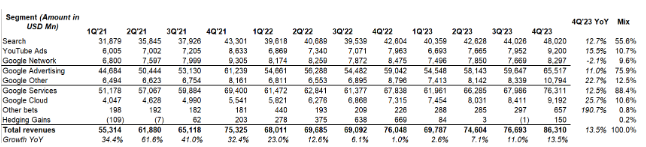

Alphabet, Google’s parent company, announced its financial performance for the fourth quarter of 2023, showing a strong performance. The company reported total revenue of $86.3 billion for the quarter, a 13% increase from the $76 billion reported in the same period in 2022. This growth is notable in several key areas of Alphabet’s business.

Notably, Alphabet’s operating income for the quarter was $23.7 billion, with a net profit of $20.7 billion, which is impressive. This indicates a significant increase compared to the previous year. CEO Sundar Pichai attributed this performance to the continued strength of search and the growing contributions of YouTube and Cloud, which have benefited from investments in artificial intelligence and innovation.

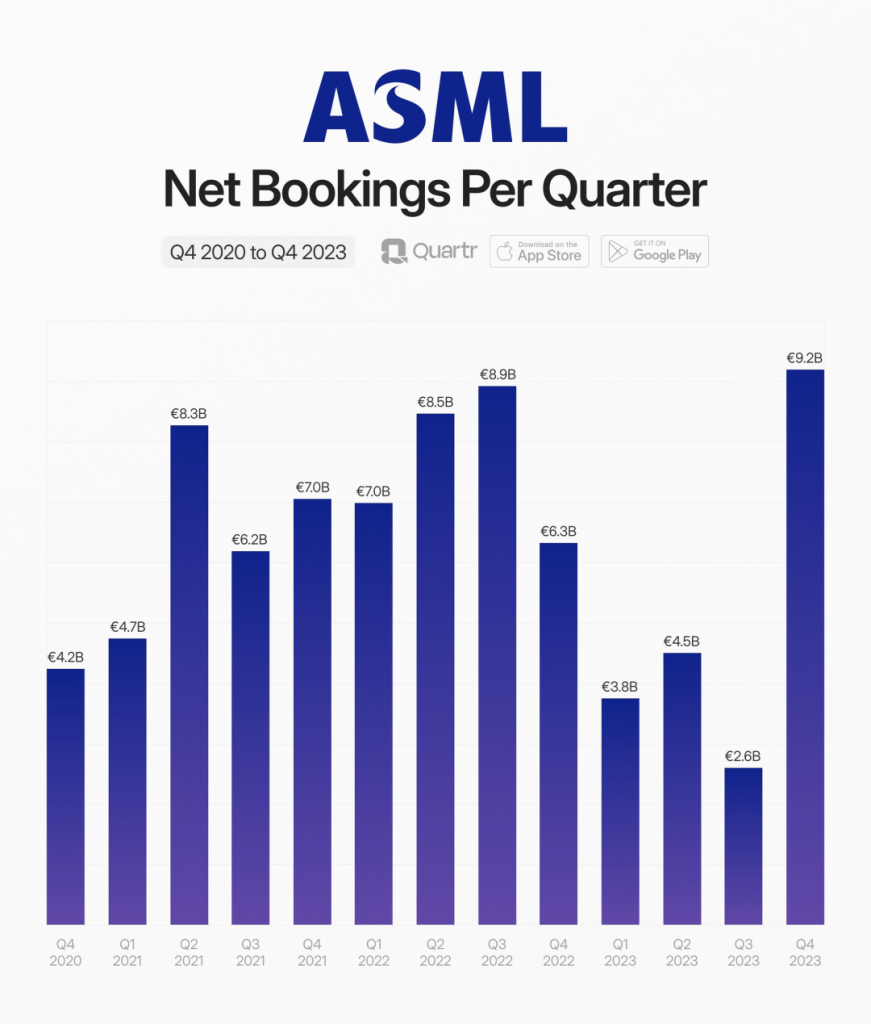

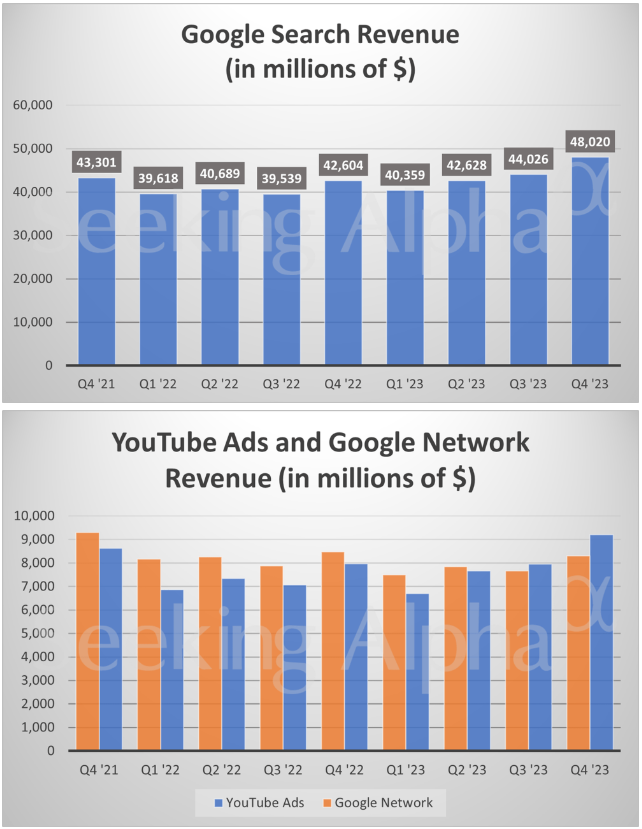

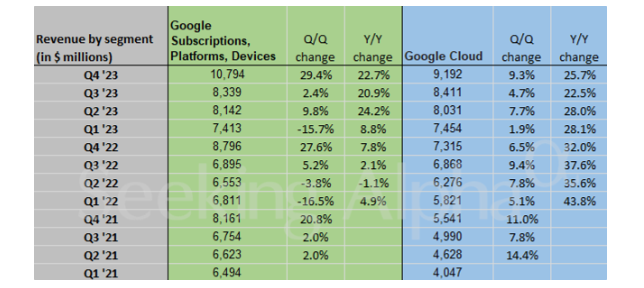

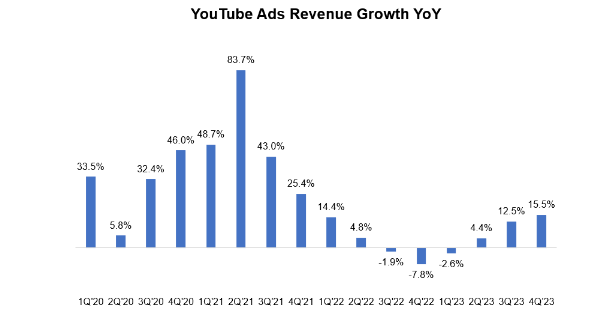

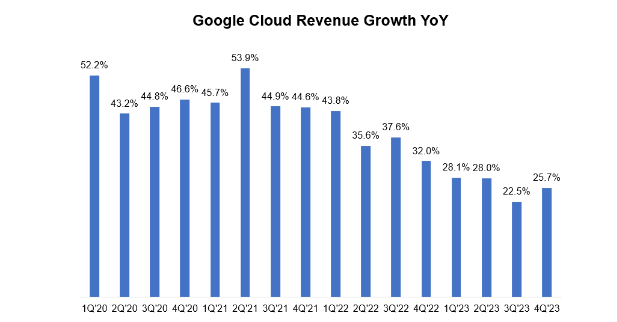

Breaking down the earnings, YouTube’s advertising revenue was $9.2 billion, a significant increase from the $7.96 billion a year ago. Google Cloud also announced strong figures, with revenue at $9.19 billion, compared to $7.32 billion in the same period last year. Another area of note is “Google Subscriptions, Platforms, and Devices,” which includes hardware, Play Store, and non-advertising YouTube revenue, bringing in $10.79 billion, compared to $8.79 billion in the same period last year.

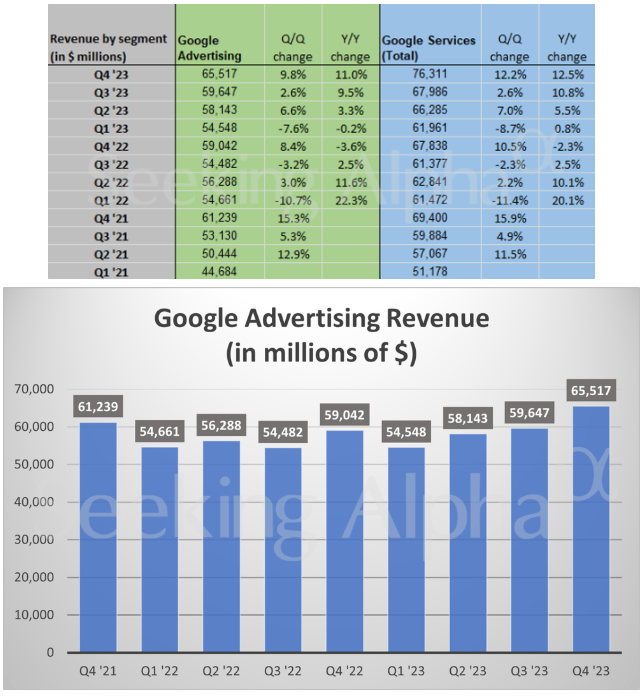

However, it should be noted that the growth in advertising revenue was slightly below some market expectations. The full-year advertising revenue grew to $65 billion, which was below expectations, leading to a drop in Alphabet’s stock price in after-hours trading.

Alphabet also made strategic financial decisions, such as extending the useful life of its hardware, saving a significant amount of money. By extending the useful life of servers from three to six years and network equipment from four to five years, Alphabet reduced depreciation expenses and increased net income. In the last quarter of 2023, this decision reduced depreciation expenses by $983 million and increased net income by $765 million. For the full year, depreciation was reduced by $3.9 billion, and net income increased by $3 billion.

In summary, Alphabet’s financial performance in the fourth quarter of 2023 was strong, with significant growth in several key areas, although the growth in advertising revenue was slightly below expectations. The company’s strategic investments in artificial intelligence and efficient management of hardware resources played an important role in this success.

Revenue

- Revenue was $86.31B (+13.5% Y/Y) exceeding by $1.04B.

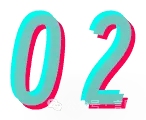

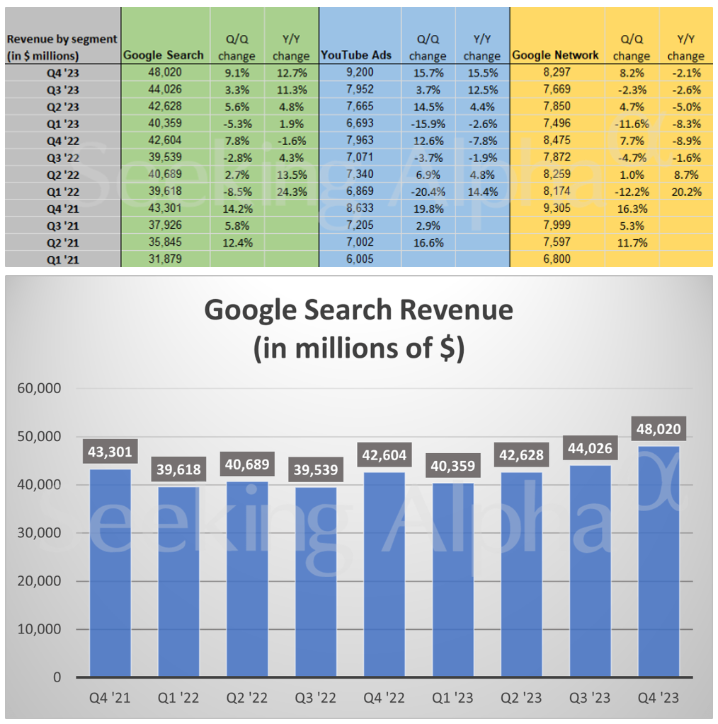

- Net sales by category: Google Search and Other: $48.02B (12.7 Y/Y %); YouTube Advertising: $9.2B (15.6 YoY %); Google Network: $8.3B (-2.1 Y/Y %); Google Subscriptions, Platforms, and Devices: $10.79B (22.6 YoY %); Google Cloud: $9.19B (25.5 YoY)

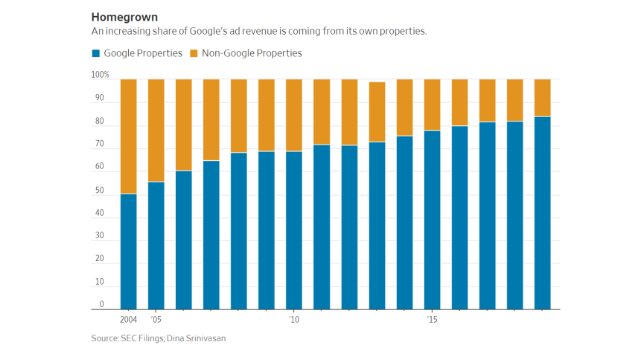

Although almost every revenue segment achieved double-digit growth, Google Network declined by ~2% YoY, and by ~10% compared to Q4 of 21. The Network business may not be very significant, as it is a relatively low-margin segment compared to search, but it may indicate a general direction of the open network’s development.

As I mentioned earlier, since its initial public offering 20 years ago, Google’s reliance on non-Google assets has been decreasing, a trend that may have accelerated and could continue to do so in the GenAI era.

Is this bad news for Google? On the one hand, you could argue that the role of the open network has been diminishing for years without causing too much impact on Google’s health. On the other hand, Dan Taylor, Google’s Vice President of Global Advertising, was quoted in a 2022 Wall Street Journal article saying:

Without websites, there is less content that is searchable and discoverable, and thus less need for search engines like ours. In this way, our interests are aligned with publishers who are supported by advertising.

In my view, the extent to which Google can be insulated if the open network becomes increasingly paralyzed is still an open question. If Google did not own YouTube, this would obviously be terrible news; perhaps Google’s acquisition of YouTube will prove to be a better masterpiece than people thought 5 years later!

EBIT (Earnings Before Interest and Taxes)

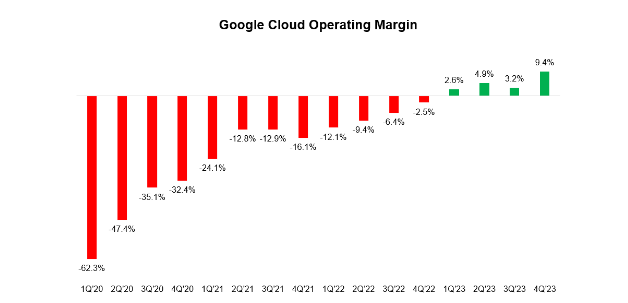

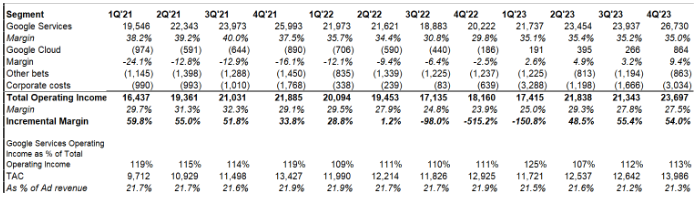

Google’s services business maintained an operating profit margin in the mid-30s. What is truly surprising is Google Cloud, which increased its profit margin from 3.2% in Q3 of 2023 to 9.4% in Q4 of 2023. In just 16 quarters, Google Cloud’s profit margin has improved from a negative 62% to a positive 9.4%!

Google’s incremental profit margin also remained quite healthy at 54% in Q4 of 2023. While the company’s costs seem exaggerated, please note that this includes $1.2 billion in restructuring costs in Q4 of 2023 and $3.9 billion in 2023.

Search

The year-over-year growth in search revenue continues to accelerate. While the bear case for GenAI remains the most concerning search issue for Google watchers, the business seems to be cruising so far.

Some interesting comments about search from the earnings call:

- We are already experimenting with Gemini in Search, where it’s making our Search Generative Experience, or SGE, faster for users. We have seen a 40% reduction in latency in English in the U.S.

- We had particular strength in retail in APAC, a trend that began in the second quarter of 2023 and continued through the end of the year.

YouTube

Like search, YouTube advertising growth also accelerated in the quarter. YouTube Shorts are now viewed 70 billion times a day (please note, this is the same data they shared last quarter).

Google Cloud

After disappointing investors last quarter, Google Cloud exceeded expectations this quarter (~22%).

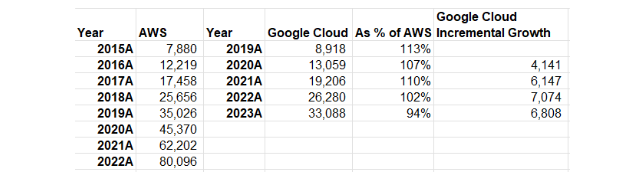

Google Cloud’s revenue has historically lagged AWS’s revenue by four years. Looking at AWS’s performance during the 2020-22 period, I think it’s fair to assume that Google Cloud will almost certainly not maintain this historical trend during the 2024-26 period. 2023 was also the first time that Google Cloud’s incremental revenue growth was lower than the previous year.

Google Other

Google Other is now categorized as “Google Subscriptions, Platforms, and Devices.” Subscription revenue (YouTube Premium and Music, YouTube TV, and Google One) now stands at $15 billion, having grown ~5x since 2019.

Capital Allocation

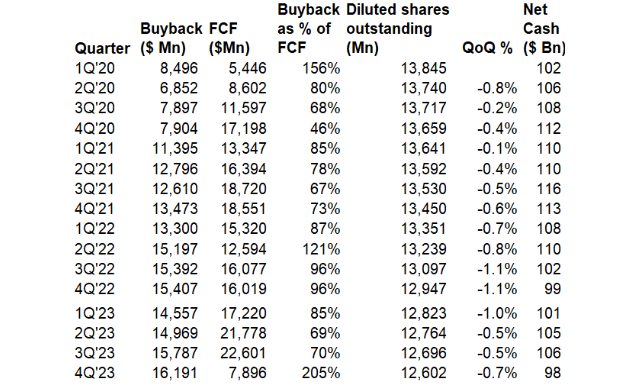

Google announced $7.9 billion in FCF last quarter and repurchased $16 billion in stock. Please note that Google paid $10.5 billion in taxes last October, which affected their FCF this quarter. Overall, they generated $69 billion in FCF in 2023 and repurchased $62 billion in stock. They still have $98 billion in net cash on their balance sheet.

Capital Expenditures and Operating Expenses

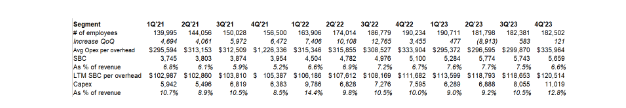

Google’s employee headcount remained essentially flat quarter-over-quarter, but the percentage of capital expenditures to revenue increased to 12.8% in Q4 of 2023, up from Q1 of 2022. The increase in capital expenditures was “primarily driven by investment in technology infrastructure, with the largest portion being servers, followed by data centers.”

Google also stated that capital expenditures in 2024 will be “significantly larger” than the ~$32 billion in 2023. Management did not fully hint at or clarify what “significantly larger” means, but I guess around $40-44 billion:

- The increase in Q4 capital expenditures reflects our extraordinary outlook for applications of artificial intelligence that will serve users, advertisers, developers, cloud enterprise customers, and governments globally, as well as the long-term growth opportunities provided by it. In 2024, we expect capital expenditure investments to be significantly larger than in 2023.

Outlook

Google did not provide guidance, but management seemed to imply that the company will face tougher competition in the future:

- As we move into 2024, with ad revenue more than $100 billion higher than in 2019, we remain focused on maintaining healthy growth on this larger base.

While revenue may face a tougher second half for Google (and other big tech companies), Google may be able to navigate this and increase earnings through better operational discipline:

- As we have emphasized repeatedly, we remain committed to our framework of enduringly redesigning our cost base while we invest to support our growth priorities. Key factors in slowing our expense growth include: first, prioritization of products and processes to ensure we have the right resources behind the most important opportunities and reallocate resources where possible; second, organizational efficiency and structure. We are focused on removing layers to simplify execution and increase speed.