The wave of interest rate cuts and improved profit prospects make it timely to allocate to small cap stocks!

The expectation of interest rate cuts is heating up, and investors may be at a critical moment to pay attention to the Russell 2000 index and capture the potential of small cap stocks.

Jefferies’ analysis shows that small cap stocks had strong profits in the second quarter, largely exceeding expectations, and the market’s expectations for them have significantly decreased, reflecting good resilience under economic pressure.

In addition, although the overall market’s profit correction is usually low, the correction rate of small cap stocks still shows a slight positive change, indicating that the market’s expectations for these companies have not significantly deteriorated.

Jefferies predicts that although small cap stocks may experience a slight decline in profits in 2024, they are expected to achieve a growth of 16.7% in 2025, surpassing the 14.2% of large cap stocks! This shows that against the backdrop of interest rate cuts and economic recovery, the growth potential of small cap stocks may become more prominent!

The S&P Small Cap 600 index outperformed the S&P 500 in the second half of the year, indicating a shift in market focus from small cap stocks. Large cap stocks with high valuations may prompt investors to turn to small cap stocks with reasonable valuations and great growth potential.

The market is becoming increasingly diversified, and small cap stocks are becoming more and more eye-catching, especially when the valuation of large cap stocks is high. Investors will look for stocks that still have room for growth.

Small cap stocks’ profits hit bottom, outlook for strong recovery

Small cap stocks’ profits will remain strong in the second quarter, making them more competitive with large cap stocks

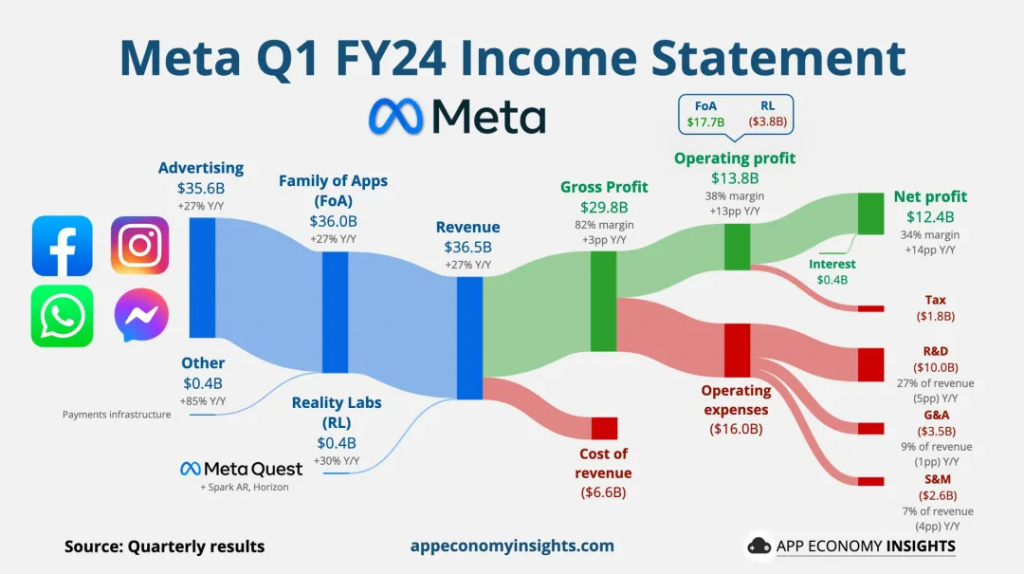

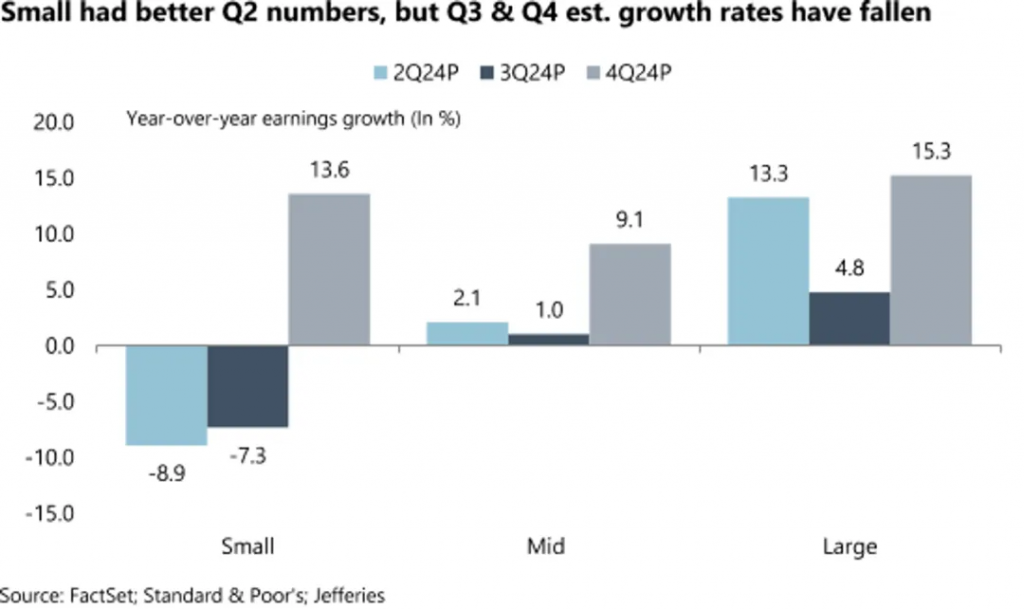

As shown in the figure, the estimated annual profit growth rates for small, mid, and large cap stocks in the second quarter (2Q24P), third quarter (3Q24P), and fourth quarter (4Q24P) of 2024.

Small cap Q2 profits decreased by 8.9%, showing negative growth. But the performance this quarter was more robust than expected; Q3 and Q4 profits are expected to decrease by 7.3% and increase by 13.6% respectively. Although Q3 is expected to perform weakly in the short term, Q4 is expected to show a significant rebound, demonstrating the market’s optimistic outlook for the future.

The Q2 profit of medium-sized stocks increased by 2.1%, showing a relatively stable performance and showing a small positive growth; Q3 and Q4 growth is expected to be relatively moderate, at 1.0% and 9.1% respectively. Although the growth of larger cap stocks is relatively slow, they are still steadily rising, reflecting the potential for sustained growth of mid cap stocks in the future.

Large cap stocks increased by 13.3% in Q2, which is consistent with the dominant position of large cap stocks in the current market; The expected growth in Q3 and Q4 is 4.8% and 15.3% respectively, indicating strong sustained growth momentum, especially with Q4 growth significantly higher than other market cap types of stocks.

Small cap stocks have performed poorly in the first half of 2024, especially falling in Q2 and Q3, but are expected to surge to 13.6% by the end of the year. This indicates that everyone is optimistic about the resilience of small businesses when the economy improves, and Q4 may be a good time for those who want to invest in small cap stocks.

Mid sized stocks will perform steadily in 2024, making them the preferred choice for investors pursuing stability and happiness.

Large cap stocks performed well in Q2, maintaining relatively high growth expectations throughout the year, which may be attributed to the financial strength and market leadership of large enterprises, allowing them to better cope with market fluctuations.

Steven DeSanctis, a strategist at Jefferies, stated in Thursday’s report, “We believe that the profits of small cap stocks will remain stable and compete more strongly with large cap stocks. We only have a few small cap companies’ financial reports to release, and overall Q2 performance is robust

DeSanctis pointed out that the profit correction ratio of small cap stocks in the past three months has remained at 0.89, the sales correction ratio is 0.90, and the rolling average over the past three months is slightly lower than 1.0. The profit correction ratio of large cap stocks increased to 1.28, mainly driven by technology stocks, and the sales correction ratio rose to 0.86.

However, for the full year of 2024, profits of small cap stocks are expected to decline by 1.6%, while profits of large cap stocks are expected to grow by over 9%. Jefferies also expects small cap stocks to grow faster than large cap stocks next year, with a growth rate of 16.7% for small cap stocks and 14.2% for large cap stocks.

Earlier this week, Charles Schwab emphasized that since the second half of 2024, the key indicator of US small cap companies – the S&P Small Cap 600 index (SP600) – has performed better than Wall Street’s benchmark S&P 500 index (SP500), indicating a shift in market breadth from large cap stocks to other areas.

Small cap stocks are performing steadily with high expectations for future growth, and the market breadth is gradually expanding from super large investors to small cap stocks. In the second half of 2024, small cap stocks will perform better than large cap stocks. For investors who are interested in small cap stocks, using related ETFs (such as IJR, IWM, etc.) can track the market performance of small cap stocks and seize potential opportunities.

Is the best time to allocate to small cap stocks for interest rate cuts?

Interest rate cuts typically lower borrowing costs, which is crucial for the growth of small businesses as they often require external funding to expand their business. As market liquidity increases, the attractiveness of small cap stocks increases, and investors are more willing to invest in these small cap stocks with growth potential.

Small cap stocks had poor profits in the first half of the year, but it is expected that Q4 will rebound significantly to 13.6%, reflecting the market’s optimistic expectations for their future profit improvement.

In the past few years, due to the high valuation of large cap stocks, small cap stocks have been favored for their low valuation and high growth potential during interest rate cuts, and investors may turn to small cap stocks.

The market is shifting from super cap technology stocks to small cap stocks, with the S&P Small Cap 600 index outperforming the S&P 500, indicating increased interest in small cap stocks, which may continue to attract funds and drive stock prices up.

Loose monetary policy benefits small businesses and growth stocks. When concerns about economic recession subside, investors tend to prefer high-risk assets, and small cap stocks will benefit more.

Which ETFs will benefit deeply?

Based on the future growth potential of small cap stocks, using ETFs (such as IJR, IWM, VB, etc.) can help investors diversify investment risks and gain broader exposure to the small cap stock market.

These ETFs track small cap stocks with broad market representativeness, suitable for investors who wish to participate in small cap stock growth through index investing.

Here are a few recommended small cap ETFs that may benefit from interest rate cuts, especially those tracking the Russell 2000 Index:

IShares Russell 2000 ETF (IWM): IWM is the most representative Russell 2000 Index ETF, tracking 2000 small cap US companies. The Russell 2000 Index covers stocks with a wide range of performance in small cap stocks, making it suitable for investors who wish to invest in small cap stocks through a widely representative index. Cutting interest rates will improve the financing environment for small cap companies, driving their profitability and stock price performance. IWM, as a highly liquid and widely distributed ETF, is an ideal choice for capturing small cap stock market trends.

Vanguard Small Cap ETF (VB): VB tracks the CRSP US Small Cap Index, which includes some of the smallest cap companies in the United States. Compared to IWM, VB’s constituent stocks are more diversified and cover a wider range. VB not only tracks small cap stocks, but also covers some targets of mid cap stocks, providing broader market exposure and better diversification when the market turns.

Schwab U.S. Small Cap ETF (SCHA): SCHA tracks the Dow Jones U.S. Small Cap Composite Index, which covers 2500 small American companies and has a low-cost advantage. Due to its low expense ratio and wide coverage, SCHA has become a good choice for long-term investors looking to invest in small cap stocks.

Vanguard Small Cap Value ETF (VBR): VBR focuses on value stocks in small cap stocks and tracks the CRS US Small Cap Value Index. Value stocks typically perform well during the economic recovery phase. Against the backdrop of interest rate cuts, value stocks benefit from a reduction in capital costs and an increase in profitability. Therefore, VBR can provide additional advantages in economic recovery.

IShares S&P Small Cap 600 ETF (IJR): IJR tracks the S&P Small Cap 600 index, which selects small companies with strong profitability and therefore has slightly lower risk than other small cap stock indices. Due to the focus on profitability requirements of the S&P Small Cap 600 index, the quality of IJR’s constituent stocks is relatively high, and the positive impact of interest rate cuts and market recovery is more significant.

SPDR S&P 600 Small Cap Value ETF (SLYV): SLYV tracks the S&P Small Cap 600 Value Index, focusing on small cap value stocks with a focus on value features such as low P/E ratios and low price to book ratios. Similarly, value stocks have upward potential in the context of interest rate cuts and economic recovery, and SLYV is a good choice to capture the trend of small cap value stocks.

If you want to allocate a wide range of small cap stocks, IWM and VB are good choices, especially IWM directly tracks the Russell 2000 Index; If you tend to invest in value stocks among small cap stocks, VBR and SLYV can provide more targeted exposure; SCHA and IJR are low-cost and highly diversified options, suitable for long-term holding.

Here are some small cap ETFs covering different industries that typically perform well in the context of interest rate cuts:

IShares U.S. Aerospace&Defense ETF (ITA): In the aerospace and defense industry, ITA invests in small cap and mid cap stocks in the U.S. aerospace and defense sector. Interest rate cuts and increased government spending typically drive growth in the industry, especially for defense related companies. Government investment in defense and infrastructure, especially during economic recovery, may drive the growth of companies in this industry. In addition, the recovery of the aerospace industry will also drive the development of related enterprises.

SPDR S&P Biotech ETF (XBI): Biotechnology industry, XBI tracks the S&P Biotechnology Select Industry index, covering a large number of small cap biotech companies, focusing on innovation and research and development. The biotechnology industry is highly sensitive to policy changes and financing environments, and interest rate cuts may promote financing and research and development activities in this industry. With the decrease in financing costs and the development of innovative product pipelines, small biotechnology companies will directly benefit from interest rate cuts, especially those in the clinical research and development stage may be more dynamic.

Invesco S&P SmallCap Health Care ETF (PSCH): In the healthcare industry, PSCH focuses on small cap healthcare companies in the United States, covering the fields of medical equipment, supply, services, and biotechnology. Interest rate cuts typically promote growth in the industry, as these companies often rely on financing for research and market expansion. With the aging population and increasing demand for healthcare, small cap stocks in the healthcare sector have long-term growth potential. Cutting interest rates will further reduce the financing costs of these enterprises and enhance their profitability.

IShares U.S. Home Construction ETF (ITB): The housing construction industry, which tracks the U.S. housing construction industry and includes some small cap housing construction companies. Interest rate cuts directly reduce the loan costs for homebuyers and usually have a positive impact on the real estate market. The interest rate cut will drive an increase in demand in the housing market, especially the decrease in mortgage interest rates, which will further stimulate the growth of small cap companies in the real estate industry.

First Trust Small Cap Energy ETF (FTXS): In the energy industry, FTXS covers small cap energy companies in the United States, particularly oil and gas production, equipment, and service companies. The energy industry is usually greatly affected by fluctuations in raw material prices and economic activity, but interest rate cuts and economic recovery will promote energy demand growth. With the economic recovery driving up energy demand, the performance of small energy companies may significantly improve, especially against the backdrop of reduced financing costs.

Invesco S&P SmallCap Industries ETF (PSCI): Industrial, PSCI tracks the S&P SmallCap 600 Industries index, covering small cap companies in the industrial sector, including machinery, transportation, construction, and other areas. Interest rate cuts usually help promote investment in the industrial sector and the advancement of infrastructure projects, especially for small industrial enterprises that may perform well when the market recovers.

First Trust Nasdaq Clean Edge Green Energy ETF (QCLN): In the clean energy industry, QCLN focuses on small cap stocks in the clean energy sector, covering related technologies such as solar, wind, and energy storage. As the global demand for green energy increases, small companies in this industry may benefit from reduced financing costs and policy support. The interest rate cutting environment usually provides more financing opportunities for the clean energy sector and drives the development of these innovative companies.

If you want to capture small cap opportunities in specific fields through industry ETFs, these ETFs are a good choice:

High growth industries such as biotechnology (XBI), healthcare (PSCH), and clean energy (QCLN) have high growth potential in the context of interest rate cuts and economic recovery.

Industries that are greatly affected by policies and interest rates, such as housing construction (ITB), industry (PSCI), and energy (FTXS), are often closely related to the macro economy, and interest rate cuts can promote investment and demand in these areas.

Based on your judgment and risk preference of various industries, you can choose suitable industry ETFs to allocate small cap stocks.

Disclaimer: The content of this article is for reference only and does not constitute investment advice. Investment carries risks, and caution is necessary when entering the market.