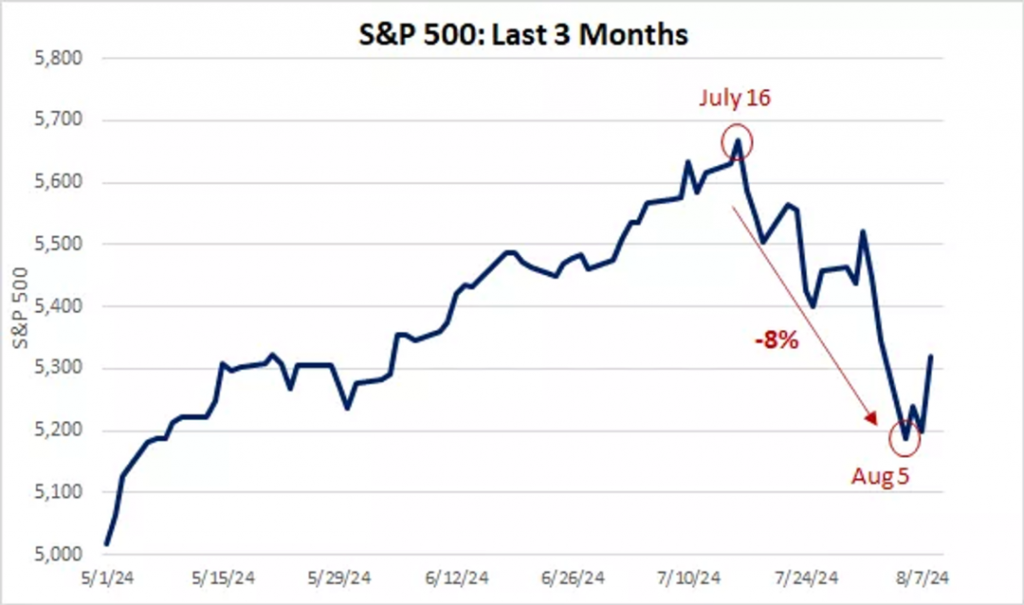

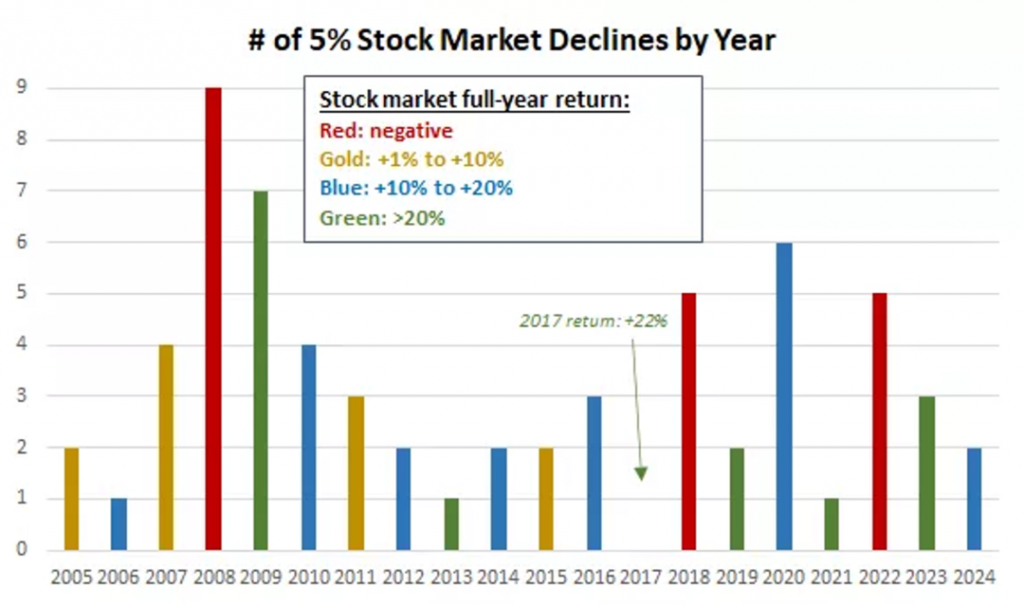

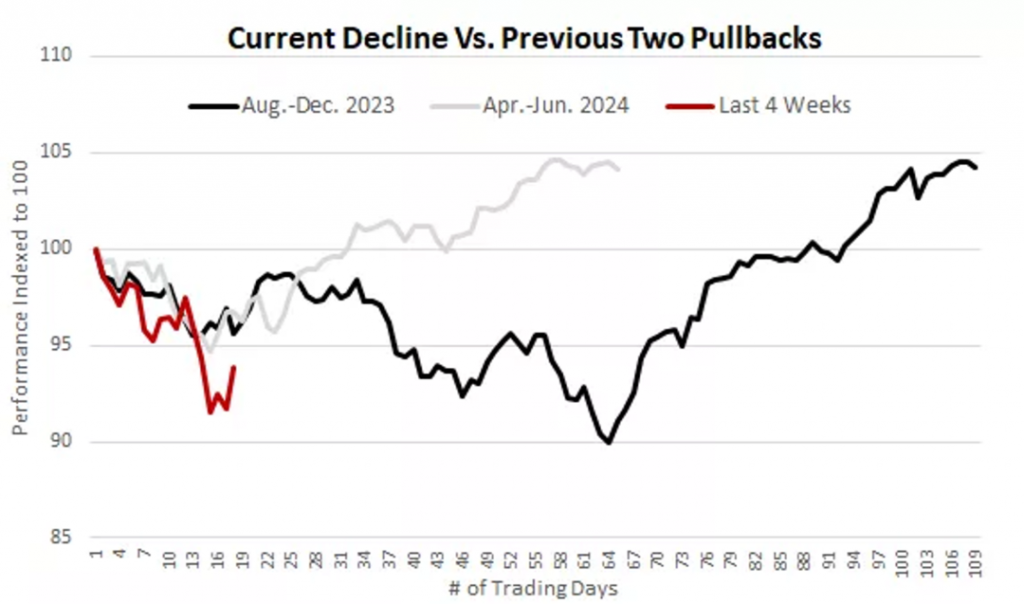

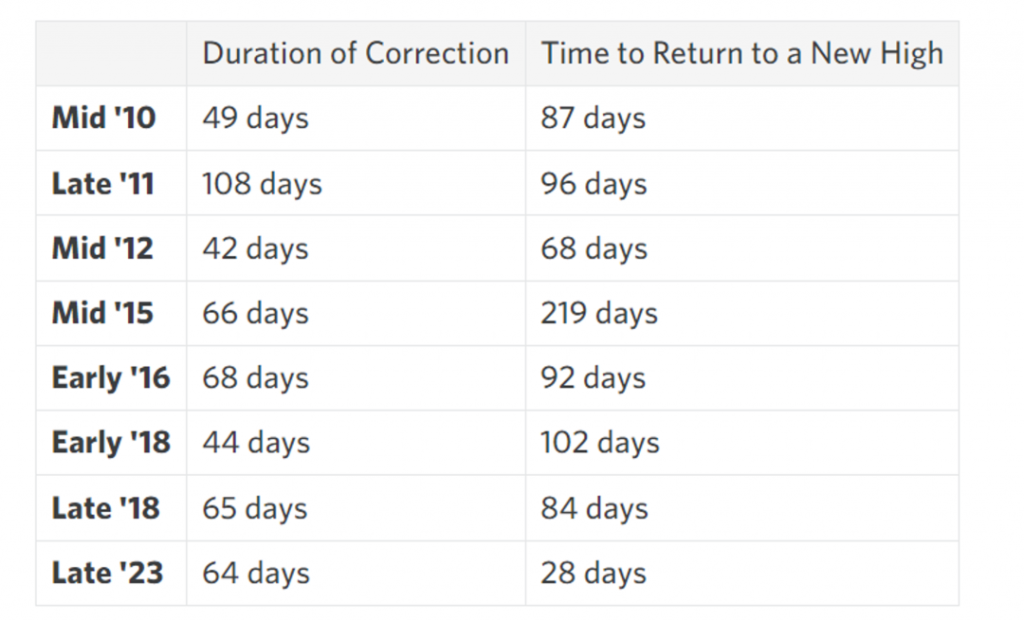

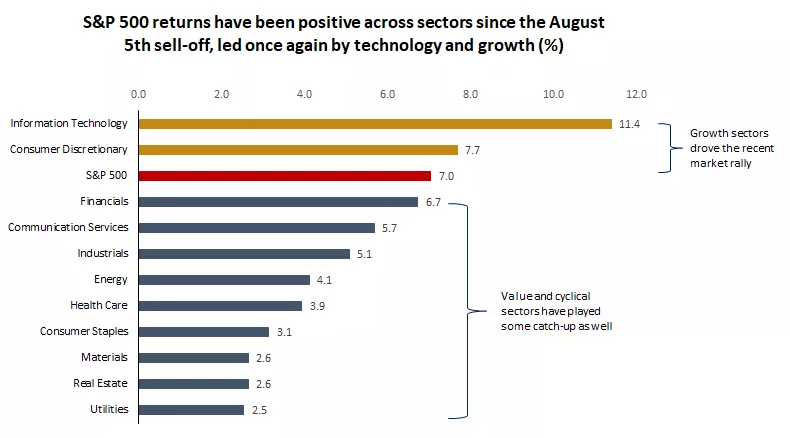

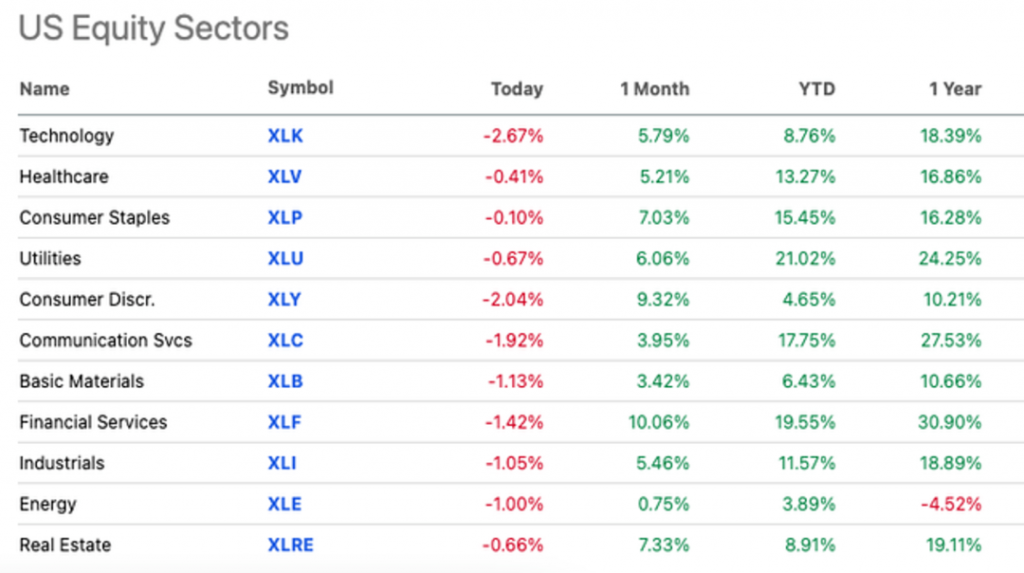

“ The U.S. stock market experienced a sharp decline. Worried about potential significant short-term volatility while aiming for long-term investment, considering adding some hedge ETFs.”

Recently, the U.S. stock market has been quite unstable, especially in the semiconductor sector. With high expectations from everyone, industry giants are facing tough earnings seasons. Therefore, if their performance falls slightly short, stock prices will plummet.

On July 17th, ASML’s earnings fell short of expectations, triggering a sell-off in the semiconductor sector, which in turn led to a sharp decline in Nasdaq’s tech stocks. The seven giants recorded their largest single-day drop in over a year!

The mother of all chips triggers semiconductor meltdown.

One stone stirs up a thousand layers of waves. Due to poor performance of ASME, it has encountered policy setbacks.

On July 17th, semiconductor and technology giants were sold off. On Wednesday, the market value of the Wall Street Semiconductor Index evaporated by over $500 billion, marking the worst trading day since 2020.

。

On the other hand, the United States has strengthened its control over semiconductor exports to China. President Trump has made strong statements about targeting TSMC. The recent sharp decline in Wall Street’s semiconductor stocks reflects the market’s sensitivity to geopolitical risks and policy changes.

Recently, the semiconductor industry has become a focal point in the technological competition between China and the United States. The U.S. government is taking measures to protect its own advantages, which has caused some anxiety in the market and affected investor confidence. In this situation, it is important to closely monitor policies and international developments to better understand the risks and opportunities in the market.

The ASML incident has sounded the alarm for the semiconductor industry, indicating potential soft demand or supply chain issues.

Faced with this situation, investors can consider diversifying their investments by allocating to multiple industries and categories to reduce the impact of a single industry on the overall investment portfolio.

Alternatively, they can consider investing in multiple countries and regions to diversify geopolitical risks.

Utilize hedging tools, such as shorting hedge ETFs like ProShares Short QQQ (PSQ), ProShares UltraShort QQQ (QID), Direxion Daily Semiconductor Bear 3x Shares (SOXS), etc.

Use put options to protect against market downturns.

Carefully analyze the fundamentals of companies and select those with long-term growth potential and stable finances.

During market volatility, remain calm and avoid panic selling. Dollar-cost averaging can help smooth out fluctuations.

Are you looking to hold for the long term but concerned about significant short-term fluctuations?

Shorting hedge ETFs

Specific stock category

For example, Nvidia, the GraniteShares 2x Short NVDA Daily ETF (NVD.US), is a double inverse ETF designed specifically for shorting Nvidia (NVIDIA) stock. There are also others like AMDS, NVDS, FNGD, etc.

Index category

ProShares Short QQQ (PSQ):This ETF aims to provide inverse performance of the Nasdaq-100 Index, meaning that when the Nasdaq-100 falls, PSQ will rise. It is suitable for hedging against investment risks related to technology stocks and the Nasdaq-100 Index.

ProShares UltraShort QQQ (QID):This ETF aims to provide twice the inverse daily performance of the Nasdaq-100 Index, meaning that when the Nasdaq-100 falls by 1%, QID will rise by 2%. It is suitable for short-term hedging of high volatility risks in technology stocks.

ProShares Short S&P 500 (SH):The ETF aims to provide inverse performance of the S&P 500 index, meaning that when the S&P 500 falls, SH will rise. It is suitable for hedging overall market risks, especially the impact of large-cap tech stocks on the S&P 500.

ProShares UltraShort S&P 500 (SDS): The ETF aims to provide twice the inverse daily performance of the S&P 500 index, so when the S&P 500 falls by 1%, SDS will rise by 2%. It is suitable for short-term hedging of high volatility risks in the overall market.

Direxion Daily Semiconductor Bear 3x Shares (SOXS):This ETF aims to provide daily inverse performance three times that of the Philadelphia Semiconductor Index (PHLX Semiconductor Index), meaning that when the Philadelphia Semiconductor Index falls by 1%, SOXS will rise by 3%. It is specifically designed to hedge risks in the semiconductor industry and is suitable for short-term high volatility market conditions.

ProShares UltraPro Short QQQ (SQQQ):This ETF aims to provide daily inverse performance of three times the Nasdaq-100 Index, meaning that when the Nasdaq-100 falls by 1%, SQQQ will rise by 3%. It is suitable for short-term hedging of high volatility risks in technology stocks.

There are also some ETFs that can be used for hedging and shorting specific industries or market indices.

Tuttle Capital Short Innovation ETF (SARK):Provide the inverse performance of the ARK Innovation ETF (ARKK). Suitable for hedging risks related to ARKK.

Direxion Daily Technology Bear 3x Shares (TECS):Provide daily triple inverse performance of the Technology Select Sector Index. Suitable for hedging risks in the technology sector.

ProShares Short Dow30 (DOG):Provide the inverse performance of the Dow Jones Industrial Average. Suitable for hedging investment risks related to the Dow Jones Industrial Average.

ProShares UltraShort Dow30 (DXD):Provide daily inverse performance of the Dow Jones Industrial Average at twice the rate. Suitable for short-term hedging against the high volatility risk of the Dow Jones Industrial Average.

ProShares Short Russell2000 (RWM):Provide the inverse performance of the Russell 2000 Index. It is suitable for hedging risks in the small-cap stock market.

ProShares UltraShort Russell2000 (TWM):Providing daily inverse performance of the Russell 2000 Index at twice the rate, suitable for short-term hedging in the high-volatility small-cap stock market.

When using these tools, investors should fully understand their mechanisms and risks, and choose based on their own risk tolerance and investment objectives.

Disclaimer: The content of this article is for reference only and does not constitute investment advice. Investment involves risks, please be cautious when entering the market.