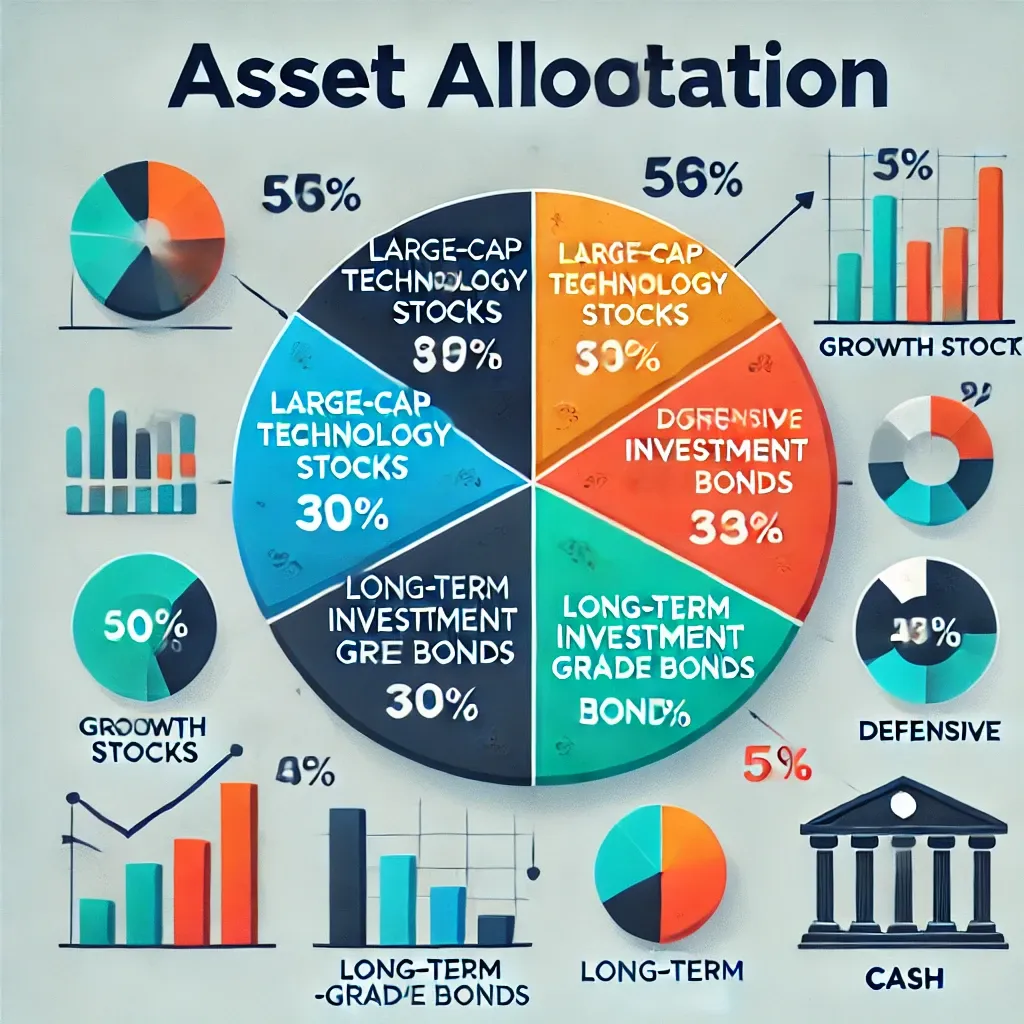

Summary of Major Asset Rotation

The onset of a global rate cut cycle usually triggers a systematic rotation of major asset classes:

- Early Stage: Bonds and gold benefit first, especially long-term government bonds and safe-haven assets. Defensive sectors in the stock market perform better.

- Mid Stage: Growth stocks (e.g., technology, consumer discretionary) start to lead, while high-yield and corporate bonds are favored. Precious metals prices continue to rise.

- Late Stage: Cyclical sectors (e.g., finance, energy, industrials) take over the stock market, and demand for industrial commodities increases. Meanwhile, investment opportunities in real estate shift from residential to commercial properties.

Throughout this rotation, investors need to adjust their asset allocations based on the macroeconomic context, monitor the transitions in the economic cycle, and identify which asset classes and sectors will emerge as winners at each stage.