Bitcoin breaks through 88,000!

Many people attribute the recent surge in Bitcoin to Trump taking office. Indeed, Trump has been positioning himself as a candidate friendly to the cryptocurrency community since the beginning of the year. He even mentioned at a Bitcoin conference in July that he wanted to make Bitcoin a strategic asset for the United States and even launched his own cryptocurrency. However, upon closer examination, it seems that Trump’s influence may not be as significant as perceived.

Today, Bitcoin has once again hit a new record, surpassing $88,000 per coin, with exaggerated records even higher. Last week, The Bitcoin Archive tweeted that the world’s largest asset management group, BlackRock’s Bitcoin ETF, has surpassed their gold ETF in terms of fund size in just 10 months. Perhaps many are not aware of this. To put it in another way, BlackRock’s gold ETF was launched in 2005 and took nearly 20 years to reach its current size, while Bitcoin surpassed it in less than a year. This news is undoubtedly shocking. It is believed that many institutions on Wall Street are eagerly eyeing this opportunity. A clear signal since Trump took office is that regulation in the cryptocurrency space will become clearer, so during this period, various institutions are internally strategizing on how to seize this opportunity.

Forbes’ article today points out that institutions can no longer ignore Bitcoin. The article indicates that the reasons why institutions have previously rejected or ignored Bitcoin can basically be summarized into four points: legality, intrinsic value, channels, and volatility. Let’s explain them one by one.

Concerns about legality are actually evolving. Initially, institutions were worried that government bans would cause Bitcoin to plummet overnight. However, the ban by the Chinese government revealed that the entire ecosystem of Bitcoin is very resilient. Unless all countries in the world ban it together, it will continue to grow in places where it remains legal. Later, institutions were concerned that engaging in Bitcoin business would face regulatory crackdowns. The recent handling of Coinbase by the U.S. Securities and Exchange Commission is a typical example. With Trump now in office, the likelihood of regulatory crackdowns in the future is expected to decrease significantly. Therefore, the threat to the legality of Bitcoin and the entire cryptocurrency market has basically disappeared.

Concerns about intrinsic value, many people now believe that Bitcoin is like digital gold. However, in the beginning, the vast majority of people actually scoffed at Bitcoin, considering it virtual and devoid of any value. Those who do not understand the mechanism behind blockchain may also claim that Bitcoin’s supply can be tampered with at any time. However, is a network that cannot be eliminated by the government and can transfer large amounts of funds really without value? The answer is obviously negative. Now, with the introduction of Bitcoin ETFs, it has become a tool for asset allocation, so there is no longer any concern about its intrinsic value, but rather whether the price is reasonable.

The above two concerns are more fundamental, while concerns about channels and volatility are at the practical operational level. Now, with Bitcoin custody, Bitcoin ETFs, and the introduction of various financial instruments in the future, institutional investors have more choices. Not only is it easier to invest in Bitcoin, but various trading methods can also be used to control and adjust Bitcoin’s volatility. Therefore, according to Forbes, after regulatory clarity, more institutional funds that were previously on the sidelines choose to enter, driving up the price of the currency. Carwright, a pension fund in the UK, stated that UK institutional investors must catch up with other global players and start positioning themselves in Bitcoin, otherwise they will fall seriously behind. Their company suggests that in the first phase of pension funds, they can allocate about 3% to Bitcoin and gradually increase it. Obviously, institutional entry is one of the biggest bullish factors for Bitcoin.

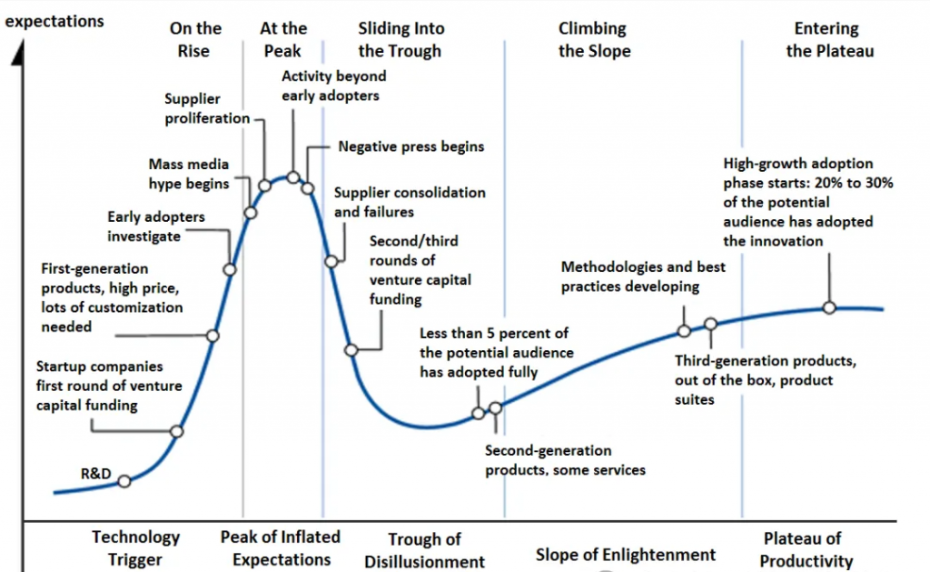

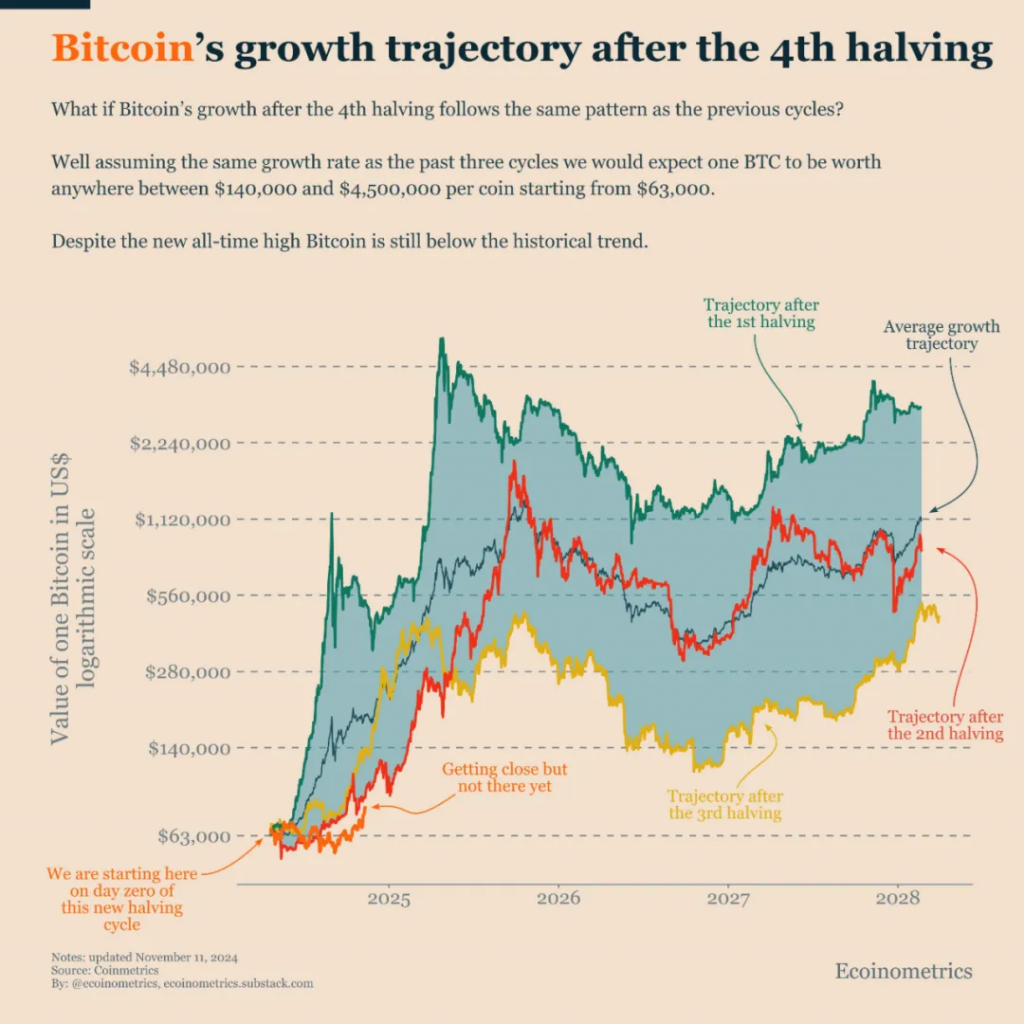

Apart from institutional involvement, there are many bullish factors for Bitcoin, including major economies worldwide, except for Japan, entering a rate-cutting cycle, seasonal and cyclical factors, as well as the possibility of countries purchasing Bitcoin. Among these, seasonal and cyclical factors are worth mentioning separately. Those familiar with Bitcoin may know that Bitcoin operates on a four-year cycle, with the supply halving roughly every four years. Following each halving, Bitcoin tends to enter a bull market for about a year to a year and a half.

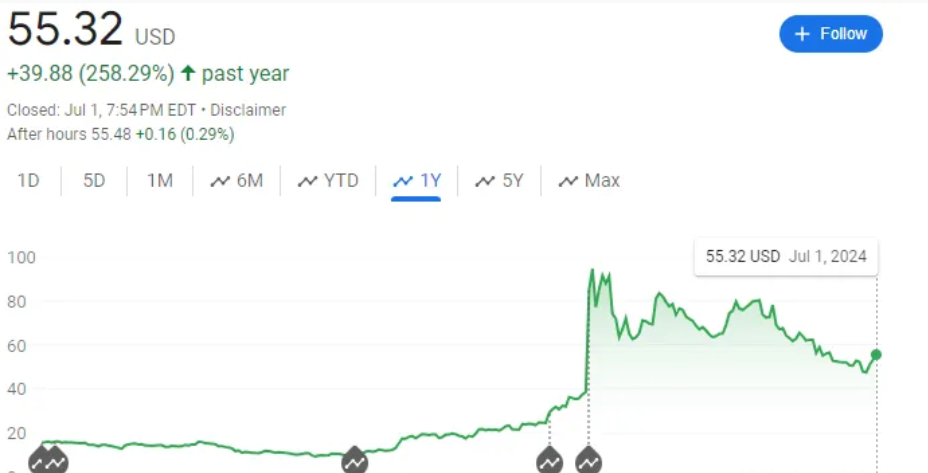

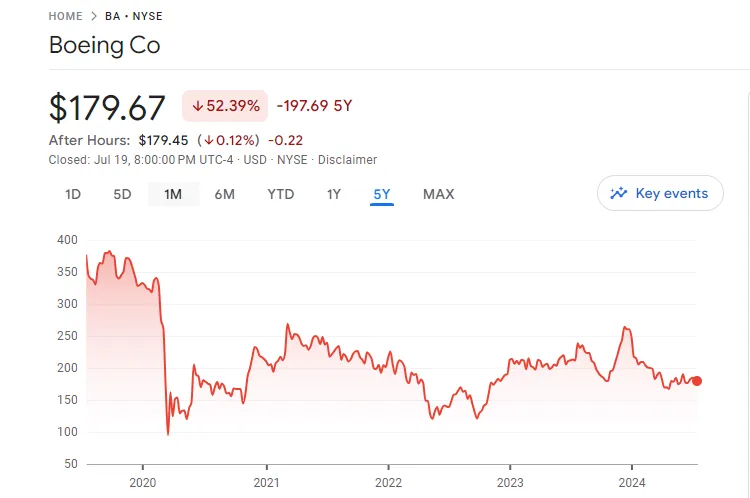

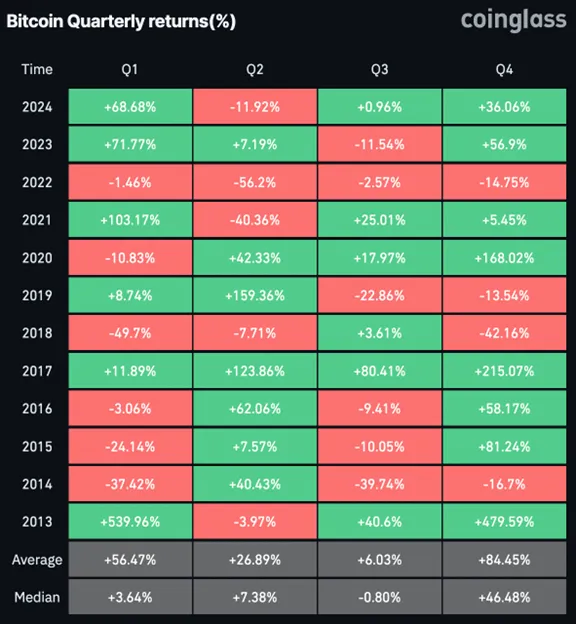

Some analysts in the cryptocurrency community believe that Trump’s presidency is merely a catalyst, and in terms of cycles, Bitcoin’s recent surge is just history repeating itself. The chart below summarizes Ecoinometrics’ findings. It shows that post-halving, Bitcoin’s performance is quite similar to previous cycles, lagging behind the first three cycles, and the current surge is merely catching up with historical trends. According to Coinglass’s analysis, the fourth quarter and the first quarter are generally the two best quarters for Bitcoin. The average increase in the fourth quarter is close to 85%, while in the first quarter, it exceeds 56%. Therefore, it is difficult to determine definitively which factor is prevailing.

Aggie believes that distinguishing whose influence is greater offers limited help for our investments. From a fundamental perspective, as long as Bitcoin continues to be more widely adopted, its value will increase. Whether the price rises due to cyclical trends or Trump’s presidency, it will attract more attention and increase adoption rates, that is certain. The skyrocketing price will also generate a certain level of FOMO sentiment, further boosting the upward trend. Therefore, I believe that in this fervent environment, Bitcoin’s upward momentum is likely to continue. However, amidst the frenzy, I would like to remind investors of the risks that they may overlook.

Firstly, within a Bitcoin bull market, there will naturally be significant pullbacks, which will not disappear just because of the frequent positive news, especially under such intense recent price surges, the risk of pullbacks has undoubtedly increased. Secondly, there is the risk of the Federal Reserve’s monetary policy. If the Fed slows down or pauses interest rate cuts, it will definitely impact global liquidity, which could have a negative effect on the price of Bitcoin, something to be mindful of.

Reference article: WeChat Official Account “MeiTouinvesting”